Attorney-Approved Lady Bird Deed Template for Rhode Island

In the intricate web of estate planning, various tools enable individuals to navigate the future of their property with precision and foresight. Among these, the Lady Bird Deed has emerged as a remarkable instrument, particularly for residents and property owners in Rhode Island. This specialized deed, not universally available in all states, offers a unique blend of flexibility and security in managing how real estate is passed on to heirs. It permits the current property owner to retain control over their property until their passing, at which point the property is seamlessly transferred to a designated beneficiary without the need for probate court proceedings. This not only simplifies the often-complicated process of transferring property but also ensures that the property remains protected from certain debts or claims that may arise against the estate. The presence of this option in Rhode Island's legal landscape provides a vital pathway for individuals looking to secure their estate and offer clarity and stability to their heirs with minimized legal hurdles.

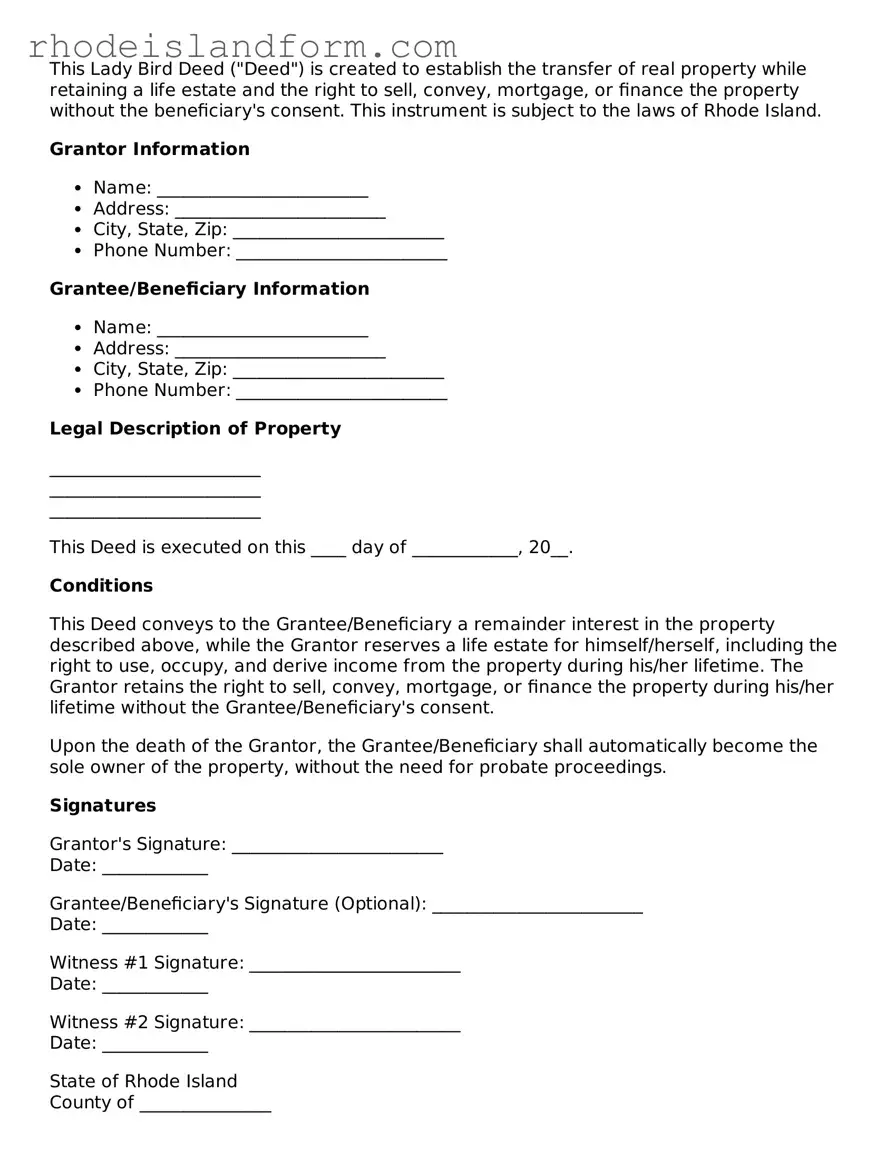

Rhode Island Lady Bird Deed Preview

This Lady Bird Deed ("Deed") is created to establish the transfer of real property while retaining a life estate and the right to sell, convey, mortgage, or finance the property without the beneficiary's consent. This instrument is subject to the laws of Rhode Island.

Grantor Information

- Name: ________________________

- Address: ________________________

- City, State, Zip: ________________________

- Phone Number: ________________________

Grantee/Beneficiary Information

- Name: ________________________

- Address: ________________________

- City, State, Zip: ________________________

- Phone Number: ________________________

Legal Description of Property

________________________

________________________

________________________

This Deed is executed on this ____ day of ____________, 20__.

Conditions

This Deed conveys to the Grantee/Beneficiary a remainder interest in the property described above, while the Grantor reserves a life estate for himself/herself, including the right to use, occupy, and derive income from the property during his/her lifetime. The Grantor retains the right to sell, convey, mortgage, or finance the property during his/her lifetime without the Grantee/Beneficiary's consent.

Upon the death of the Grantor, the Grantee/Beneficiary shall automatically become the sole owner of the property, without the need for probate proceedings.

Signatures

Grantor's Signature: ________________________

Date: ____________

Grantee/Beneficiary's Signature (Optional): ________________________

Date: ____________

Witness #1 Signature: ________________________

Date: ____________

Witness #2 Signature: ________________________

Date: ____________

State of Rhode Island

County of _______________

On this ____ day of ____________, 20__, before me, a Notary Public in and for said state, personally appeared ________________________ [name of Grantor], known to me or satisfactorily proven to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: ________________________

My Commission Expires: ____________

PDF Data

| Fact Number | Fact Detail |

|---|---|

| 1 | Rhode Island does not have a specifically recognized "Lady Bird Deed" form. |

| 2 | "Lady Bird Deeds" allow property to be transferred automatically upon the death of the owner, bypassing probate. |

| 3 | In states where recognized, Lady Bird Deeds provide a way for homeowners to retain control over their property while they are alive. |

| 4 | Property owners in Rhode Island may use alternative estate planning tools to achieve similar objectives. |

| 5 | Tools similar to Lady Bird Deeds in Rhode Island may include life estates or transfer-on-death instruments, where applicable. |

| 6 | The use of such tools depends on specific circumstances and should be guided by legal advice. |

| 7 | A primary goal of using tools like Lady Bird Deeds is to avoid the time and expense associated with probate proceedings. |

| 8 | Persons interested in bypassing probate for their property in Rhode Island should consult with a local estate planning attorney. |

| 9 | Governing laws for estate planning and property transfer vary by state and are subject to change. |

| 10 | It is important to have an up-to-date will and other estate planning documents, in addition to considering tools like Lady Bird Deeds. |

Rhode Island Lady Bird Deed - Usage Guidelines

Filling out a Rhode Island Lady Bird Deed form might seem like a daunting task at first. This document is a helpful tool for managing what happens to property after someone's death, without going through the probate process. It allows the owner to retain control over the property during their lifetime, including the right to sell or change the deed. When they pass away, the property seamlessly passes to the named beneficiaries. Correctly completing this form is crucial, so here's a step-by-step guide to make the process clearer and ensure that the transfer of your property is handled according to your wishes.

- Start by gathering all necessary information: the legal description of the property, the exact names of the current owner(s) and the intended beneficiary(ies). Ensure this information is accurate to prevent any future disputes or confusion.

- At the top of the form, write the name(s) of the current property owner(s) as the grantor(s). This refers to the person or persons who currently own the property and have the right to transfer it.

- Include the address of the property in question, making sure to use the legal address and any additional description that identifies the property uniquely.

- Identify the intended beneficiary(ies) clearly. These are the person(s) who will receive the property upon the death of the last surviving owner. Full legal names are required to avoid any misidentification.

- Specify the conditions under which the transfer to the beneficiary will occur. Although the standard language in a Lady Bird Deed automatically includes the transfer upon death, it’s important to state any specific wishes or conditions clearly.

- Sign the document in front of a notary. This step is crucial as it legitimizes the deed. Make sure the current owner(s) are present to sign the document, and have a government-issued ID for verification.

- Have the document notarized. The notary will fill out their section, sign, and usually affix a stamp or seal. This officially notarizes the document, making it a legally binding instrument.

- Finally, record the deed with the local county land records office where the property is located. There might be a small fee associated with recording the deed. It's important to complete this step to make the transfer on death arrangement official and public record.

By following these steps, you'll have completed the essential process of filling out a Rhode Island Lady Bird Deed form. This action can offer peace of mind, knowing that your property will be transferred according to your wishes, smoothly and without the need for probate. While it's a relatively straightforward process, don't hesitate to seek legal advice if you have any questions or concerns about filling out the form correctly. Your attention to detail now can ensure that your real estate assets are transferred seamlessly to your loved ones.

Essential Queries on Rhode Island Lady Bird Deed

What is a Lady Bird Deed in Rhode Island?

A Lady Bird Deed in Rhode Island is a legal document that allows property owners to transfer their real estate to beneficiaries upon their death without the need for probate court. It grants the owner retained life estate, meaning they can use and control the property during their lifetime, and the remainder interest passes automatically to the designated beneficiaries.

How does a Lady Bird Deed differ from a traditional life estate deed?

Unlike traditional life estate deeds, a Lady Bird Deed gives the property owner the flexibility to sell, mortgage, or otherwise dispose of the property without the consent of the remainder beneficiaries. This distinguishing feature allows the property owner comprehensive control over the property until their death, ensuring that it only passes to the designated beneficiaries if it remains part of the owner's estate at their death.

Are Lady Bird Deeds legally recognized in Rhode Island?

Lady Bird Deeds are not explicitly recognized or provided for in Rhode Island statutes. However, the principles underlying enhanced life estate deeds may still be applied in Rhode Island through carefully drafted documents that comply with state laws and regulations. It's recommended to consult with a local attorney to determine the viability and proper execution of such a deed in Rhode Island.

What are the benefits of using a Lady Bird Deed in Rhode Island?

Using a Lady Bird Deed can offer several benefits, including avoiding the costly and time-consuming process of probate, maintaining control over the property during the owner's lifetime, and potential Medicaid eligibility advantages. Additionally, it can provide peace of mind by ensuring that the property will seamlessly pass to the intended beneficiaries upon death.

Who should use a Lady Bird Deed?

A Lady Bird Deed may be particularly beneficial for property owners who wish to avoid probate, maintain full control over their property during their lifetime, and assure an effortless transfer of property to beneficiaries. It's suitable for individuals looking for a straightforward estate planning tool that provides flexibility and security for the future of their property.

How can I create a Lady Bird Deed in Rhode Island?

Creating a Lady Bird Deed in Rhode Island requires a well-drafted document that specifies the life estate reserved by the owner and the remainder interest granted to the beneficiaries. Due to the complex nature of these deeds and the lack of specific statutory recognition in Rhode Island, it is strongly advised to seek legal counsel familiar with Rhode Island laws and estate planning to ensure the deed is valid and achieves the desired outcomes.

Common mistakes

When individuals decide to fill out the Rhode Island Lady Bird Deed form, certain errors are commonly made. These mistakes can lead to significant legal and financial complications, potentially negating the form’s intended benefits. A Lady Bird Deed, also known as an enhanced life estate deed, allows property to be transferred upon the death of the owner without going through probate. Understanding and avoiding these common errors is crucial for ensuring the deed achieves its intended purpose.

Incorrectly Identifying the Property: One of the most critical sections of the Lady Bird Deed is the legal description of the property. Often, individuals simply use the street address or a brief description that does not match the legal description used in official records. The legal description typically includes lot numbers, subdivision names, and other detailed information that uniquely identifies the property. An incorrect description can render the deed ineffective, as it may not clearly identify the property meant to be transferred.

Failure to Properly Identify the Beneficiary: The Lady Bird Deed requires the grantor to designate a beneficiary (or beneficiaries) who will receive the property upon the grantor’s death. Errors occur when the beneficiary's full legal name is not used or when there is ambiguity about the beneficiary's identity. Additionally, failing to consider how multiple beneficiaries will co-own the property (e.g., as joint tenants or tenants in common) can lead to disputes and confusion after the grant GL30's death.

Not Understanding the Impact on Eligibility for Government Benefits: Property owners often do not fully grasp how the creation of a Lady Bird Deed can affect eligibility for government benefits, such as Medicaid. Since the grantor retains control over the property during their lifetime, including the right to sell or mortgage the property, it may impact their ability to qualify for certain benefits. Consulting with a legal professional who understands the interplay between real estate and government assistance programs is vital to avoid unintended consequences.

Neglecting to Have the Deed Properly Witnessed or Notarized: Rhode Island law requires that deeds, including Lady Bird Deeds, be witnessed and notarized to be legally valid. Sometimes, individuals complete the form but do not follow through with these final, critical steps. A deed that has not been properly witnessed or notarized is not legally enforceable, which means the property could end up going through probate, contrary to the grantor's wishes.

To ensure the Rhode Island Lady Bird Deed form is filled out and executed correctly, it is wise to seek the guidance of a legal professional. This approach will help to avoid common pitfalls that could undermine the deed’s purpose and benefits. Missteps in completing the deed not only create potential legal challenges but can also result in unintended financial burdens for the intended beneficiaries. Paying close attention to details and understanding the legal implications of a Lady Bird Deed are key steps in effective estate planning.

Documents used along the form

In estate planning, particularly within the state of Rhode Island, a Lady Bird Deed form plays a crucial role in transferring property efficiently and effectively upon the death of the property owner. This specialized deed allows homeowners to retain control over their property during their lifetime, including the right to use, sell, or mortgage the property, and then automatically transfer it to a designated beneficiary when they pass away, bypassing the probate process. The effectiveness of a Lady Bird Deed, however, often hinges on the correct completion and submission of other essential legal documents. The following forms and documents are frequently used alongside the Lady Bird Deed to ensure a comprehensive approach to estate planning.

- Warranty Deed - This document is used to officially transfer property ownership from the seller to the buyer and guarantees that the seller holds clear title to the property. In the context of estate planning, it might be employed prior to executing a Lady Bird Deed to ensure that the title is free of encumbrances.

- Last Will and Testament - While a Lady Bird Deed automatically transfers property upon death, a Last Will and Testament covers the disposition of other assets not included within such deeds. It's a fundamental document that expresses the decedent's wishes regarding the distribution of their estate.

- Power of Attorney - This legal document grants someone else the authority to act on behalf of the person in financial or medical decisions, should they become incapacitated. In estate planning, this ensures that an individual's affairs can be managed according to their wishes even if they're unable to communicate those wishes themselves.

- Revocable Living Trust - Often used alongside or in place of a Lady Bird Deed, a Revocable Living Trust provides a mechanism for managing the property during the grantor's lifetime and distributing the property upon their death, often without the need for probate.

- Declaration of Homestead - This legal document is designed to protect a portion of a person's home equity from creditors. In Rhode Island, filing a Declaration of Homestead can ensure that a primary residence is shielded, to some extent, bolstering the estate planning process.

Each of these documents serves a distinct purpose in the larger framework of estate and property planning. They work in concert with the Lady Bird Deed to not only streamline the transfer of assets and minimize the burdens of probate but also to protect the rights and wishes of the individuals throughout the process. It's essential, then, for homeowners and beneficiaries alike to understand these documents and how they relate to each other within the scope of estate planning to ensure a seamless and effective transfer of property.

Similar forms

The Rhode Island Lady Bird Deed form is similar to other estate planning instruments that allow property to bypass the probate process but it maintains unique attributes that set it apart. Specifically, it can be compared to a traditional life estate deed and a revocable living trust in terms of its function and objectives.

One document similar to the Lady Bird Deed is the traditional life estate deed. Like the Lady Bird Deed, a traditional life estate deed divides ownership of property between a life tenant and one or more remaindermen. The life tenant has the right to use and occupy the property during their lifetime, and the remaindermen receive full ownership automatically upon the life tenant's death. However, a key difference is that with a traditional life estate deed, the life tenant cannot sell or mortgage the property without the consent of the remaindermen, whereas a Lady Bird Deed allows the property owner to retain complete control over the property, including the rights to sell or change the designated remainder beneficiaries without needing anyone else’s permission.

Another document closely related to the Lady Bird Deed is the revocable living trust. This estate planning tool also allows property to be passed to beneficiaries without going through probate. The property owner (grantor) creates the trust, transfers ownership of assets into the trust, and may serve as the trustee, managing the assets during their lifetime. The grantor retains the power to revoke or amend the trust at any time. In comparison, the Lady Bird Deed is simpler and more cost-effective for transferring real estate specifically. Unlike a trust, it does not require the ongoing management of assets, nor does it involve the more complex process of trust creation and administration, making it a preferred option for those seeking a straightforward method to transfer real estate upon their death.

Dos and Don'ts

When preparing a Rhode Island Lady Bird Deed, it's important to proceed with care to ensure that the document reflects your intentions and complies with state laws. Here are some guidelines to help you through the process:

- Do review Rhode Island's specific requirements for Lady Bird Deeds, as state laws vary and can impact the validity of your deed.

- Do ensure that all parties involved in the deed, such as the current property owner and the beneficiary, are clearly identified with their full legal names to avoid any confusion.

- Do accurately describe the property being transferred, including its full address and any legal descriptions or parcel numbers, to ensure it’s unmistakably identified.

- Do sign the deed in the presence of a notary public to authenticate the identity of the signer and to meet legal requirements for notarization.

- Do keep a copy of the completed deed for your records and consider giving a copy to the beneficiary so that they are aware of the arrangements.

- Don't leave any sections of the form blank; incomplete forms can lead to misunderstandings or challenges to the deed’s validity.

- Don't attempt to use a Lady Bird Deed without consulting a legal professional if you have any uncertainties about the process or its implications for estate planning.

- Don't forget to file the completed deed with the Rhode Island county recorder's office where the property is located, as failing to do so can affect the transfer of the property.

- Don't disregard the potential impact of a Lady Bird Deed on your eligibility for Medicaid or other benefits, as rules can vary and sometimes property transfers can affect qualification.

Misconceptions

When discussing property planning tools like the Lady Bird Deed, especially in Rhode Island, several misconceptions frequently arise. By addressing these misunderstandings, individuals can make more informed decisions about managing their estates.

Lady Bird Deeds are universally recognized. Contrary to what some believe, Lady Bird Deeds are not recognized or applicable in all states, including Rhode Island. This legal tool is specific to certain jurisdictions and, as of the latest information available, is not part of Rhode Island estate planning law.

They can bypass probate in any state. While Lady Bird Deeds are designed to avoid probate in the states where they are recognized, they are not a universal solution to bypassing probate processes across the board. Rhode Island residents should seek alternative estate planning tools that are valid within the state.

A Lady Bird Deed protects the property from all creditors. Even in jurisdictions where Lady Bird Deeds are used, they may not shield the property from all types of creditors, especially those with claims arising after the deed's execution.

It offers the best tax advantages for heirs. The tax implications of Lady Bird Deeds vary by state and individual circumstance. It's a misconception that this type of deed always provides the best tax benefits for heirs, and Rhode Island residents need to consult with a local tax advisor to explore tax-efficient estate planning strategies.

Executing a Lady Bird Deed is complicated. The complexity of executing a Lady Bird Deed, or any estate planning tool, greatly depends on the specific legal requirements of the state and the individual’s estate situation. However, because Rhode Island does not recognize Lady Bird Deeds, this process is not applicable within the state.

Only seniors can create a Lady Bird Deed. In states where Lady Bird Deeds are a legal option for estate planning, there is no age restriction on who can create such a deed. The misconception that only older adults can use this tool may limit its consideration by a wider range of property owners.

Rhode Island offers a standardized Lady Bird Deed form. Given that Lady Bird Deeds are not recognized in Rhode Island, the state does not offer a standardized form for this purpose. This emphasizes the need for Rhode Island property owners to consider alternative legal instruments for estate planning.

It automatically transfers property to beneficiaries upon the owner's death. In states where Lady Bird Deeds are valid, the deed allows property to automatically transfer to designated beneficiaries upon the death of the current owner. However, because such deeds are not recognized in Rhode Island, residents must seek other estate planning methods to achieve a similar outcome.

Creating a Lady Bird Deed avoids the need for a will. Even in jurisdictions that recognize Lady Bird Deeds, relying solely on this tool without a comprehensive will can leave parts of an estate plan incomplete. Comprehensive estate planning often requires a will, among other documents, to fully address all potential issues and assets.

All real estate attorneys in Rhode Island can prepare a Lady Bird Deed. Since Lady Bird Deeds are not applicable in Rhode Island, local real estate attorneys are unlikely to prepare such deeds. Instead, they can provide advice on valid alternatives for estate planning and property transfer within the state.

Key takeaways

When considering the use of a Lady Bird Deed in Rhode Island, it's important to understand its function, benefits, and specific requirements. This unique legal document allows property owners to transfer property to their heirs while retaining the right to use and control the property during their lifetime. Here are key takeaways regarding filling out and using the Rhode Island Lady Bird Deed form:

- Understand the Purpose: A Lady Bird Deed, also known as an Enhanced Life Estate Deed, permits the property owner (grantor) to retain certain rights during their lifetime, including the right to use, sell, or mortgage the property, and then automatically transfers the property to the named beneficiaries upon the owner's death without the need for probate.

- Identify the Parties Clearly: Clearly identify the grantor, who is the current property owner, and the grantee, who are the beneficiaries. Accurate identification prevents any potential disputes regarding the property’s rightful heirs.

- Legal Description of the Property: Include a precise legal description of the property. This information can often be found on the deed to the property or by contacting the local county recorder’s office.

- Retention of Life Estate: The deed must explicitly state that the grantor retains a life estate in the property. This means the grantor can use the property and its benefits during their lifetime.

- Selecting a Beneficiary: The beneficiaries, or remaindermen, should be chosen with care. Once the deed is executed, changing the beneficiaries can be complex and may require their consent.

- Signature and Notarization: For the deed to be valid, it must be signed by the grantor in the presence of a notary public. This formalizes the document and helps prevent fraud.

- Recording the Deed: After notarization, the deed needs to be recorded with the appropriate county recorder’s office in Rhode Island. Filing the deed with the county ensures it is a matter of public record and enforces the transfer upon the grantor's death.

- Consult with an Attorney: Due to the nuances of state laws and the complexity of estate planning, it’s advisable to consult with a legal professional specializing in estate planning to ensure the Lady Bird Deed aligns with the grantor's overall estate plan and complies with Rhode Island law.

Understanding these key elements about the Lady Bird Deed helps grantors in Rhode Island effectively plan for the future of their estate and ensures a smoother transfer of property to their heirs, avoiding the time-consuming and often costly probate process.

Find Some Other Forms for Rhode Island

Power of Attorney Form Ri - Creating a Power of Attorney ensures that your financial matters are taken care of smoothly and efficiently.

Probate Forms Ri - Facilitate the smooth transition of your business interests and investments by including them in your Last Will and Testament.