Attorney-Approved General Power of Attorney Template for Rhode Island

In the picturesque state of Rhode Island, a tool exists that offers individuals the chance to ensure their personal affairs are managed according to their wishes, even when they cannot oversee these matters themselves. This tool, known as the General Power of Attorney form, serves as a legal document that grants one person—the agent—the authority to make decisions on behalf of another—the principal. Its applicability spans a wide range of areas, from handling financial transactions to managing real estate and other important personal matters. Crucially, this form requires the principal to thoroughly consider their choice of agent, as the granted authority encompasses a broad spectrum of actions that could significantly impact the principal's life and assets. Furthermore, the form's validity and the powers it encompasses are subject to Rhode Island's state laws, underscoring the importance of both parties understanding their rights and the form's legal implications. By executing this form, individuals can take comfort in knowing that their affairs can be managed efficiently and in alignment with their preferences, thereby providing peace of mind to both the principal and their loved ones.

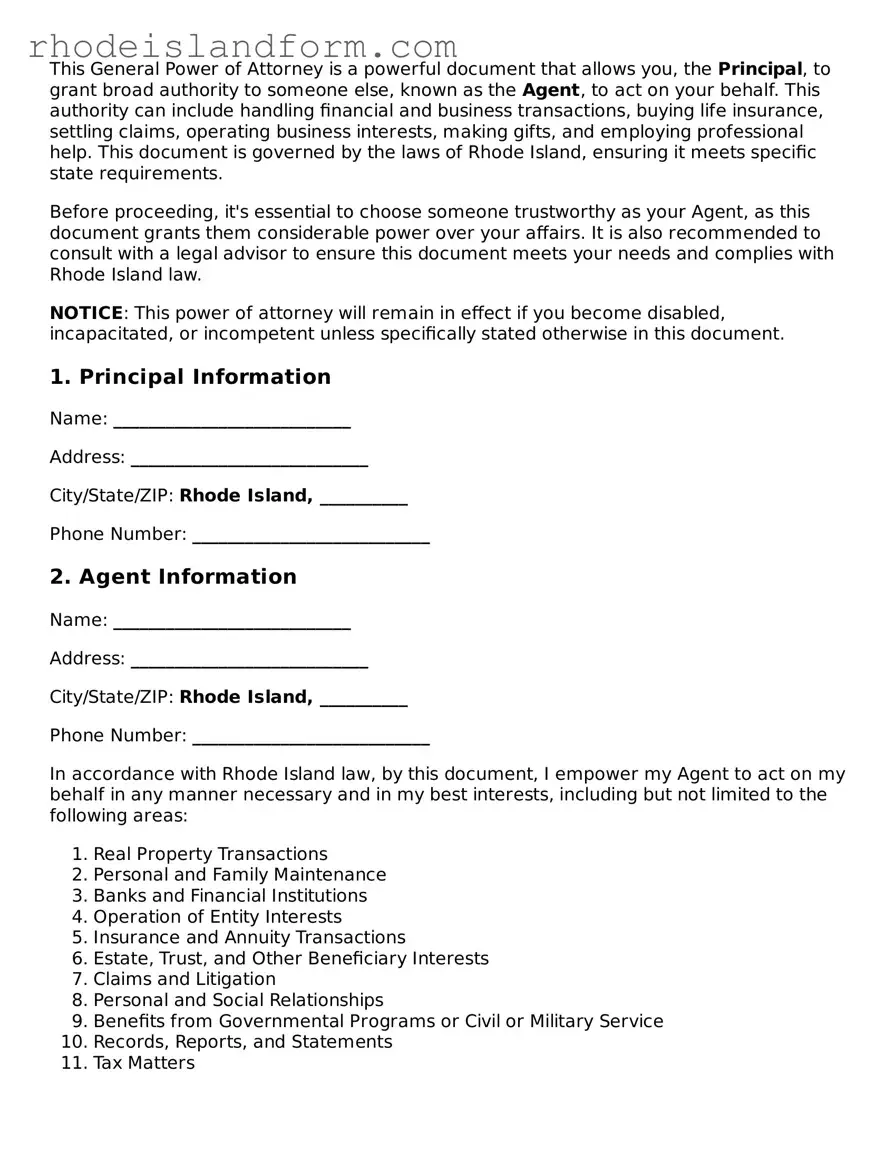

Rhode Island General Power of Attorney Preview

This General Power of Attorney is a powerful document that allows you, the Principal, to grant broad authority to someone else, known as the Agent, to act on your behalf. This authority can include handling financial and business transactions, buying life insurance, settling claims, operating business interests, making gifts, and employing professional help. This document is governed by the laws of Rhode Island, ensuring it meets specific state requirements.

Before proceeding, it's essential to choose someone trustworthy as your Agent, as this document grants them considerable power over your affairs. It is also recommended to consult with a legal advisor to ensure this document meets your needs and complies with Rhode Island law.

NOTICE: This power of attorney will remain in effect if you become disabled, incapacitated, or incompetent unless specifically stated otherwise in this document.

1. Principal Information

Name: ___________________________

Address: ___________________________

City/State/ZIP: Rhode Island, __________

Phone Number: ___________________________

2. Agent Information

Name: ___________________________

Address: ___________________________

City/State/ZIP: Rhode Island, __________

Phone Number: ___________________________

In accordance with Rhode Island law, by this document, I empower my Agent to act on my behalf in any manner necessary and in my best interests, including but not limited to the following areas:

- Real Property Transactions

- Personal and Family Maintenance

- Banks and Financial Institutions

- Operation of Entity Interests

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Interests

- Claims and Litigation

- Personal and Social Relationships

- Benefits from Governmental Programs or Civil or Military Service

- Records, Reports, and Statements

- Tax Matters

This General Power of Attorney will become effective immediately upon signing unless a different start date is specified here: ________________ (MM/DD/YYYY).

This authority will remain in effect until ________________ (MM/DD/YYYY) unless it is revoked earlier by the Principal in a written document or the Principal dies.

Signature of Principal:___________________________

Date: ___________________________

Signature of Agent:___________________________

Date: ___________________________

To ensure this document is effective and in compliance with Rhode Island laws, it's recommended to have it notarized and to follow all necessary legal procedures related to the signing and execution of a General Power of Attorney.

Acknowledgment of Notary Public

State of Rhode Island

County of _____________________

On ______________________ (MM/DD/YYYY), before me, ______________________ (Notary Public), personally appeared the above-named Principal, who proved to me through government-issued photo identification to be the person whose name is subscribed to this instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness where, I have hereunto set my hand and official seal.

Notary Public Signature: _________________________

Date: ___________________________

My commission expires: ___________________________

PDF Data

| Fact | Detail |

|---|---|

| Definition | A General Power of Attorney (GPOA) in Rhode Island allows an individual (the principal) to grant broad financial powers to another person (the agent) to handle financial matters on their behalf. |

| Governing Laws | The form and its use are governed by Chapter 18 of Title 18 of the Rhode Island General Laws, which covers Powers and Letters of Attorney. |

| Form Requirements | For a GPOA to be valid in Rhode Island, it must be signed by the principal and notarized. Additionally, it's recommended to have two witnesses sign, although not strictly required by law. |

| Duration | Unless specified otherwise within the document, the GPOA remains in effect until the principal dies or revokes the power granted. |

| Revocation | The principal can revoke the GPOA at any time, as long as they are mentally competent. This needs to be done in writing and communicated to the agent and any institutions where the GPOA was used. |

| Agent's Authority | The agent can perform a wide range of financial activities on behalf of the principal, such as handling bank transactions, buying or selling property, and managing financial assets. However, the specific powers granted should be detailed within the GPOA document. |

Rhode Island General Power of Attorney - Usage Guidelines

When it's time to set up a General Power of Attorney (POA) in Rhode Island, knowing the correct steps can smooth the process, ensuring that your affairs will be managed as you wish should you be unable to do so yourself. A General Power of Attorney is a powerful document that grants another person the authority to make decisions on your behalf, and filling it out correctly is crucial. Here’s a simple guide to help you through the process, so you can rest easy knowing you've taken the right steps.

- Gather all necessary information: Before beginning, make sure you have all the relevant details such as the full legal name, address, and contact information of both the principal (the person granting the power) and the agent (the person receiving the power). Also, consider the specific powers you wish to grant and any limitations to those powers.

- Find a suitable form: Obtain a Rhode Island General Power of Attorney form. This can usually be found online through legal services websites or at a local law library.

- Fill out the principal’s information: At the top of the form, enter the principal’s full legal name, address, and the date the document is being filled out.

- Specify the agent: Enter the full legal name, address, and contact details of the agent who will be granted the power. Ensure this information is accurate to avoid any legal challenges in the future.

- Define the powers granted: Carefully read through the powers listed on the form. Check or initial next to the powers you are granting to the agent. If there are any powers you do not wish to grant, or if you wish to specify limitations, make sure to detail these clearly on the form or attach a separate document outlining these specifics.

- Sign and date the form: In the presence of a notary public, sign and date the form. Rhode Island law requires a General Power of Attorney to be notarized to be legally valid.

- Obtain the agent’s acceptance: It's not only courteous but often required that the agent formally accepts the responsibilities being granted. This section may be part of the form. If so, ensure the agent signs and dates this section, acknowledging their acceptance of the powers.

- Store the document safely: Once completed and signed, make several copies of the document. Store the original in a safe place, such as a safe deposit box or with a trusted attorney, and provide a copy to the agent as well as any institutions or individuals who may need it.

With your Rhode Island General Power of Attorney properly filled out, you're now prepared to move forward, knowing your affairs can be managed according to your wishes. Remember, the clarity and accuracy of the information provided in this document are imperative for its legal effectiveness. It’s also a good idea to review this document periodically and update it as necessary to reflect any changes in your wishes or personal circumstances.

Essential Queries on Rhode Island General Power of Attorney

What is a General Power of Attorney form in Rhode Island?

A General Power of Attorney (POA) form in Rhode Island is a legal document that allows one person, known as the principal, to grant another individual, known as the agent or attorney-in-fact, the authority to make decisions and take actions on their behalf regarding their financial affairs and assets. This document is flexible, enabling the agent to handle a wide range of tasks, except for making healthcare decisions.

How do I create a General Power of Attorney in Rhode Island?

To create a General Power of Attorney in Rhode Island, you need to complete a POA form that clearly identifies the principal and the agent, outlines the powers being granted, and complies with Rhode Island laws. Both the principal and the agent must sign the document, ideally in the presence of a notary public or two witnesses, to enhance its legal standing.

Does a General Power of Attorney need to be notarized in Rhode Island?

Yes, in Rhode Island, it is highly recommended to notarize the General Power of Attorney to ensure its validity. Although state laws may vary regarding the necessity of notarization for the legal effectiveness of the document, notarization adds a level of credibility and can prevent complications when the document is presented to financial institutions or other parties.

Can I revoke a General Power of Attorney?

Yes, the principal has the right to revoke a General Power of Attorney at any time as long as they are mentally competent. To revoke the POA, the principal should provide written notice to the agent and any institutions or individuals that were aware of the existence of the POA, informing them of the revocation. It is also advisable to destroy all physical copies of the POA document.

What happens if the principal becomes incapacitated?

In Rhode Island, a standard General Power of Attorney becomes invalid if the principal becomes incapacitated, as it does not have "durable" powers. If the principal wishes for the POA to remain effective even if they become unable to make decisions for themselves, they should consider creating a Durable Power of Attorney specifically designed for this purpose.

Is there a difference between a General Power of Attorney and a Durable Power of Attorney?

Yes, the key difference between a General Power of Attorney and a Durable Power of Attorney lies in their effectiveness upon the principal’s incapacitation. A General Power of Attorney typically ceases to be effective if the principal becomes incapacitated. In contrast, a Durable Power of Attorney is specifically designed to remain in effect even after the principal cannot make decisions for themselves.

Where can I find a General Power of Attorney form in Rhode Island?

General Power of Attorney forms for Rhode Island can be obtained from several sources, including legal services websites, law offices, and sometimes at public libraries or government offices. It is crucial to ensure that the form is up-to-date and compliant with current Rhode Island laws. Consulting with a legal professional to tailor the document to your specific needs is also highly recommended.

Common mistakes

When filling out the Rhode Island General Power of Attorney form, it's critical to approach it with diligence and accurate information. This document grants someone else the authority to make decisions on your behalf, so any mistake can have profound implications. Here are ten common mistakes people make when completing this form:

- Not specifying the powers granted - Often, individuals fail to clearly describe the scope of authority they are giving. This lack of specificity can lead to confusion and misuse of the power.

- Choosing the wrong agent - Selecting someone who is not fully trustworthy or who doesn’t have the capability to handle the responsibilities can lead to mismanagement of one’s affairs.

- Failing to include alternate agents - Without listing a secondary choice, if the primary agent is unable or unwilling to serve, the document could become ineffective.

- Omitting effective date and duration - Not specifying when the powers begin and end can create legal ambiguities, potentially rendering the document useless when needed.

- Ignoring need for notarization - Depending on the jurisdiction, not having the form notarized can invalidate it entirely.

- Poor choice of powers - Granting too much or too little power because of misunderstanding the document’s purpose can cause problems, either by limiting the agent too much or exposing one’s self to unnecessary risk.

- Failure to provide clear instructions for specific situations - Without detailed guidance, an agent might make decisions that are counter to the principal’s wishes during unforeseen circumstances.

- Not updating the document - Life changes like marriage, divorce, or the death of an agent can render the current document inappropriate or invalid if not updated.

- Skipping legal advice - Not consulting with a legal professional can lead to errors in understanding and completing the form, potentially making it void or ineffective.

- Misunderstanding the form’s significance - Underestimating the legal power this document holds can lead to careless completion, affecting financial and legal standings significantly.

To avoid these common errors, individuals should:

- Be explicit in detailing the powers granted and the conditions under which they're effective.

- Choose an agent and alternates carefully, ensuring they're trustworthy and capable.

- Consult with a legal professional to understand the nuances of the form and the implications of the powers being granted.

- Regularly review and update the document to reflect current wishes and life circumstances.

In conclusion, the Rhode Island General Power of Attorney is a powerful legal instrument that should be approached with caution and understanding. By avoiding these common pitfalls and taking the time to accurately complete the document, individuals can ensure that their affairs will be managed according to their wishes should they become unable to do so themselves.

Documents used along the form

In the intricate web of legal documentation, the Rhode Island General Power of Attorney (GPOA) form plays a pivotal role, enabling an individual to grant broad powers to an agent to manage various aspects of their life, from financial to business decisions. However, this powerful document does not stand alone. Several other forms and documents often accompany the GPOA, each serving a complementary or necessary function in ensuring one’s affairs are comprehensively managed. Let’s explore some of these crucial documents that often join the General Power of Attorney in safeguarding an individual’s interests.

- Rhode Island Short Form Power of Attorney - A more concise version of the GPOA, allowing for the delegation of specific powers to an agent, rather than a broad authority.

- Durable Power of Attorney - Similar to the General Power of Attorney but includes provisions that maintain its effectiveness even if the principal becomes incapacitated.

- Health Care Power of Attorney - Designates an agent to make healthcare decisions on behalf of the principal, should they become unable to do so themselves.

- Living Will - Often paired with a Health Care Power of Attorney, this document outlines the principal’s wishes regarding life-sustaining treatment in the event they become terminally ill or incapacitated.

- Revocation of Power of Attorney - Used when the principal decides to terminate the powers previously granted to an agent through a General Power of Attorney or any other type of power of attorney document.

- Real Estate Deed - Essential for transactions involving real estate owned by the principal, ensuring the property is transferred according to their wishes as directed by the agent.

- Bank Documents - Various forms required by financial institutions to recognize the agent’s authority to manage the principal’s accounts as stipulated in the GPOA.

- Vehicle Power of Attorney - Authorizes an agent to handle matters related to the ownership, transfer, or registration of a vehicle on behalf of the principal.

While the General Power of Attorney stands as a cornerstone in delegating authority, the true strength in managing one’s affairs with precision comes from the supportive role of these additional documents. Together, they form a robust framework ensuring that every aspect of an individual’s life can be managed effectively, respecting their wishes and legal rights. As such, integrating these documents with the Rhode Island General Power of Attorney form provides a comprehensive approach to personal and financial affairs management, tailored to individual needs and circumstances.

Similar forms

The Rhode Island General Power of Attorney form is similar to other types of legal documents that grant someone the authority to act on your behalf. These documents vary by the scope of power they grant and under what circumstances they become effective or are terminated.

One document similar to the Rhode Island General Power of Attorney is the Durable Power of Attorney. Both forms empower an agent to make decisions on the principal's behalf. However, the key difference lies in their durability. A Durable Power of Attorney remains in effect even if the principal becomes mentally incapacitated, unlike the General Power of Attorney, which typically becomes invalid if the principal loses the ability to make informed decisions.

Another document that shares similarities is the Medical Power of Attorney. While the General Power of Attorney and Medical Power of Attorney both allow an agent to make decisions on behalf of the principal, the scope of their powers differs significantly. The Medical Power of Attorney is specifically limited to healthcare-related decisions, enabling the agent to make medical choices for the principal if they cannot do so themselves, whereas the General Power of Attorney covers a broader spectrum of decisions beyond health care.

Lastly, the Limited Power of Attorney is similar to the Rhode Island General Power of Attorney in that it grants someone else the authority to act on your behalf. The distinction, however, is in the scope and duration of the authority granted. A Limited Power of Attorney is often designated for a specific task or for a limited period of time, unlike the broader and more indefinite granting of powers under a General Power of Attorney.

Dos and Don'ts

Filling out a General Power of Attorney form in Rhode Island is a significant legal step that empowers another person to make decisions on your behalf. It's essential to approach this task with careful attention to detail and a clear understanding of the implications. Here are some dos and don'ts to guide you through the process.

Do:

- Thoroughly review the document before you start filling it out. Understanding every section of the form will help ensure that you correctly express your wishes.

- Use precise language to define the scope of power you are granting. Be as specific as possible to avoid any ambiguity regarding the agent’s authority.

- Choose a trusted individual as your agent. This person will act on your behalf, so it's crucial that they are reliable and fully understand your intentions.

- Sign the document in the presence of a notary public. In Rhode Island, notarizing your General Power of Attorney is essential for validating the document.

- Keep the original document in a safe place and provide copies to your agent and any relevant institutions, such as banks or doctors' offices, where the agent may need to act on your behalf.

Don't:

- Rush through the process without fully understanding the document. If there’s anything you’re unsure about, consider seeking legal advice.

- Neglect to specify any limitations on the agent’s power that you wish to enforce. If you only want to grant certain powers, make sure they are clearly outlined in the document.

- Forget to discuss your decision with the individual you’re choosing as your agent. They need to be aware of their responsibilities and agree to take on the role.

- Overlook the importance of periodically reviewing and updating the document. Life changes might necessitate adjustments to your Power of Attorney.

- Underestimate the need for witnesses. While the specific requirements may vary, having witnesses sign the document can add an extra layer of legality and protection.

Misconceptions

When it comes to the Rhode Island General Power of Attorney (POA) form, there are several misconceptions that people often have. It's important to clarify these misconceptions to ensure that individuals are fully informed about the implications and responsibilities associated with granting a power of attorney. Here are ten common misconceptions and explanations to help clear them up:

-

Only for the elderly: Many believe that a General POA is only for the elderly. However, anyone over the age of 18 can benefit from having a POA, as it allows someone to handle your affairs if you become unable to do so yourself.

-

Gives away all control: There's a misconception that creating a POA means you lose all control over your affairs. In reality, you can specify what powers your agent has and can revoke the POA at any time.

-

Legally complex: Some think that the process of creating a POA is complicated and requires a lawyer. While legal advice is often helpful, the process can be straightforward, especially with the right resources and forms.

-

One size fits all: A common misconception is that one POA document fits all situations. However, a General POA in Rhode Island might need to be tailored to your specific needs and circumstances.

-

Only covers financial matters: Many believe a General POA only covers financial affairs. While it often includes financial powers, it can also grant authority in other areas, depending on how the document is drafted.

-

Effective immediately and forever: Some assume that once a POA is signed, it's effective immediately and lasts forever. The truth is, you can specify when the POA takes effect and when it ends.

-

Can't be revoked: A significant misconception is that a POA cannot be revoked. You can revoke your POA as long as you are mentally competent.

-

Not necessary if you're married: It's thought that if you're married, your spouse can automatically make decisions for you. However, there are many situations where a legally recognized POA is necessary for your spouse to act on your behalf.

-

Automatically includes health care decisions: People often think a General POA includes making health care decisions. A separate document, a Health Care Power of Attorney, is generally needed for those decisions.

-

State forms are the same: There's a belief that POA forms are uniform across states. Each state has its own laws and requirements for POA documents. The Rhode Island General POA form must comply with Rhode Island laws.

Understanding these misconceptions can help ensure that when you decide to create a General Power of Attorney, you're making informed decisions that reflect your wishes and needs. If you have any doubts or questions, consulting with a legal professional can provide guidance tailored to your situation.

Key takeaways

Filling out a General Power of Attorney (GPA) form in Rhode Island is a significant legal step that grants another individual the authority to make decisions on your behalf. Here are five key takeaways to consider when completing and using the Rhode Island General Power of Attorney form:

- Understanding the scope: A General Power of Attorney in Rhode Island allows the designated person, or agent, to handle a wide range of financial matters on your behalf. This includes, but is not limited to, managing bank accounts, signing checks, and handling real estate transactions. It's crucial to understand that the powers granted can be broad, giving the agent considerable control over your financial affairs.

- Choosing an agent carefully: The person you choose to grant power of attorney should be trustworthy and reliable. Considering the extent of power they will have, it’s important to select someone who has your best interests in mind and is capable of handling the responsibilities effectively. This could be a family member, a close friend, or a trusted advisor.

- Durability: In Rhode Island, a General Power of Attorney can be made "durable," meaning it remains in effect even if you become incapacitated. To ensure your General Power of Attorney is durable, specific language must be included in the form. This is crucial for long-term planning and ensuring your affairs are managed according to your wishes, even if you are unable to make decisions yourself.

- Legality and notarization: Rhode Island law requires that the General Power of Attorney form be notarized to be legally binding. This means the document must be signed in front of a Notary Public, who verifies the identity of the signer and ensures that they are signing under their free will. Skipping this step can make the document unenforceable.

- Revocation: It’s important to remember that you can revoke a General Power of Attorney at any time as long as you are mentally competent. To do so, a written notice must be provided to your agent and to any institutions or individuals that were relying on the original power of attorney. Creating a new General Power of Attorney does not automatically revoke the old one unless it explicitly states that it does.

Making use of a General Power of Attorney in Rhode Island is a powerful tool in managing one's financial affairs, especially in planning for future incapacity. However, with great power comes great responsibility, both in choosing an agent and in the careful crafting of the document itself. Individuals are encouraged to consult with a legal professional to ensure that their General Power of Attorney effectively reflects their wishes and is compliant with Rhode Island laws.

Find Some Other Forms for Rhode Island

Probate Forms Ri - A Last Will and Testament is an essential tool for anyone looking to establish a clear, enforceable plan for their estate.

Rhode Island NDA - This agreement emphasizes the legal and ethical responsibility to protect privacy and intellectual property rights.