Attorney-Approved Articles of Incorporation Template for Rhode Island

The path to formalizing a business in Rhode Island begins with the completion of a crucial document known as the Articles of Incorporation. This foundational paperwork serves as both a declaration of a company's existence and as a compliance instrument with state legal requirements. By filing this document, entrepreneurs take the first official step towards establishing their corporation's legal identity, setting the stage for its operation within Rhode Island's regulatory framework. The form itself encompasses several major aspects including the corporation's name, its purpose, information about its stock, the details regarding its registered agent, and the incorporator's information, among others. Each of these sections plays a vital role in not only ensuring the legitimacy and legality of the business but also in laying down the groundwork for its future governance and operational strategies. Through this document, businesses are able not only to legitimize their existence but also to communicate vital information to the Rhode Island Secretary of State, facilitating a smoother pathway towards achieving their operational goals while adhering to state laws.

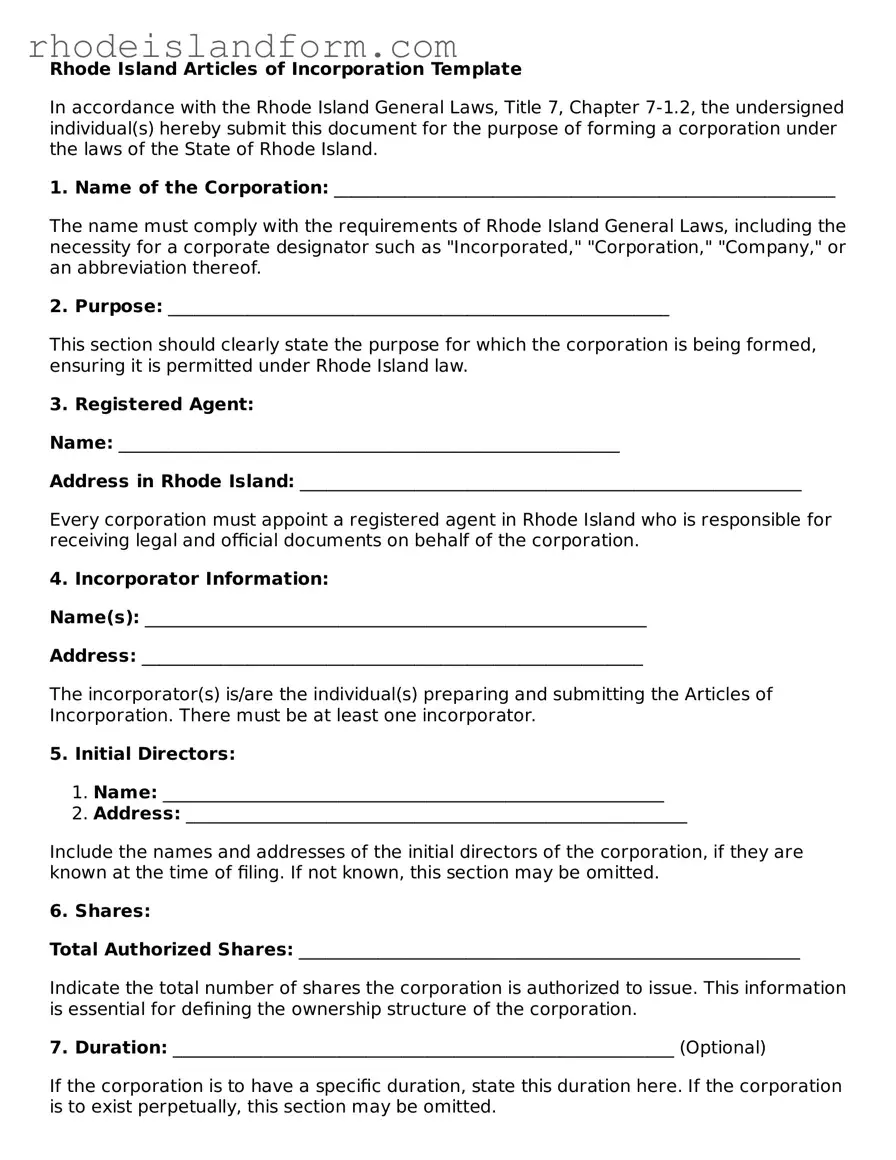

Rhode Island Articles of Incorporation Preview

Rhode Island Articles of Incorporation Template

In accordance with the Rhode Island General Laws, Title 7, Chapter 7-1.2, the undersigned individual(s) hereby submit this document for the purpose of forming a corporation under the laws of the State of Rhode Island.

1. Name of the Corporation: _________________________________________________________

The name must comply with the requirements of Rhode Island General Laws, including the necessity for a corporate designator such as "Incorporated," "Corporation," "Company," or an abbreviation thereof.

2. Purpose: _________________________________________________________

This section should clearly state the purpose for which the corporation is being formed, ensuring it is permitted under Rhode Island law.

3. Registered Agent:

Name: _________________________________________________________

Address in Rhode Island: _________________________________________________________

Every corporation must appoint a registered agent in Rhode Island who is responsible for receiving legal and official documents on behalf of the corporation.

4. Incorporator Information:

Name(s): _________________________________________________________

Address: _________________________________________________________

The incorporator(s) is/are the individual(s) preparing and submitting the Articles of Incorporation. There must be at least one incorporator.

5. Initial Directors:

- Name: _________________________________________________________

- Address: _________________________________________________________

Include the names and addresses of the initial directors of the corporation, if they are known at the time of filing. If not known, this section may be omitted.

6. Shares:

Total Authorized Shares: _________________________________________________________

Indicate the total number of shares the corporation is authorized to issue. This information is essential for defining the ownership structure of the corporation.

7. Duration: _________________________________________________________ (Optional)

If the corporation is to have a specific duration, state this duration here. If the corporation is to exist perpetually, this section may be omitted.

8. Additional Provisions: (Optional) _________________________________________________________

This area allows for the inclusion of any additional provisions not covered in the standard template sections, as long as they are compliant with Rhode Island law.

9. Signature:

Incorporator's Signature: _____________________________________ Date: _______________

Make sure the incorporator signs and dates the document. If there are multiple incorporators, each must sign and date.

Submission and filing information: After completing this template, submit the signed Articles of Incorporation to the Rhode Island Secretary of State, along with the required filing fee. Check the current filing fee and submission methods on the Rhode Island Secretary of State's website.

PDF Data

| Fact | Detail |

|---|---|

| Purpose | Used to legally form a corporation in Rhode Island. |

| Governing Law | Rhode Island General Laws, specifically under Title 7 (Corporations, Associations, and Partnerships). |

| Submission Method | Must be filed with the Rhode Island Secretary of State. |

| Key Information Required | Including, but not limited to, the corporation's name, principal office address, the number of authorized shares, the name and address of the registered agent, and the incorporator's signature. |

Rhode Island Articles of Incorporation - Usage Guidelines

Filing the Rhode Island Articles of Incorporation is a pivotal step for anyone looking to formally establish their corporation within the state. This document lays the foundation for your business's legal operations, including its recognition by the state, which enables you to move forward with other important tasks like opening bank accounts and applying for tax identification numbers. The process can seem daunting at first glance, but with a clear set of instructions, you can navigate it with confidence. Let's walk through the necessary steps to complete this form accurately and efficiently.

- Gather Necessary Information: Before you start filling out the form, ensure you have all the required information. This includes the name of the corporation, the purpose for which it is being formed, the number and type of shares the corporation is authorized to issue, the name and address of the registered agent, the names and addresses of the incorporators, and the duration of the corporation, if not perpetual.

- Provide the Name of the Corporation: Enter the exact name of the corporation as you want it registered, including an appropriate corporate identifier such as "Inc." or "Corporation."

- Detail the Corporate Purpose: Clearly articulate the purpose for which the corporation is being formed. This should include the primary business activities.

- Specify Stock Information: Indicate the total number of shares the corporation is authorized to issue, along with the class and any series within those classes, if applicable. If there are multiple classes or series, provide the rights and preferences of each.

- Identify the Registered Agent: State the name and address of the registered agent in Rhode Island, who is authorized to receive legal documents on behalf of the corporation.

- List the Incorporators: Include the names and addresses of all the individuals who are participating in the incorporation process.

- State the Duration of the Corporation: If the corporation will not exist perpetually, specify the planned duration.

- Provide Additional Provisions (If Necessary): If there are any additional articles or provisions that need to be included in the Articles of Incorporation due to specific requirements or preferences, attach them separately.

- Sign and Date the Form: The form must be signed and dated by all incorporators or by an attorney-in-fact acting on their behalf.

- File the Form: Submit the completed form to the Rhode Island Secretary of State's office along with the required filing fee. Check the current fee and acceptable methods of payment on the Secretary of State's website to ensure accuracy and completeness.

Completing the Rhode Island Articles of Incorporation is a critical step in establishing your corporation's legal identity. By carefully following these steps and thoroughly reviewing the information before submission, you can ensure a smooth filing process. Once filed and approved, your corporation will be officially recognized in Rhode Island, allowing you to embark on your business journey with a solid legal foundation.

Essential Queries on Rhode Island Articles of Incorporation

What information do I need to fill out the Rhode Island Articles of Incorporation form?

When preparing to file the Rhode Island Articles of Incorporation, several pieces of information are essential. The name of the corporation, which must be distinguishable from other entities registered in the state, is required. You will also need to provide a detailed business purpose, the name and address of the incorporator(s), and information regarding the corporation's initial registered agent, who will receive legal and official documents on behalf of the corporation. Additionally, you should specify the number of shares the corporation is authorized to issue and, if applicable, the classes of shares. Lastly, some contact information for correspondence related to the filing must be included.

How do I submit the Rhode Island Articles of Incorporation, and what is the fee?

To submit the Rhode Island Articles of Incorporation, you can either file online through the Rhode Island Secretary of State's website or mail the completed form to their office. Filing fees vary depending on the type of corporation (for example, profit, non-profit, etc.), so it's important to consult the current fee schedule available on the Secretary of State's website. Payment methods include credit cards for online filings and checks or money orders for mail submissions. Make sure that all necessary information is complete and accurate to avoid delays.

Can I reserve a corporation name before filing the Rhode Island Articles of Incorporation?

Yes, you can reserve a corporation name before filing the Articles of Incorporation in Rhode Island. This process ensures your desired name isn't taken by another entity before you complete your filing. To reserve a name, you must submit a Name Reservation Application to the Rhode Island Secretary of State, either online or by mail, along with the appropriate fee. Name reservations are valid for 120 days, giving you ample time to prepare and submit your Articles of Incorporation under the reserved name.

What happens after I file my Rhode Island Articles of Incorporation?

After the Rhode Island Articles of Incorporation are filed, the Secretary of State will review the documents for compliance with state requirements. If approved, the corporation becomes officially recognized as a legal entity in Rhode Island. You'll receive a certificate of incorporation, which is important for many subsequent business activities, such as opening bank accounts and applying for business licenses. Additionally, you should hold an organizational meeting to adopt bylaws, issue stock certificates to the initial shareholders, and appoint directors if they were not named in the Articles of Incorporation. It’s also essential to ensure compliance with any other state and federal requirements, such as obtaining an Employer Identification Number (EIN) from the IRS.

Common mistakes

Filling out the Rhode Island Articles of Incorporation is a critical step in the process of establishing a business entity within the state. However, this procedure can be fraught with errors if not approached with care and due diligence. Here are the ten common mistakes people make that can lead to delays, rejection, or future legal complications:

- Incorrect or Incomplete Entity Name: Businesses often neglect to include the necessary suffix (e.g., Inc., Corporation) in their name or choose a name already in use, leading to confusion and rejection of the document.

- Failing to Appoint a Registered Agent: Every corporation in Rhode Island needs a registered agent for service of process. Providing incorrect information or leaving this section blank can hinder legal processes down the line.

- Improper Stock Information: When the document requests information about authorized shares, inaccuracies can significantly affect the company's structure and financing capabilities.

- Not Specifying the Business Purpose: A vague or missing business purpose can delay the approval process, as the state needs to ensure the business activities are lawful and clearly understood.

- Omitting Officer or Director Information: Not including comprehensive details about the directors or officers of the corporation can cause issues, especially since this information is crucial for corporate governance and accountability.

- Missing Signatures: An easily overlooked mistake is forgetting to sign the document. Unsigned documents are invalid and will be returned without processing.

- Incorrect Filing Fee: Either overpaying or underpaying can result in processing delays. Ensure the correct amount is sent with the application to avoid such issues.

- Neglecting to Specify the Duration of the Corporation: If the corporation is not intended to be perpetual, failing to specify its duration can lead to misunderstandings and potential legal hurdles in the future.

- Using Unauthorized or Restricted Words: Certain words may require additional paperwork or permissions to use. Without proper authorization, including these in the business name can lead to outright rejection.

- Forgetting to Choose a Fiscal Year End: This date is important for tax and accounting purposes. Not specifying it can lead to complications when filing annual reports or taxes.

To avoid these common pitfalls, individuals are encouraged to review the Rhode Island Articles of Incorporation form carefully, perhaps even seeking legal advice. Ensuring accuracy and completeness from the outset can save time, money, and frustration, laying a solid foundation for the business's future operations. It's also advisable to check the Rhode Island Secretary of State website or contact their office for the most current filing requirements and guidance.

In conclusion, while the task of filling out the Articles of Incorporation may seem straightforward, attention to detail is key. Common mistakes can be avoided through a careful review of the requirements and, when necessary, seeking clarification or assistance. Doing so not only facilitates a smoother application process but also contributes to the long-term success and compliance of the corporation.

Documents used along the form

When establishing a corporation in Rhode Island, filing the Articles of Incorporation is a crucial step. However, this form is just the beginning. A range of other documents supports and complements this primary document, ensuring compliance with state laws and facilitating smooth operations. Here's a list of up to 10 essential forms and documents often used along with the Rhode Island Articles of Incorporation.

- Bylaws: Bylaws are internal rules that govern the day-to-day operations of the corporation. They outline procedures for meetings, voting, and the roles of directors and officers.

- Operating Agreement: Though more common for LLCs, corporations, especially S corporations, might also use an operating agreement to specify the financial and working relationships among business owners.

- Employer Identification Number (EIN) Application: This IRS form SS-4 is used to apply for an EIN, which is necessary for tax purposes, hiring employees, and opening business bank accounts.

- Share Certificates: These are issued to shareholders to signify ownership in the corporation. They include details such as the number of shares owned.

- Initial Report: Some states require an initial report to be filed shortly after the corporation is formed, providing information such as the corporation's address and directors.

- Annual Report: This document is filed annually with the Rhode Island Secretary of State and updates or confirms the details of the corporation’s address, directors, and officers.

- Stock Ledger: A stock ledger is a record of a corporation's stock transactions and ownership. It is crucial for maintaining corporate transparency and compliance.

- Corporate Resolution: These are formal documents used to record decisions made by the corporation's board of directors or shareholders.

- Banking Resolution: A banking resolution is a document needed to open a business bank account, detailing who has the authority to conduct financial transactions on behalf of the corporation.

- Articles of Amendment: If a corporation needs to make changes to its Articles of Incorporation, such as a name change or address update, Articles of Amendment must be filed with the state.

Together, these documents form a comprehensive legal framework for a corporation in Rhode Island. While the Articles of Incorporation officially bring a corporation into existence, subsequent documents like bylaws and various permits and registrations play a pivotal role in its operational and legal compliance. Staying on top of these documents ensures your corporation is well-positioned for long-term success.

Similar forms

The Rhode Island Articles of Incorporation form is similar to other foundation documents required to formally establish a business entity within different jurisdictions. These documents, while serving a parallel purpose, differ in their specific details, terminology, and areas of focus depending on the region and the type of business structure being established. Below, we'll look at how the Articles of Incorporation stack up against a couple of key documents used in other contexts.

The first notable comparison is with the Articles of Organization commonly filed for the formation of a Limited Liability Company (LLC) in many states. Both documents play a similar foundational role in the business creation process, detailing essential information about the new entity to the respective state's filing office. Where they differ primarily is in the terminology and the structure of the business being formed. The Articles of Incorporation are used to establish a corporation, focusing on elements like the corporation's name, purpose, and the number and type of authorized shares. On the other hand, the Articles of Organization cater to LLCs, emphasizing the names of the members/managers and the operating agreements that dictate the management structure of the LLC.

Another document the Articles of Incorporation bear resemblance to is the Certificate of Incorporation. While these terms are often used interchangeably in some jurisdictions, they essentially serve the same purpose: to register a corporation with the state and outline its foundational aspects. This includes the corporation's name, purpose, authorized share structure, and information about its initial directors. The distinction comes more from regional preferences in terminology than from differences in the content or function of the documents. For instance, some states prefer the term "Articles of Incorporation", while others use "Certificate of Incorporation", yet the requirements for what must be included in the document remain largely consistent.

Dos and Don'ts

When setting up a business in Rhode Island, completing the Articles of Incorporation correctly is a crucial step. This document serves as your business's legal foundation, outlining its structure, purpose, and compliance with state laws. To ensure accuracy and avoid common mistakes, here are six dos and don'ts to consider:

What You Should Do:

- Provide accurate and complete information: Double-check all details, including the business name, registered agent information, and business address, to ensure they are correct and complete.

- Choose the correct corporate structure: Understand the different types of corporations (e.g., S Corp, C Corp) and choose the one that best fits your business needs and goals.

- Follow state-specific requirements: Each state has unique requirements. Make sure your Articles of Incorporation comply with Rhode Island's specific rules and regulations.

- Include a detailed business purpose: Clearly describe your corporation's intended activities. This helps in the approval process and ensures you are compliant with state laws.

- Sign and date the document: The form requires a signature from an authorized person, such as an incorporator or company officer. Ensure the document is signed and dated.

- Keep a copy for your records: After filing, keep a copy of the submitted Articles of Incorporation. This document is important for future legal and business processes.

What You Shouldn't Do:

- Overlook the need for a registered agent: A registered agent is necessary for receiving official and legal documents. Not appointing one can lead to compliance issues.

- Use a P.O. Box for the business address: Most states require a physical address for the corporation's principal office. Using a P.O. Box might invalidate your form.

- Forget to specify share information: If your corporation will issue shares, specify the types and the number of shares authorized. Failing to do so can complicate future business endeavors.

- Ignore additional filings: Completing the Articles of Incorporation is an essential step, but remember other requirements, such as obtaining business licenses or filing an annual report.

- Misstate the corporate name: The corporate name must be unique and comply with Rhode Island’s naming conventions. Avoid using restricted words without authorization.

- Assume instant approval: After submission, allow time for the state to review and process your Articles of Incorporation. Immediate business transactions or operations should wait for official approval.

Misconceptions

When businesses seek to formalize their operations in Rhode Island, the Articles of Incorporation form plays a crucial role. However, misunderstandings about this document can lead to confusion and errors in the incorporation process. The misconceptions can range from its purpose to the details required within the form. Here, we clarify four common misconceptions:

Only for Large Corporations: People often mistakenly believe that the Articles of Incorporation are exclusively for large corporations. In reality, any corporation, regardless of its size, must file this document to legally operate within Rhode Island. This includes small, privately owned businesses seeking the benefits and protections of incorporation.

Complexity and Professional Assistance: Another common belief is that the process of filling out and filing the Articles of Incorporation is overly complex, necessitating the need for expensive legal assistance. While having legal guidance can ensure accuracy and compliance, many small business owners successfully complete and file the paperwork on their own or with minimal help. Rhode Island offers resources and straightforward instructions, making the process attainable for those willing to invest a bit of time and effort.

One-Time Requirement: Some might think that once the Articles of Incorporation are filed, no further documentation is required with the state. This is not accurate. Corporations are often required to file annual reports and, in some cases, additional documents based on changes within the company (such as amendments to the Articles or changes in corporate structure) must be reported to the state.

Immediate Business Operations: Filing the Articles of Incorporation does not mean a business can start operating in Rhode Island immediately. Other steps are typically needed post-filing, such as obtaining business licenses, permits, and an EIN (Employer Identification Number) from the IRS. Additionally, compliance with local city or county ordinances is necessary before business operations can legally commence.

Understanding the true nature and requirements of the Rhode Island Articles of Incorporation is the first step towards establishing a corporation that is compliant with state laws and regulations. It’s advisable for prospective business owners to research thoroughly or consult with a professional to navigate the process effectively.

Key takeaways

The Rhode Island Articles of Incorporation form is a critical document for establishing a corporation in the state. When preparing this form, it's essential to provide accurate and comprehensive details to ensure a smooth filing process. Here are ten key takeaways to consider:

- The name of the corporation must be unique and follow Rhode Island's naming conventions, including the use of corporate designators such as Inc., Corporation, or similar variants.

- The purpose of the corporation should be clearly stated, though Rhode Island allows for a broad statement of purpose if desired.

- Details regarding the corporation's authorized shares, including the number of shares and the class of shares, must be included. This information is crucial for determining the corporation's ownership structure.

- The address of the corporation's initial registered office and the name of the initial registered agent who resides at that address are required. This facilitates legal and official communication.

- It is necessary to provide the name(s) and address(es) of the incorporator(s) responsible for completing and filing the form.

- The duration of the corporation, if not perpetual, should be specified. Many corporations choose a perpetual duration to avoid the need for future adjustments.

- Provisions regarding the distribution of assets upon dissolution of the corporation should be included. This outlines how assets will be handled if the corporation is dissolved.

- In some cases, additional articles may be added to address specific legal or operational requirements specific to the nature of the corporation's business.

- The form requires the signature of the incorporator(s), which is a statement of accuracy and compliance with Rhode Island laws.

- After completion, the form must be filed with the Rhode Island Secretary of State along with the appropriate filing fee. The filing fee is subject to change, so it's advisable to check the current amount with the Secretary of State's office.

Thoroughly reviewing and understanding these takeaways can facilitate a smoother filing process for the Articles of Incorporation in Rhode Island. Careful preparation and attention to detail in complying with the state's requirements are key to establishing a successful corporation.

Find Some Other Forms for Rhode Island

Quitclaim Deed Rhode Island - By opting for a Transfer-on-Death Deed, you're taking charge of your estate planning, ensuring your real estate bypasses common probate challenges.

How Long Does a Divorce Take in Ri - The form represents a key milestone in the divorce process, marking the point where both parties have come to a mutual understanding and agreement.