Attorney-Approved Last Will and Testament Template for Rhode Island

Preparing for the future and ensuring that one's estate is handled according to personal wishes is a crucial aspect of life planning. This is where the importance of having a Rhode Island Last Will and Testament form comes into play. Tailored to meet the specific legal requirements of Rhode Island, this document plays a pivotal role in estate planning. It allows individuals to clearly outline how they want their assets distributed upon their death, name guardians for minor children, and express their wishes regarding certain personal matters. Not only does it provide peace of mind for the person making the will, but it also simplifies the process for loved ones by directing the distribution of the estate according to the decedent's wishes, potentially avoiding the complications of intestate succession laws. Understanding this form's components, the legal requirements for its execution, and its implications is essential for anyone looking to secure their legacy and reduce the burden on their families during a difficult time.

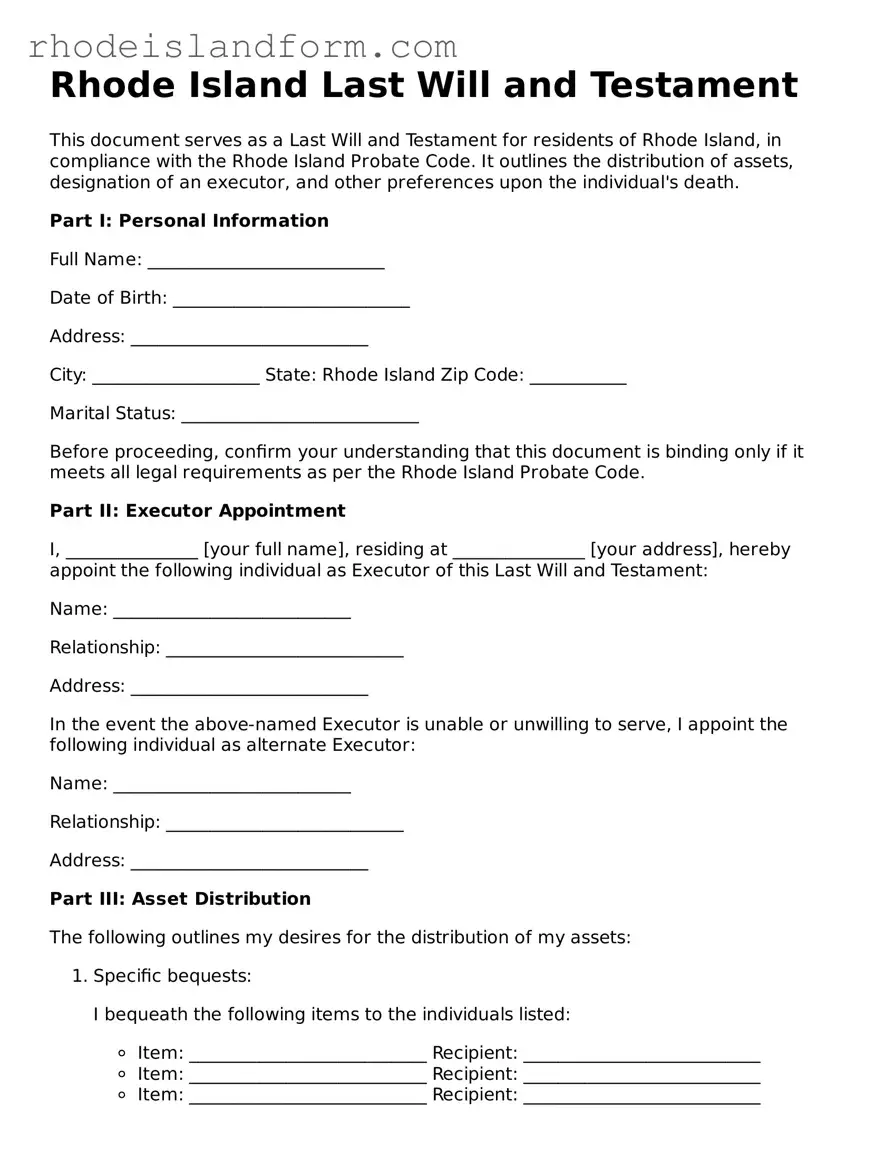

Rhode Island Last Will and Testament Preview

Rhode Island Last Will and Testament

This document serves as a Last Will and Testament for residents of Rhode Island, in compliance with the Rhode Island Probate Code. It outlines the distribution of assets, designation of an executor, and other preferences upon the individual's death.

Part I: Personal Information

Full Name: ___________________________

Date of Birth: ___________________________

Address: ___________________________

City: ___________________ State: Rhode Island Zip Code: ___________

Marital Status: ___________________________

Before proceeding, confirm your understanding that this document is binding only if it meets all legal requirements as per the Rhode Island Probate Code.

Part II: Executor Appointment

I, _______________ [your full name], residing at _______________ [your address], hereby appoint the following individual as Executor of this Last Will and Testament:

Name: ___________________________

Relationship: ___________________________

Address: ___________________________

In the event the above-named Executor is unable or unwilling to serve, I appoint the following individual as alternate Executor:

Name: ___________________________

Relationship: ___________________________

Address: ___________________________

Part III: Asset Distribution

The following outlines my desires for the distribution of my assets:

- Specific bequests:

- Item: ___________________________ Recipient: ___________________________

- Item: ___________________________ Recipient: ___________________________

- Item: ___________________________ Recipient: ___________________________

- Residual Estate:

- Recipient: ___________________________

- Recipient: ___________________________

- Recipient: ___________________________

I bequeath the following items to the individuals listed:

All remaining assets not specifically bequeathed shall be distributed as follows:

Part IV: Guardian for Minor Children (if applicable)

In the event I have minor children at the time of my death, I appoint the following individual as guardian:

Name: ___________________________

Relationship: ___________________________

Address: ___________________________

Part V: Additional Provisions and Acknowledgements

I, _______________ [your full name], hereby declare that this Last Will and Testament reflects my desires without any undue influence. I have prepared this document while of sound mind and understand the implications of the same.

Part VI: Signatures

This document must be signed in the presence of two witnesses, who also need to sign the document to ensure its validity as per Rhode Island law.

___________________________ [Your signature] Date: _______________

Witness 1 Signature: ___________________________ Date: _______________

Print Name: ___________________________

Witness 2 Signature: ___________________________ Date: _______________

Print Name: ___________________________

This Last Will and Testament was prepared to align with the desires and the law governing residents of Rhode Island. It is recommended to consult a legal professional to ensure all aspects of the will meet legal requirements.

PDF Data

| Fact | Details |

|---|---|

| Number of Witnesses Required | Two individuals must witness the signing of the Last Will and Testament in Rhode Island. |

| Witness Requirements | Witnesses must be at least 18 years old and must not be beneficiaries of the will to avoid conflicts of interest. |

| Notarization | Notarization is not required for the will to be valid in Rhode Island, but it is recommended to make the will self-proving. |

| Self-proving Affidavit | A self-proving affidavit can be attached to the will, which can speed up the probate process since it verifies the will’s authenticity ahead of time. |

| Oral Wills | Oral wills are not recognized in the State of Rhode Island. |

| Holographic Wills | Rhode Island does not recognize holographic wills, which are handwritten wills without witness signatures. |

| Age Requirement | The individual creating the will (testator) must be at least 18 years old. |

| Capacity Requirement | The testator must be of sound mind, understanding the nature of making a will, the extent of their assets, and the identity of those who are the natural beneficiaries. |

| Governing Law | Chapter 33 of the Rhode Island General Laws governs wills in the State of Rhode Island. |

Rhode Island Last Will and Testament - Usage Guidelines

When it comes time to ensure your wishes are honored after you pass away, filling out a Last Will and Testament in Rhode Island is a crucial step. This pivotal document legally protects your assets, specifies who inherits them, and appoints a guardian for minor children, if applicable. It might seem daunting, but breaking it down into steps can make the process manageable. By attentively completing your Rhode Island Last Will and Testament, you're not just organizing your affairs; you're providing peace of mind for yourself and your loved ones. Let's walk through the steps needed to fill out this important document.

- Start by gathering personal information, including your full legal name, date of birth, and address. This establishes your identity as the testator (the person who's making the will).

- Determine who will act as your executor. This individual will be responsible for managing your estate according to the instructions laid out in your will. Choose someone you trust implicitly and include their full name and relationship to you.

- Choose your beneficiaries, the people or organizations who will inherit your assets. List their full names, relationships to you, and what you wish each to receive.

- If you have minor children, appoint a guardian to take care of them. Include the guardian’s full name and their relationship to the children. It’s a heavy decision, so make it with great care.

- List your assets and to whom they will be distributed. This can include money, real estate, investments, and personal possessions. Be as specific as possible to avoid confusion.

- Consider any specific instructions you want to leave, such as donations to charities, conditions of inheritance, or final wishes regarding funeral arrangements.

- Once the will is complete, review it carefully to ensure all the information is accurate and reflects your wishes.

- Sign the document in front of two witnesses, who must be over the age of 18 and not named as beneficiaries in the will. Their signatures will attest that you signed the will voluntarily and were of sound mind.

- Finally, store the will in a safe place, such as a fireproof safe or a safety deposit box. Inform your executor where the document is kept, so it can be easily accessed when needed.

With your Rhode Island Last Will and Testament properly filled out, you can feel confident that your wishes will be honored. Remember, life's circumstances change, and it’s wise to review and possibly update your will periodically to reflect these changes. This legal document is your voice after you’ve passed; it helps ensure your assets are protected and distributed according to your wishes, providing you and your loved ones with invaluable assurance.

Essential Queries on Rhode Island Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament is a legal document that allows individuals to specify how they want their assets distributed upon their passing. It also allows them to appoint an executor who will manage the estate until its final distribution.

Who can create a Last Will and Testament in Rhode Island?

In Rhode Island, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. Being of "sound mind" generally means that the person understands the nature of the will, knows the value and extent of their property, and recognizes the individuals who are the natural beneficiaries of their estate.

Do I need an attorney to make a Last Will and Testament in Rhode Island?

While it is not a legal requirement to use an attorney to create a will in Rhode Island, it is highly recommended. A knowledgeable attorney can ensure that your will meets all legal requirements, accurately reflects your wishes, and provides the best legal protection for your heirs.

Can a Last Will and Testament be changed once it has been written?

Yes. A will can be modified, added to, or completely rewritten at any time before the will maker's death, as long as the will maker is legally competent. Changes are typically made through a legal document called a codicil, which must follow the same signing and witnessing requirements as the original will.

What happens if I die without a Last Will and Testament in Rhode Island?

If you die without a will in Rhode Island, your assets will be distributed according to the state’s intestacy laws. These laws prioritize close relatives such as spouses, children, and parents, potentially leaving friends or nontraditional heirs without any inheritance. Additionally, the court will appoint an executor for your estate, which may not be the person you would have chosen.

Is a handwritten Last Will and Testament legal in Rhode Island?

Handwritten wills, also known as holographic wills, are not legally recognized in Rhode Island. For a will to be valid in this state, it must be typed or printed and comply with specific signing and witnessing requirements.

How many witnesses are required for a Rhode Island Last Will and Testament?

Rhode Island law requires that at least two individuals witness the signing of the will. These witnesses must be present at the same time, watch you sign the will (or acknowledge that you have signed it), and must sign the will themselves in the presence of the will maker.

Can I name a guardian for my children in my Last Will and Testament?

Yes, you can name a guardian for your minor children in your will. This is an important step that allows you to have a say in who will look after your children if both parents pass away before the children reach adulthood. Without such a designation, a court will decide based on state law and potentially without knowledge of your wishes or the best interests of your children.

What assets can be included in a Last Will and Testament?

Most of your assets can be included in your will, such as real estate, bank accounts, securities, and personal property. Some assets, however, may not be covered by your will. These include life insurance policies, retirement accounts, and any assets owned as joint tenants with rights of survivorship. Such assets typically pass to the co-owner or a named beneficiary outside the will.

Can digital assets be included in a Last Will and Testament?

Yes, digital assets such as social media accounts, digital photos, emails, and online accounts can also be included in your will. You can specify who inherits these assets and provide necessary instructions for how they should be managed or distributed. It's important to also include information on how executors can access these digital assets.

Common mistakes

Filling out a Last Will and Testament in Rhode Island is an essential step in managing one's estate and ensuring that your assets are distributed according to your wishes upon your passing. However, mistakes can easily be made during this process, which can lead to confusion, legal challenges, or the Will being considered invalid. Here are six common mistakes people make when completing their Rhode Island Last Will and Testament form:

- Not adhering to state-specific requirements. Rhode Island has specific legal requirements for a Will to be considered valid. These include the need for the document to be witnessed by two individuals, both present at the signing, who are not beneficiaries of the Will. Overlooking these requirements can result in the Will being invalid.

- Choosing the wrong executor. The executor of the Will is responsible for managing the estate in accordance with the deceased's wishes. Choosing someone who is either unsuitable or unwilling to take on this responsibility can lead to complications and delays in the distribution of the estate.

- Failure to update the Will. Life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets necessitate updates to your Will. Failing to keep the Will updated can result in assets being distributed in ways that no longer reflect the deceased's wishes.

Frequently, misunderstanding around the legal weight of a Will leads to oversights. For example, assuming that a Will can override beneficiary designations on life insurance policies or retirement accounts is incorrect. These types of assets are distributed according to the beneficiary designations filed with the institution holding the account, not according to wishes expressed in a Will. This misunderstanding can leave loved ones unprovided for in ways the deceased did not intend.

- Lack of specificity in asset distribution can create conflicts among beneficiaries. It's essential to be as clear as possible when detailing which assets go to which beneficiaries to reduce the potential for disputes.

- Omitting to sign and date the Will in accordance with Rhode Island laws can void the document. A Will must be properly executed to be valid, including being signed in the presence of witnesses.

- Attempting to use a "one-size-fits-all" document without consulting a professional. While templates can serve as a helpful starting point, estate planning is highly individualized. Engaging a legal professional to ensure that the document accurately reflects your wishes and adheres to Rhode Island law is crucial.

By avoiding these common pitfalls, individuals can offer their loved ones clarity and certainty during a difficult time, ensuring their wishes are honored and disputes are minimized. It's always recommended to consult with a professional when preparing a Last Will and Testament to ensure all legal requirements are met, and the document reflects your current wishes accurately.

Documents used along the form

Creating a Last Will and Testament is a crucial step in planning one's estate. However, this document often does not stand alone. Several other forms and documents are commonly used alongside a Last Will and Testament to ensure a person’s final wishes are fully understood and legally protected. These complementary documents can offer additional clarity and security, not only for the individual creating them but also for their loved ones and beneficiaries.

- Living Will: This document, also known as an advance directive, outlines an individual's preferences regarding medical treatments and interventions in scenarios where they are unable to communicate their decisions. It acts as a guide for family members and healthcare providers.

- Healthcare Power of Attorney: This legal document allows an individual to designate another person to make healthcare decisions on their behalf if they become incapacitated. It’s an essential part of a comprehensive estate plan, ensuring that healthcare preferences are respected.

- Durable Financial Power of Attorney: Similar to a Healthcare Power of Attorney, this document grants a trusted individual the authority to manage the financial affairs of the person creating the document, should they become unable to do so themselves. This could include paying bills, managing investments, or selling property.

- Trust Agreement: Often used in conjunction with a Last Will and Testament, a trust agreement can help manage and protect assets both during an individual's life and after their passing. Trusts vary widely, but they can offer benefits such as avoiding probate and providing for minors or individuals with special needs.

- Designation of Beneficiary Forms: These forms are used to specify beneficiaries for specific assets that may not be covered under a will. Common assets that require such forms include life insurance policies, retirement accounts, and certain bank accounts. These designations must be kept up to date to ensure that assets are distributed according to the individual’s current wishes.

Each of these documents serves its unique purpose, complementing a Last Will and Testament by covering aspects of an individual’s life and estate that the will alone cannot. When crafted carefully and updated regularly, these documents work together to form a comprehensive estate plan that protects an individual's wishes and provides for their loved ones. Consultation with a legal professional can help ensure that these documents are properly executed and work harmoniously with one another.

Similar forms

The Rhode Island Last Will and Testament form is similar to other estate planning documents in several key respects, although each serves unique purposes and features specific nuances. Understanding these parallels and differences is essential for individuals planning their estates to ensure their final wishes are honored and their assets are distributed as they desire.

Living Trust: A document closely resembling the Rhode Island Last Will and Testament is the Living Trust. Both serve the purpose of designating beneficiaries for one's assets upon death. However, a Living Trust, specifically a Revocable Living Trust, distinguishes itself by avoiding probate, a legal process that a Last Will and Testament must go through. This means assets can be transferred to beneficiaries more quickly and with less expense. Additionally, a Living Trust offers privacy since it is not made public upon death, unlike a Last Will and Testament, which becomes a public record through the probate process.

Financial Power of Attorney: While this document primarily operates during an individual's lifetime, it shares a core similarity with the Rhode Island Last Will and Testament in that it involves designating someone to manage affairs. A Financial Power of Attorney allows an individual to appoint an agent to handle their financial affairs, should they become incapacitated. Unlike a Last Will and Testament, which only takes effect upon death, a Financial Power of Attorney is only effective during the individual's lifetime and ceases to be effective upon their death.

Healthcare Power of Attorney: Another document with similarities is the Healthcare Power of Attorney, which, like a Last Will and Testament, enables an individual to designate someone to make decisions on their behalf. However, while a Last Will and Testament focuses on property and asset distribution, a Healthcare Power of Attorney pertains to medical decisions should the individual become unable to make those decisions themselves. This distinction underscores the importance of having both types of documents as part of a comprehensive estate plan.

Living Will: Often confused with a Last Will and Testament due to the similar nomenclature, a Living Will is distinctly focused on end-of-life care decisions rather than the distribution of assets. A Living Will allows an individual to outline their wishes regarding medical treatment and life support in situations where recovery is not expected. While it does not appoint someone to make decisions on behalf of the individual, it serves as a guide for healthcare providers and family members, aligning with the anticipatory nature of estate planning seen in a Last Will and Testament.

Dos and Don'ts

Preparing a Last Will and Testament is a significant step in ensuring that your wishes are carried out after your passing. When filling out a Last Will and Testament form for Rhode Island, it's important to do so with care. To help guide you through this process, here are seven do's and don'ts to keep in mind:

Do:Read all instructions carefully before beginning the filling process. Understanding every section thoroughly will help you complete the form accurately.

Use clear and precise language to state your wishes. This minimizes the chances of misinterpretation or confusion.

Ensure all property you mention is described in detail, including addresses for real estate and full descriptions for personal property.

Be specific about your beneficiaries. Include full names, relationships to you, and any other identifying details to prevent any ambiguity.

Sign in the presence of witnesses. Rhode Island requires your will to be witnessed by two people who don't stand to inherit anything in the will.

Consult with a legal professional if you have any questions. An expert can provide advice tailored to your situation.

Keep the document in a safe but accessible place, and inform your executor or a trusted person of its location.

Leave any sections incomplete. An incomplete form can lead to parts of your will being unenforceable or open to challenge.

Use ambiguous language or vague terms that could be open to interpretation.

Rely on verbal promises or agreements. Make sure all your wishes are documented in the will.

Forget to update your will after significant life events, such as marriage, divorce, the birth of a child, or acquisition of significant assets.

Attempt to dispose of property in a way that contradicts Rhode Island laws. Certain legal restrictions may apply, particularly to spousal inheritance rights.

Sign without witnesses present. The absence of required witnesses can make the will invalid under Rhode Island law.

Store your will in a location where no one can find it. It’s essential that your will is accessible when it’s needed.

Misconceptions

When it comes to understanding the Rhode Island Last Will and Testament form, several misconceptions often arise, causing confusion. Identifying and addressing these misunderstandings can clarify the estate planning process, ensuring individuals make well-informed decisions.

Only for the Wealthy: A common misconception is that creating a Last Will and Testament in Rhode Island is only necessary for individuals with substantial wealth. In reality, this document is vital for anyone wanting to dictate how their assets, regardless of size, are distributed after death.

Too Young to Worry: Another belief is that only older adults need a Last Will and Testament. However, life is unpredictable, and having a will in place is prudent for adults of all ages, particularly those with dependents or assets.

Oral Wills are Just as Good: Some people think that an oral will is sufficient in Rhode Island. While oral wills, known as nuncupative wills, are recognized under very specific circumstances in some jurisdictions, Rhode Island law emphasizes the importance of having a formally written and witnessed Last Will and Testament.

It's Too Complicated and Expensive: The process of creating a will is often viewed as overly complicated and costly. Although seeking legal advice is advisable, Rhode Island offers resources and straightforward procedures to create a will, making the process accessible and often more affordable than anticipated.

A Last Will Covers Everything: Some believe that a Last Will and Testament in Rhode Island will cover the disposition of all their assets. However, certain assets such as those held in joint tenancy, life insurance proceeds, and retirement accounts typically pass outside the will, directly to designated beneficiaries.

Once Made, No Need for Updates: The notion that a Last Will and Testament is a one-time task is misleading. Life changes—such as marriages, divorces, births, and deaths—may necessitate updates to ensure the will accurately reflects the individual's current wishes.

The State Takes Everything if There's No Will: There's a fear that, without a will, the state of Rhode Island automatically inherits everything. In fact, the state has intestate succession laws determining how assets are distributed among surviving relatives. While the state can inherit in the absence of any surviving kin, this is a rare occurrence.

Dispelling these misconceptions can empower individuals to take control of their estate planning, ensuring their wishes are honored and their loved ones are provided for according to their desires.

Key takeaways

Filling out and using the Rhode Island Last Will and Testament form involves several crucial steps to ensure your final wishes are clearly understood and legally enforceable. Whether you're planning your estate for the first time or updating previous documents, consider these key takeaways:

- Clearly identify yourself in the document, including full name and residence, to avoid any confusion about the will's owner.

- Choose an executor wisely. This person will oversee the distribution of your estate and ensure your wishes are carried out as specified in your will.

- Be specific about who gets what. Clear instructions about who inherits your assets can prevent disputes among family members and ensure your possessions are distributed according to your wishes.

- Consider appointing a guardian if you have minor children or dependents to ensure they are taken care of by someone you trust in the way you want.

- Do not overlook your digital assets, such as social media accounts, online savings accounts, and digital files. Include instructions on how these should be handled.

- Ensure the document is signed in the presence of witnesses. Rhode Island law may require witness signatures for the document to be legally binding, emphasizing the importance of this step.

- Keep the document in a safe but accessible place. Inform your executor or a trusted individual about where your will is stored so it can be easily found after your death.

- Review and update your will regularly, especially after significant life events such as marriage, divorce, birth of a child, or substantial changes in assets. This ensures your will always reflects your current wishes and circumstances.

By paying attention to these aspects, you can create a Last Will and Testament in Rhode Island that clearly communicates your wishes, contributes to the smooth distribution of your estate, and minimizes the burden on your loved ones during a difficult time.

Find Some Other Forms for Rhode Island

Rhode Island Bill of Sale - The Trailer Bill of Sale not only facilitates the transaction process but also contributes to the orderly compliance with state laws and regulations.

Hold Harmless Letter - Travel companies and tour operators use it to ensure customers participate at their own risk, limiting the company's liability.