Attorney-Approved Durable Power of Attorney Template for Rhode Island

In Rhode Island, individuals have the opportunity to prepare for unforeseen circumstances through the execution of a Durable Power of Attorney (DPOA) form. This document plays a crucial role in managing one’s personal and financial affairs in the event that they become incapacitated or unable to make decisions for themselves. By appointing a trusted agent, also known as an attorney-in-fact, this legal instrument ensures that one's preferences and interests are considered in important decision-making processes. The DPOA form covers various aspects including, but not limited to, real estate transactions, handling of financial matters, and making decisions related to personal and health care. It is distinguished from other power of attorney forms by its durability - it remains in effect even when the individual loses mental capacity. The preparation and execution of this document require careful consideration and often, the guidance of legal professionals to ensure it accurately reflects the individual's wishes and complies with Rhode Island laws.

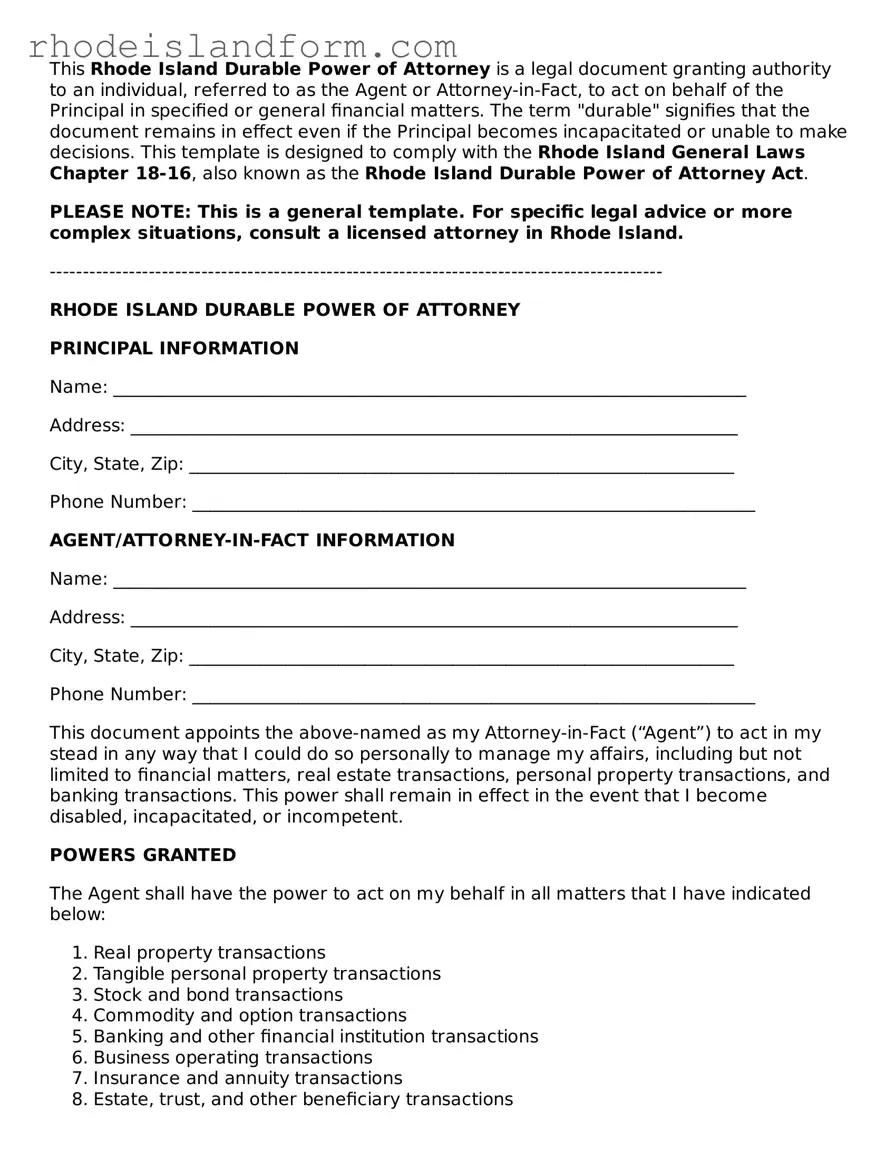

Rhode Island Durable Power of Attorney Preview

This Rhode Island Durable Power of Attorney is a legal document granting authority to an individual, referred to as the Agent or Attorney-in-Fact, to act on behalf of the Principal in specified or general financial matters. The term "durable" signifies that the document remains in effect even if the Principal becomes incapacitated or unable to make decisions. This template is designed to comply with the Rhode Island General Laws Chapter 18-16, also known as the Rhode Island Durable Power of Attorney Act.

PLEASE NOTE: This is a general template. For specific legal advice or more complex situations, consult a licensed attorney in Rhode Island.

---------------------------------------------------------------------------------------------

RHODE ISLAND DURABLE POWER OF ATTORNEY

PRINCIPAL INFORMATION

Name: ________________________________________________________________________

Address: _____________________________________________________________________

City, State, Zip: ______________________________________________________________

Phone Number: ________________________________________________________________

AGENT/ATTORNEY-IN-FACT INFORMATION

Name: ________________________________________________________________________

Address: _____________________________________________________________________

City, State, Zip: ______________________________________________________________

Phone Number: ________________________________________________________________

This document appoints the above-named as my Attorney-in-Fact (“Agent”) to act in my stead in any way that I could do so personally to manage my affairs, including but not limited to financial matters, real estate transactions, personal property transactions, and banking transactions. This power shall remain in effect in the event that I become disabled, incapacitated, or incompetent.

POWERS GRANTED

The Agent shall have the power to act on my behalf in all matters that I have indicated below:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

Please mark the specific powers you are granting:

______________________________________________________________________________

______________________________________________________________________________

SPECIAL INSTRUCTIONS

Additional instructions, limitations, or stipulations to the Agent’s powers may be outlined below:

______________________________________________________________________________

______________________________________________________________________________

SIGNATURES

This Power of Attorney will start on ______________ (date) and will remain effective indefinitely unless a specific termination date is set forth below or I revoke it in writing.

Termination Date (if applicable): _______________________________________________

In witness whereof, I have executed this Durable Power of Attorney on this day of ____________, 20______.

Principal's Signature: __________________________________________________________

Principal's Name Printed: _______________________________________________________

Agent's Signature: _____________________________________________________________

Agent's Name Printed: __________________________________________________________

NOTARIZATION

This document was acknowledged before me on ________________________ (date) by _______________________________________________________ (name of Principal).

__________________________________

Notary Public

My Commission Expires: __________________

PDF Data

| Fact | Detail |

|---|---|

| Purpose | A Rhode Island Durable Power of Attorney (DPOA) form allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf, especially regarding financial matters, and the designation remains effective even if the principal becomes incapacitated. |

| Governing Laws | The form and its execution are governed by Rhode Island General Laws, Title 18, Chapter 18-16, also known as the "Rhode Island Short Form Power of Attorney Act." |

| Requirements for Validity | For a DPOA to be valid in Rhode Island, it must be signed by the principal, dated, and either notarized or witnessed by two adult witnesses who are not named as agents in the document. |

| Agent's Authority | The agent can be granted a broad range of powers, such as handling financial transactions, real estate matters, personal and family maintenance, and more, based on the principal’s selections on the form. |

| Duration | Unless otherwise stated, the DPOA remains in effect until the principal's death, revocation, or if a termination date is specified within the document. |

| Revocation Process | The principal can revoke a DPOA at any time, provided they are of sound mind, by providing a written notice of revocation to the agent and any institutions or parties relying on the original DPOA. |

| Special Considerations | When deciding on an agent, it's essential for the principal to choose someone trustworthy and capable of handling the responsibilities, as this person will have significant control over the principal’s affairs and welfare. |

Rhode Island Durable Power of Attorney - Usage Guidelines

Completing a Durable Power of Attorney form is a responsible step to ensure that your affairs will be handled according to your wishes if you are unable to do so yourself. This document grants someone you trust the authority to act on your behalf. The process requires attention to detail to ensure accuracy and ensure your intentions are clear. It is crucial to follow each step carefully and review your information before finalizing.

- Begin by providing your full legal name at the top of the form, identifying yourself as the Principal.

- Enter your complete address, including street, city, state, and zip code to ensure there is no ambiguity regarding your identity.

- Choose an individual you trust implicitly to serve as your Agent. Write their full legal name along with their complete address, including street, city, state, and zip code.

- For an alternate agent, in case your primary agent is unable or unwilling to serve, repeat the previous step with another individual's information.

- Specify the powers you are granting to your Agent. Be as detailed as possible to ensure your agent understands their responsibilities and limitations.

- Include any special instructions or limitations on your Agent's power that are important to you. This could relate to certain assets, decision-making preferences, or any circumstances under which the powers should not apply.

- Enter the effective date of the Power of Attorney. Specify whether it becomes effective immediately or upon the occurrence of a future event, often your incapacity.

- Read through the rest of the document carefully. Look for any additional sections requiring your input or decision, such as choice of jurisdiction.

- Sign and date the form in the presence of a notary public. The notary will also need to sign and may affix their seal to validate the document.

- Finally, distribute copies of the completed and notarized form to your Agent, any alternate agents, and perhaps a trusted family member or advisor. You may also wish to keep a copy in a safe but accessible place.

By taking these steps, you are ensuring that your affairs can be managed efficiently and according to your wishes, should the need arise. This act of preparation can provide peace of mind to you and your loved ones. Remember, laws can vary by state, so consider consulting with a legal professional to ensure your document meets all applicable requirements.

Essential Queries on Rhode Island Durable Power of Attorney

What is a Durable Power of Attorney (DPOA) form in Rhode Island?

A Durable Power of Attorney form in Rhode Island is a legal document that allows an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to manage their financial affairs. This form remains effective even if the principal becomes incapacitated or unable to make decisions for themselves.

Who can serve as an agent in a DPOA in Rhode Island?

In Rhode Island, any competent adult can be designated as an agent in a Durable Power of Attorney. It is crucial that the principal chooses someone they trust completely, as the agent will have broad powers to manage the principal's financial affairs. This person can be a family member, a friend, or even a professional advisor.

How can someone revoke a Durable Power of Attorney in Rhode Island?

A Durable Power of Attorney can be revoked at any time by the principal as long as they are mentally competent. This revocation must be done in writing and should be notified to the agent and any institutions or parties that were aware of the original Power of Attorney. It is also recommended to destroy all original and copied documents to prevent future misuse.

Is a lawyer required to create a Durable Power of Attorney in Rhode Island?

While it's not legally required to have a lawyer to create a Durable Power of Attorney in Rhode Island, it is highly recommended. A lawyer can ensure that the document accurately reflects the principal's wishes, complies with Rhode Island law, and addresses any specific needs or concerns the principal may have. Additionally, a lawyer can provide valuable advice on choosing an agent.

Does a Rhode Island Durable Power of Attorney need to be notarized?

Yes, for a Durable Power of Attorney to be legally effective in Rhode Island, it must be signed in the presence of a notary public. Some cases may also require the presence of witnesses, depending on the nature of the powers granted and the specific requirements under Rhode Island law. Notarization helps to verify the identity of the principal and ensures that the document is legally binding.

Common mistakes

When dealing with a Rhode Island Durable Power of Attorney form, many individuals find themselves navigating a legal document that can significantly impact their future and that of their loved ones. Errors in completing this form are not uncommon, but they can lead to unintended consequences. Awareness and avoidance of common mistakes can ensure the document reflects the principal's true intentions and stands legally valid.

One crucial mistake is overlooking the importance of precise language. The specificity with which duties and powers are detailed can determine the extent of authority granted to the agent. Vague language might give the agent either too much leeway or insufficient power to act effectively on behalf of the principal.

- Not selecting the right agent: Choosing an agent requires careful consideration. The person selected should be trustworthy, reliable, and capable of managing financial affairs. Sometimes, people hastily choose someone without fully considering the implications of their choice.

- Failing to designate a successor agent: Life is unpredictable. If the original agent is unable to serve for any reason, having a successor agent ensures that there's no gap in the management of the principal's affairs.

- Ignoring the need for specificity: It’s tempting to use broad terms to grant powers, but being specific about the powers granted to the agent can prevent misuse and confusion.

- Neglecting to include limitations: While the agent needs certain powers, including limitations can prevent potential abuse of power and ensure the agent acts within the intended scope of their authority.

- Omitting a durability clause: A Durable Power of Attorney remains in effect if the principal becomes incapacitated. Without specifying its durability, the document might not serve its intended purpose in critical times.

- Avoiding discussions with the chosen agent: Not discussing expectations and duties with the agent ahead of time can lead to misunderstandings or reluctance on the agent's part to serve.

- Failure to review and update the document: People’s circumstances change, and a document that isn’t periodically reviewed and updated may not reflect the current wishes or situations of the parties involved.

Equally important is the understanding that the Rhode Island Durable Power of Attorney form should be completed with the guidance of a legal professional. This can mitigate the risk of making errors that may invalidate the document. Additionally, properly notarizing the form and ensuring it meets all state-specific requirements are critical steps that should not be overlooked.

In conclusion, while the process of completing a Rhode Island Durable Power of Attorney form might seem straightforward, the nuances of its preparation are anything but. Avoiding the common mistakes listed can preserve the principal’s intentions and ensure that their financial matters are handled appropriately and according to their wishes.

Documents used along the form

When preparing a Durable Power of Attorney in Rhode Island, it's crucial to consider additional legal documents that compliment and provide a comprehensive approach to estate planning and medical care decisions. These documents ensure that a person's wishes are respected and legally enforceable in various scenarios. Here is a list of documents often used alongside the Rhode Island Durable Power of Attorney form:

- Medical Power of Attorney: This empowers an agent to make healthcare decisions on behalf of the principal when they are incapacitated. It complements the financial authority given in a Durable Power of Attorney by covering health and medical areas.

- Living Will: Also known as an advance healthcare directive, it specifies an individual’s preferences regarding medical treatments and life-sustaining measures in situations where they cannot communicate their wishes.

- Last Will and Testament: This document outlines how a person’s assets and estate will be distributed upon their death. It names an executor to manage the estate’s affairs and can specify guardians for minor children. -

- Revocable Living Trust: Enables an individual to manage their assets during their lifetime and specify how these should be handled and distributed after death, often allowing for avoidance of probate.

- Declaration of Homestead: Protects a primary residence from creditors by declaring it a homestead. This is crucial in safeguarding one's home from certain types of debt collections beyond the scope of a Power of Attorney.

- Designation of Health Care Surrogate: Similar to a Medical Power of Attorney, this document names a surrogate to make healthcare decisions. It is particularly relevant in cases where specific state laws govern healthcare decisions.

- HIPAA Release Form: Grants appointed individuals access to the principal's protected health information, allowing them to make informed medical decisions and communicate effectively with healthcare providers.

Collectively, these documents provide a well-rounded legal framework that addresses financial management, healthcare, and end-of-life decisions. By considering all relevant documents, individuals can ensure that their wishes are clearly stated and legally protected in Rhode Island. It's advisable to consult with a legal professional to tailor these documents to individual needs and legal requirements.

Similar forms

The Rhode Island Durable Power of Attorney form is similar to other estate planning documents that individuals may use to manage their affairs in case they are unable to do so themselves. Although the specific powers and conditions can vary, these documents share a common goal: to delegate authority to a trusted person or entity. Understanding the nuances among them can help in deciding which document best suits an individual's needs.

Health Care Power of Attorney: This document parallels the Rhode Island Durable Power of Attorney in its fundamental purpose of designating someone to make decisions on your behalf. While the Durable Power of Attorney often focuses on financial and legal decisions, the Health Care Power of Attorney zeroes in on medical decisions. This includes treatment options, end-of-life care, and even day-to-day medical decisions, depending on how it's crafted. Similar to its financial counterpart, it activates when the principal cannot make decisions for themselves, ensuring that medical preferences are respected and followed.

Living Will: At first glance, a Living Will might seem quite different from a Durable Power of Attorney. However, they share integral similarities, especially in context to planning for the unexpected. A Living Will documents specific directives for medical treatment should an individual become incapacile to communicate their desires directly. It's often used in conjunction with a Health Care Power of Attorney, sculpting a comprehensive approach to medical decision-making. Unlike the Durable Power of Attorney, which designates an agent, a Living Will speaks directly to healthcare providers about an individual's choices regarding life-sustaining treatments and other critical medical decisions.

General Power of Attorney: The General Power of Attorney is closely aligned with the Durable Power of Attorney, with a critical distinction in its durability. While a Durable Power of Attorney remains in effect even when the individual becomes incapacitated, a General Power of Attorney does not. It grants an agent broad authority over an individual's affairs, but this authority ceases if the individual is unable to make decisions due to mental incapacity or other reasons. This makes the Durable Power of Attorney particularly valuable for long-term planning, ensuring that an individual's affairs can be managed without interruption, regardless of their capacity to oversee these matters themselves.

Dos and Don'ts

When preparing to fill out the Rhode Island Durable Power of Attorney form, it's important to move forward with care and precision. This document grants someone else the authority to make legal decisions on your behalf, which can have lasting effects on both your life and finances. Here's a list of things you should and shouldn't do to ensure the process is handled correctly:

- Do thoroughly read the entire form before beginning to fill it out. Understanding every part will help you fill it out correctly.

- Do choose someone you trust implicitly as your agent (also known as your attorney-in-fact). This person will have significant power over your affairs.

- Do be very specific about the powers you are granting. The more detailed you are, the less room there is for interpretation.

- Do talk to the person you intend to appoint as your agent to make sure they are willing and able to take on the responsibilities.

- Do sign the document in the presence of a notary public to ensure it is legally binding.

- Do not leave any sections incomplete. An incomplete form can lead to misunderstandings or legal challenges.

- Do not use unclear language or jargon that could be misinterpreted. It's crucial that your intentions are clear to anyone who reads the document.

- Do not forget to specify the duration or conditions under which the power of attorney will remain effective, especially since it is durable.

- Do not hesitate to seek legal advice if you have any questions or concerns about the document or process. An attorney can provide valuable guidance.

- Do not fail to inform family members or other relevant parties about the existence of the document and who you have chosen as your agent. Keeping them informed can prevent surprises and conflicts later on.

Misconceptions

Discussion around the Durable Power of Attorney (DPOA) form in Rhode Island can often be filled with misunderstandings. It's crucial to dispel these misconceptions to help individuals make informed decisions about their legal and financial future.

It takes effect immediately upon signing: Many believe that signing a Durable Power of Attorney in Rhode Island means it takes effect right away. However, the document can be structured to become effective at a future date or upon the occurrence of a specified event, such as the principal's incapacity, affording more control over when the powers are to be exercised.

It's only for the elderly: While it's commonly associated with elder planning, the Durable Power of Attorney is a practical tool for anyone. Accidents or sudden illnesses can happen at any age, and having a DPOA in place ensures that your affairs can be managed without court intervention.

It grants complete power to the agent: The scope of authority granted to an agent under a DPOA can be as broad or as narrow as the principal decides. It's a misconception that appointing an agent means giving up all control over personal and financial matters. The principal can specify the powers granted and retain the right to revoke or amend the DPOA.

A DPOA covers medical decisions: This is a common misconception. In Rhode Island, a Durable Power of Attorney pertains to financial and property matters. Health care decisions require a separate legal document known as a Health Care Power of Attorney or Advance Directive.

It's irreversible: Some worry that once a DPOA is signed, the decision is permanent. However, as long as the principal is mentally competent, they have the right to revoke or change their DPOA at any time, ensuring they can respond to changing circumstances or relationships.

Any form will work: While templates can be found online, using a generic form without ensuring it complies with Rhode Island's specific laws and requirements can result in a document that is ineffective or does not fully protect the principal's interests. It's recommended to consult with a legal professional to create a DPOA that accurately reflects the principal's wishes and meets state legal standards.

Understanding these misconceptions about the Rhode Island Durable Power of Attorney form can lead to better preparedness and peace of mind. Every individual’s situation is unique, and consulting with a knowledgeable attorney can ensure that a DPOA aligns with personal needs and legal standards.

Key takeaways

Filling out and utilizing the Rhode Island Durable Power of Attorney form is a significant step in planning for future financial management and decision-making. Understanding the importance and the correct way to complete this document ensures your wishes are respected, even if you're unable to participate in decisions personally. Below are four key takeaways to keep in mind:

- Choose Your Agent Carefully: The person you designate as your agent will have broad authority to manage your financial affairs. It's crucial to select someone you trust implicitly. Consider their ability to handle financial matters and their willingness to act in your best interest.

- Be Specific About Powers Granted: The form allows you to specify exactly what financial powers you are transferring. You can choose to grant broad authority or limit powers to certain activities, such as paying bills or managing investments. Clarity here can prevent confusion and misuse of power in the future.

- The Form Must Be Witnessed and Notarized: To be valid, the Rhode Island Durable Power of Attorney form needs to be signed in the presence of a notary public and two witnesses. These witnesses cannot be the agent you're appointing or related to them by blood, marriage, or adoption. This process provides additional validation of your document.

- Communicate Your Wishes: After completing the form, discuss your wishes and the extent of the powers granted with your chosen agent. It's also wise to inform close family members or friends and provide copies to relevant financial institutions, ensuring that your financial affairs can be managed seamlessly if you're unable to do so yourself.

Understanding these key points can greatly enhance the effectiveness of your Rhode Island Durable Power of Attorney, ensuring that it serves as a robust tool for managing your affairs in accordance with your wishes.

Find Some Other Forms for Rhode Island

Power of Attorney Form Ri - Having a Power of Attorney can be particularly important in case of sudden illness or unexpected incapacitation.

Rhode Island Eviction No Lease - This legal document provides a formal record that can be used in court, showing that the tenant was properly informed of the eviction.