Attorney-Approved Operating Agreement Template for Rhode Island

In the realm of forming a limited liability company (LLC) in Rhode Island, a crucial step involves drafting an Operating Agreement. This document, though not a mandatory requirement by the state, plays a foundational role in defining the internal operations, financial decisions, and structure of the LLC. It is essentially a blueprint that outlines how the business will be run, who will manage it, and how various critical decisions will be made. The Rhode Jungle of limited liability companies thoroughly benefits from such an agreement, as it provides a clear governance structure, helps prevent disputes among members by clarifying roles and responsibilities, and enhances the LLC’s credibility with financial institutions and potential investors. Creating an Operating Agreement requires careful thought and consideration, as it can significantly impact the success and efficiency of the business. Tailoring the agreement to fit the unique needs of the LLC while ensuring compliance with Rhode Island law is key to crafting an effective document that safeguards the interests of all members involved.

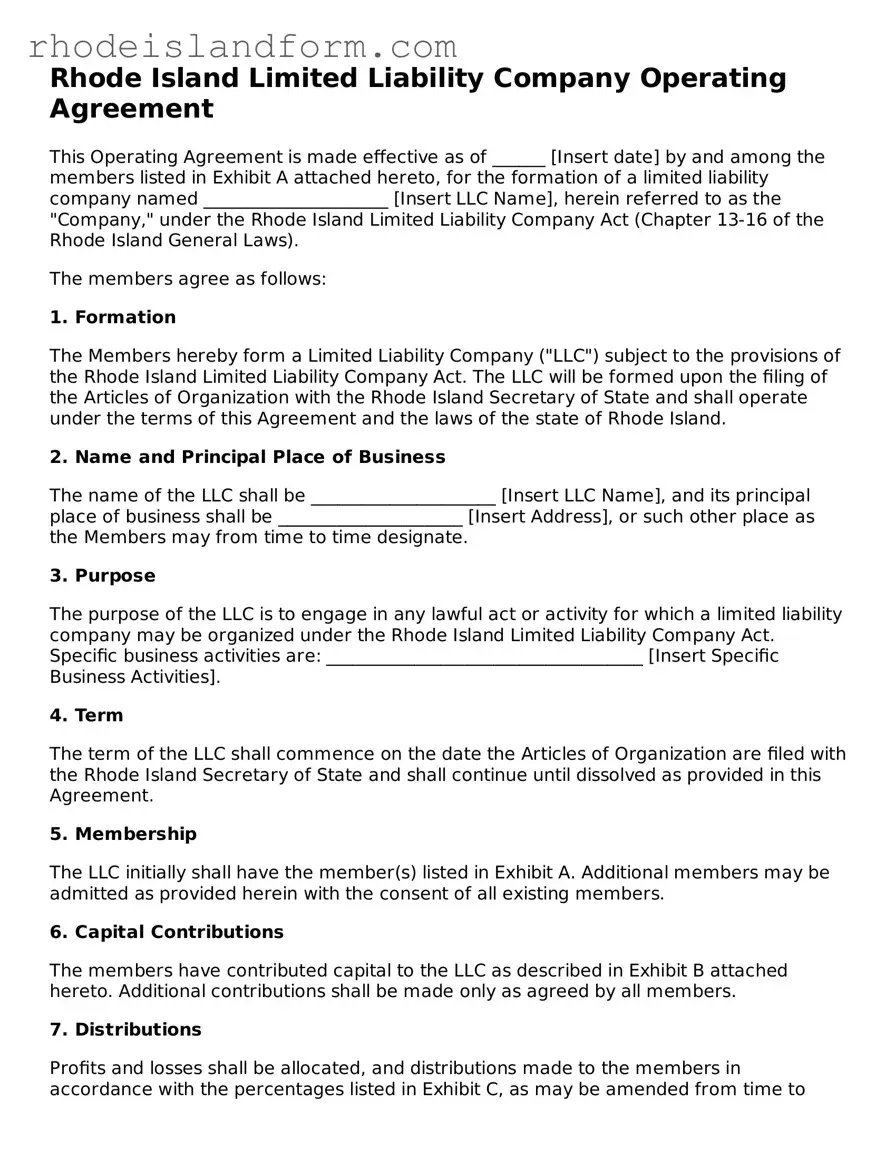

Rhode Island Operating Agreement Preview

Rhode Island Limited Liability Company Operating Agreement

This Operating Agreement is made effective as of ______ [Insert date] by and among the members listed in Exhibit A attached hereto, for the formation of a limited liability company named _____________________ [Insert LLC Name], herein referred to as the "Company," under the Rhode Island Limited Liability Company Act (Chapter 13-16 of the Rhode Island General Laws).

The members agree as follows:

1. FormationThe Members hereby form a Limited Liability Company ("LLC") subject to the provisions of the Rhode Island Limited Liability Company Act. The LLC will be formed upon the filing of the Articles of Organization with the Rhode Island Secretary of State and shall operate under the terms of this Agreement and the laws of the state of Rhode Island.

2. Name and Principal Place of BusinessThe name of the LLC shall be _____________________ [Insert LLC Name], and its principal place of business shall be _____________________ [Insert Address], or such other place as the Members may from time to time designate.

3. PurposeThe purpose of the LLC is to engage in any lawful act or activity for which a limited liability company may be organized under the Rhode Island Limited Liability Company Act. Specific business activities are: ____________________________________ [Insert Specific Business Activities].

4. TermThe term of the LLC shall commence on the date the Articles of Organization are filed with the Rhode Island Secretary of State and shall continue until dissolved as provided in this Agreement.

5. MembershipThe LLC initially shall have the member(s) listed in Exhibit A. Additional members may be admitted as provided herein with the consent of all existing members.

6. Capital ContributionsThe members have contributed capital to the LLC as described in Exhibit B attached hereto. Additional contributions shall be made only as agreed by all members.

7. DistributionsProfits and losses shall be allocated, and distributions made to the members in accordance with the percentages listed in Exhibit C, as may be amended from time to time in accordance with this Agreement.

8. ManagementThe LLC shall be managed by its members. Each member shall have authority and control over business decisions in proportion to their percentage interest in the LLC as listed in Exhibit C, subject to any limitations set forth in this Agreement.

9. MeetingsMeetings of the members shall be held annually or more frequently as needed to conduct the business of the LLC. Notice of meetings shall be given in a manner agreed upon by the members.

10. AmendmentsThis Agreement may be amended only with the written consent of all members.

11. DissolutionThe LLC may be dissolved with the consent of members owning more than fifty percent of the interest in the profits of the LLC or as otherwise provided in this Agreement. Upon dissolution, the LLC shall be wound up in accordance with the Rhode Island Limited Liability Company Act.

Exhibit A: List of Members

______________________________________

______________________________________

Exhibit B: Capital Contributions

______________________________________

______________________________________

Exhibit C: Allocation of Profits, Losses, and Distributions

______________________________________

______________________________________

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the last date written below.

Member Signature: ___________________________ Date: ____________

Member Signature: ___________________________ Date: ____________

PDF Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The Rhode Island Operating Agreement is a document used by LLCs in Rhode Island to outline the business's financial and functional decisions. |

| 2 | It's not a mandatory document by Rhode Island state law, but it's highly recommended to create one for clarity and internal governance. |

| 3 | This agreement allows members to establish their own rules and procedures, offering flexibility that the default state laws do not. |

| 4 | Governing laws for these agreements in Rhode Island fall under the Rhode Island Limited Liability Company Act, Title 7, Chapter 16 of the Rhode Island General Laws. |

| 5 | It assists in reinforcing the limited liability status, separating members' personal liabilities from that of the LLC. |

| 6 | Operating Agreements can include a wide variety of information, such as member duties, voting rights, and how profits and losses are distributed. |

| 7 | Even though it's an internal document, it's advisable to have it in writing to solve disputes among members or with external parties effectively. |

Rhode Island Operating Agreement - Usage Guidelines

For individuals who are looking to establish a framework for their business operations in Rhode Island, filling out an Operating Agreement form is a critical step in the right direction. This document serves as a blueprint, outlining the structure, policies, and procedures of your business. It can help in preventing misunderstandings between owners and provides a clear guide on the management of the business. Although the details of the form are not provided here, generally, an Operating Agreement includes information about the ownership structure, the distribution of profits and losses, and the duties and responsibilities of the members. The process of completing the Rhode Island Operating Agreement form must be approached with attention to detail to ensure all aspects of your business are thoroughly and accurately represented.

- Begin by providing the legal name of your business as registered in Rhode Island. Ensure the name is accurately spelled and includes any legal designators such as "LLC."

- Specify the principal place of business. This should be the primary location where your business operations are conducted and should include a physical address.

- List the name(s) and address(es) of all members who are part of the LLC. If the LLC is managed by managers, include the names and addresses of these managers instead.

- Outline the ownership percentages of each member. This section divides the LLC's profits, losses, and assets among the members according to their respective ownership interests.

- Describe the allocation of profits and losses. Be explicit about how and when profits and losses will be distributed to members.

- Detail the management structure of the LLC. Indicate whether the LLC is member-managed or manager-managed and outline the duties and powers of the managers or managing members.

- Include any provisions for meetings, including how often they will occur, how they will be called, and the required quorum for decision-making.

- Specify the procedure for adding or removing members, including any buy-out or buy-sell arrangements that are in place to handle such transitions smoothly.

- Set forth the terms under which the Operating Agreement itself can be amended. This usually requires a certain percentage of member approval.

- Finally, all members (and managers, if applicable) must sign and date the form, officially acknowledging their agreement to its terms.

Completing the Rhode Island Operating Agreement form is a fundamental process for defining the operational and financial relationships among members of an LLC. By carefully following the steps outlined, members can ensure that their business operations are structured in a clear and organized manner. This document not only serves as a crucial internal record but also as a testament to the professionalism and preparedness of your business.

Essential Queries on Rhode Island Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a legal document outlining the governance structure and operating procedures of a Limited Liability Company (LLC). It helps to establish the rights, powers, duties, liabilities, and obligations of the members towards each other and towards the LLC. While not mandatory in every state, it's highly recommended to have one to ensure smooth operations.

Is an Operating Agreement required for an LLC in Rhode Island?

In Rhode Island, an Operating Agreement is not strictly required by law for LLCs to operate. However, having one is beneficial for multiple reasons including clarifying business operations, offering protection of personal assets by reinforcing the LLC's limited liability status, and preventing misunderstandings among members by setting clear expectations.

What should be included in a Rhode Island Operating Agreement?

A Rhode Island Operating Agreement should include details such as the LLC's name and address, the names of the members, how the LLC will be managed, the distribution of profits and losses, member voting rights and responsibilities, processes for adding or removing members, and procedures for dissolving the business. It can also include any other provisions members wish to govern the LLC.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if necessary. The specific process for making amendments should be outlined within the agreement itself. Typically, modifications require a certain percentage of member approval. It's important to update the Operating Agreement to reflect any significant changes to the LLC's operation or member structure. Regular reviews of the agreement are advisable.

Who should keep a copy of the Operating Agreement?

Every member of the LLC should have a copy of the Operating Agreement to ensure that all members understand their rights, obligations, and the structure of the business. Additionally, while it is not required to file this document with a government agency in Rhode Island, keeping a copy at the primary business location is advisable for reference and legal compliance purposes.

How does an Operating Agreement protect members' personal assets?

An Operating Agreement can help protect members' personal assets by clearly separating the members' personal assets from the LLC's business debts and obligations. This separation reaffirms the limited liability protection afforded by the LLC structure, which is designed to shield personal assets from business-related lawsuits or debts.

What happens if an LLC does not have an Operating Agreement in Rhode Island?

If an LLC in Rhode Island operates without an Operating Agreement, the default LLC rules set by the state's statutes will apply. This can lead to generic and possibly unfavorable rules governing the LLC. Without an Operating Agreement, resolving disputes among members or making decisions about the future of the LLC can become more complicated and time-consuming.

Common mistakes

When filling out the Rhode Island Operating Agreement form, several common errors can occur. These mistakes can significantly impact the effectiveness and legal standing of the document. It’s important to approach this task with attention to detail and an understanding of what is required.

Overlooking Important Details: Often, individuals rush through the process, missing critical details that are necessary for a comprehensive agreement. This oversight may include not specifying the duties and rights of members, the distribution of profits and losses, or the procedures for adding or removing members. Such omissions can lead to disputes or confusion down the line, potentially putting the entire business at risk.

Failure to Customize the Agreement: Relying on a generic template without customizing it to fit the specific needs of the business is another common mistake. While templates can provide a helpful starting point, every business has unique aspects that should be reflected in its Operating Agreement. A failure to tailor the document to the particular business can result in inadequate protection or governance not aligned with the members’ intentions.

Incorrect Member Information: Sometimes, incorrect member information is provided. This can range from simple typographical errors in names or addresses to incorrect details regarding members’ capital contributions or ownership percentages. Accurate information is crucial for the integrity of the agreement and to ensure that all members’ rights and responsibilities are clearly defined and understood.

Not Regularly Updating the Document: Businesses evolve, and so should their Operating Agreement. Nonetheless, a frequent error is the failure to update the document to reflect changes in the business structure, member contributions, or legal requirements. Regular reviews and updates are essential to maintain the relevance and enforceability of the agreement.

To mitigate these errors, it’s advisable to approach the Rhode Island Operating Agreement with diligence and precision. Consultation with legal professionals can provide valuable insights and help ensure that the document fully meets the company's needs while adhering to Rhode Island’s legal requirements. Ensuring each section is carefully reviewed and understood can protect the interests of all parties involved and pave the way for a successful business venture.

Documents used along the form

When setting up or managing a limited liability company (LLC) in Rhode Island, the Operating Agreement is a crucial document that outlines the operational and financial agreements among its members. However, several other forms and documents often accompany the Operating Agreement to ensure the business complies with local and federal laws and operates smoothly. These documents serve various purposes, from tax documentation to organizational structuring. Understanding each document’s role can aid in maintaining a legally compliant and efficiently run business.

- Articles of Organization: This is the foundational legal document required to officially form an LLC in Rhode Island. It is filed with the state’s Secretary of State and includes basic information about the LLC, such as the business name, address, and the names of its members.

- Employer Identification Number (EIN) Confirmation Letter: After registering for an EIN from the Internal Revenue Service (IRS), businesses receive this confirmation letter. The EIN is necessary for tax purposes, hiring employees, and opening business bank accounts.

- Annual Reports: Rhode Island requires LLCs to file an annual report with the Secretary of State. This report keeps the state informed about the LLC’s current contact information and any changes in membership or management.

- Operating Agreement Amendments: Over time, an LLC may need to make changes to its Operating Agreement due to shifts in management, membership, or business operations. These amendments should be documented and kept with the Operating Agreement.

- Member Resolutions: These documents record significant decisions made by the LLC’s members outside of the regular operational guidelines laid out in the Operating Agreement. They can cover a wide range of topics, including expansion plans and asset purchases.

- Bank Account Resolutions: When opening a bank account in the name of the LLC, banks often require a resolution from the LLC’s members. This document authorizes specific members to open and manage the account, outlining their authority levels.

In addition to the Operating Agreement, these documents play an integral part in the establishment and ongoing operations of an LLC in Rhode Island. They ensure not only compliance with legal requirements but also clarity and structure within the business's internal operations. Proper management of these documents contributes to the smooth functioning and legal integrity of the LLC.

Similar forms

The Rhode Island Operating Agreement form is similar to other key documents that are fundamental in the formation and operation of businesses. These documents include Corporate Bylaws and Partnership Agreements, each serving distinct yet complementary roles in the business landscape. While they share common objectives in structuring the operations, rights, and responsibilities within a business, their applications differ based on the type of business entity they relate to.

Corporate Bylaws closely resemble the Rhode Island Operating Agreement in their function of outlining the internal management framework of a business. However, Corporate Bylaws are specifically tailored for corporations, detailing the rules, procedures, and governance of the corporation's board of directors and its officers. Like Operating Agreements, which clarify the operations and member expectations in a Limited Liability Company (LLC), Corporate Bylaws serve as the guiding document that helps ensure smooth, orderly, and efficient decision-making within a corporation. Both documents are pivotal for the organization’s internal functioning, albeit for different types of entities.

Partnership Agreements also share similarities with the Rhode Island Operating Agreement, particularly in laying the foundation for the business’s financial and management operations. Designed for partnerships, these agreements specify the partnership's terms, including the distribution of profits and losses, partnership duration, and the roles and responsibilities of each partner. By establishing clear expectations and procedures, Partnership Agreements mitigate potential conflicts between partners, similar to how Operating Agreements facilitate a mutual understanding among LLC members regarding the business's day-to-day operations and overarching goals.

Dos and Don'ts

Filling out the Rhode Island Operating Agreement form is a critical step for any Limited Liability Company (LLC) establishing itself within the state. It outlines the company's financial and functional decisions including rules, regulations, and provisions. The process can be straightforward, yet it requires careful attention to ensure that the agreement is comprehensive and accurately reflects the intentions of its members. Below are the key dos and don’ts to keep in mind when completing this important document.

Do:

- Review Rhode Island-specific requirements for operating agreements to ensure your document is compliant and relevant to state laws.

- Provide clear and detailed descriptions of each member's rights, responsibilities, and contributions to the LLC to prevent misunderstandings or conflicts in the future.

- Update the agreement regularly as your LLC grows or undergoes changes in membership, management structure, or operations to reflect current practices and agreements accurately.

- Have all members review and sign the agreement, acknowledging their understanding and consent to the terms outlined within.

Don't:

- Use vague language that could lead to interpretations that might not align with the original intent of the agreement. Clarity and specificity are key.

- Forget to address potential future scenarios, such as the process for adding or removing members, or procedures for dissolving the LLC, leaving critical decisions undecided.

- Ignore state-specific requirements and provisions that could render your operating agreement non-compliant or invalid in Rhode Island.

- Rely solely on generic templates without customizing your agreement to fit the unique needs and structure of your LLC.

Taking the time to properly fill out the Rhode Island Operating Agreement form is not just a legal necessity; it's a foundational step towards ensuring that your LLC operates smoothly, and its members are protected. By following these essential dos and don'ts, you create a strong, clear framework that supports your business's success and longevity.

Misconceptions

When it comes to setting up a Limited Liability Company (LLC) in Rhode Island, the Operating Agreement is a critical document that outlines the structure and operation of your business. However, there are many misconceptions floating around about the Rhode Island Operating Agreement form. Here, we aim to clarify some of these misunderstandings to ensure you’re well-informed.

It’s Legally Required to Have One: While highly recommended, Rhode Island law does not mandate LLCs to have an Operating Agreement. However, having one can offer crucial legal protections and clarify operating procedures among members.

One Size Fits All: Many believe that a single template or form suffices for all LLCs. This is far from true. Each LLC’s Operating Agreement should be tailored to fit its specific needs, structure, and the agreement of its members.

Only Multi-Member LLCs Need One: Whether your LLC has one member or several, an Operating Agreement is beneficial. It can protect your personal assets and provide clear direction on the management of the business, even for sole proprietors.

You Can Wait to Create One: Some think it’s okay to delay drafting an Operating Agreement. It’s wise to have it in place right from the start to address any issues that might arise early on and to clearly delineate the business structure.

It’s Too Complicated to Create: While it’s true that an Operating Agreement can be detailed, it doesn’t have to be overly complicated. Assistance from a legal professional can help simplify the process and ensure the document meets your business needs.

Only for Managing Finances: The assumption that Operating Agreements are solely for financial management is incorrect. They cover a wide range of operations including management, dispute resolution, duties of members, and more.

The State Provides a Form: Rhode Island does not provide a standard Operating Agreement form for LLCs. Each agreement is unique and should be custom-drafted to match the business’s specific requirements.

Amendments Aren't Necessary: Business needs and relationships evolve, so it’s likely your Operating Agreement will require amendments. These changes should properly reflect current operations and member agreements.

Online Templates Are Sufficient: While online templates can be a good starting point, they shouldn’t be relied upon as the final document. It’s vital to customize your Operating Agreement to align with your LLC’s structure and operations.

No Need for Legal Review: Lastly, assuming your Operating Agreement doesn’t need a legal review could be a costly mistake. A legal professional can ensure it complies with Rhode Island law and adequately protects all members.

Understanding these misconceptions about the Rhode Island Operating Agreement can save you time, protect your assets, and help your LLC operate smoothly. Remember, while the process might seem daunting, the right guidance can make it manageable and beneficial in the long term.

Key takeaways

Filling out and using the Rhode Island Operating Agreement form properly is essential for any limited liability company (LLC) established in the state. This document is not just a formality; it's a critical tool that outlines the operational framework and financial arrangements of your business. Here are four key takeaways to ensure you approach this document diligently:

- Customization is Key: Every business is unique, and the Rhode Island Operating Agreement should reflect that. While templates are available and offer a solid starting point, it's important to tailor the agreement to fit the specific needs, rules, and procedures of your LLC. This customization helps prevent future disputes by setting clear expectations.

- State Requirements Vary: While the State of Rhode Island doesn't require LLCs to file their Operating Agreement with any state agency, having one in place is still highly advisable. It's worth noting that legal requirements can differ significantly from one state to another, so ensure that your agreement complies with Rhode Island laws specifically.

- Detail Financial and Operational Procedures: The Operating Agreement should comprehensively cover financial contributions, profit distributions, and decision-making processes. Detailing these aspects helps in managing expectations and providing a clear roadmap for business operations. It can play a crucial role during financial or management disputes.

- Future Amendments: Business needs and structures evolve over time, and your Operating Agreement should be able to accommodate these changes. It's crucial to include procedures for amending the document, ensuring that changes are carried out smoothly, with the consensus of all members involved.

Proper attention to the drafting and customization of your Rhode Island Operating Agreement can make a significant difference in the smooth operation and longevity of your LLC. It's not only about fulfilling a legal requirement but also about safeguarding your business's future and the interests of all members involved.

Find Some Other Forms for Rhode Island

Ri Bill of Sale - A key document in motorcycle sales that is instrumental in updating official records with the new owner's details.

Probate Forms Ri - Without a Last Will and Testament, your estate will be distributed according to state intestacy laws, which may not align with your wishes.

Rhode Island Durable Power of Attorney - A Medical Power of Attorney is essential for anyone, regardless of age or health status, as unexpected situations can arise.