Attorney-Approved Power of Attorney Template for Rhode Island

Empowering someone to act on your behalf in legal and financial matters is a significant decision, one that the Rhode Island Power of Attorney form makes possible with clarity and precision. This document serves as a legal bridge, allowing individuals to designate another person, known as an agent, to make decisions and execute transactions as if they were making those decisions themselves. Whether for managing real estate transactions, handling financial accounts, or making medical and health-related decisions, this form meticulously outlines the extent of authority granted to the agent. Its versatility makes it a critical tool for planning ahead, ensuring that affairs are in order, regardless of what the future might hold. Rhode Island’s specific requirements aim to protect all parties involved, emphasizing the need for thoroughness and accuracy in its completion and execution. Understanding the intricacies of this form can pave the way for a smoother, more secure process in entrusting someone with your most critical decisions.

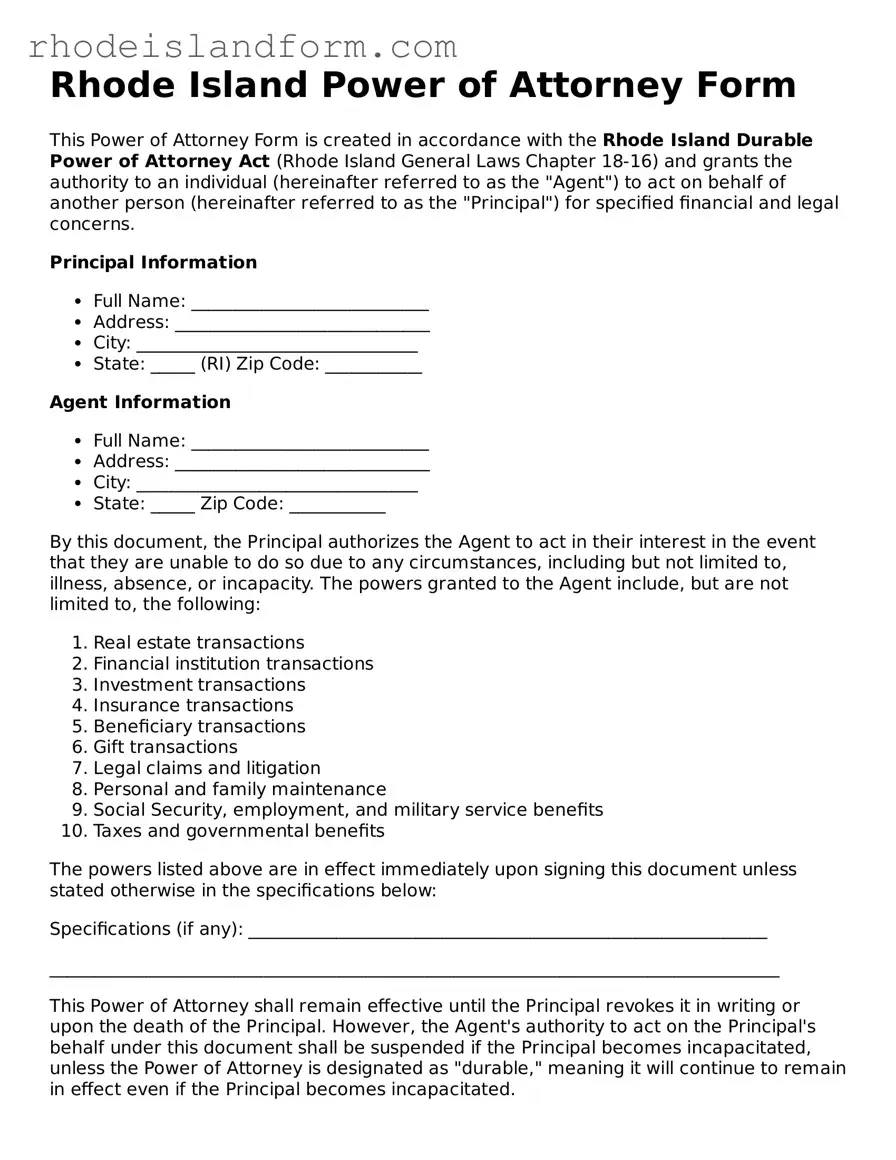

Rhode Island Power of Attorney Preview

Rhode Island Power of Attorney Form

This Power of Attorney Form is created in accordance with the Rhode Island Durable Power of Attorney Act (Rhode Island General Laws Chapter 18-16) and grants the authority to an individual (hereinafter referred to as the "Agent") to act on behalf of another person (hereinafter referred to as the "Principal") for specified financial and legal concerns.

Principal Information

- Full Name: ___________________________

- Address: _____________________________

- City: ________________________________

- State: _____ (RI) Zip Code: ___________

Agent Information

- Full Name: ___________________________

- Address: _____________________________

- City: ________________________________

- State: _____ Zip Code: ___________

By this document, the Principal authorizes the Agent to act in their interest in the event that they are unable to do so due to any circumstances, including but not limited to, illness, absence, or incapacity. The powers granted to the Agent include, but are not limited to, the following:

- Real estate transactions

- Financial institution transactions

- Investment transactions

- Insurance transactions

- Beneficiary transactions

- Gift transactions

- Legal claims and litigation

- Personal and family maintenance

- Social Security, employment, and military service benefits

- Taxes and governmental benefits

The powers listed above are in effect immediately upon signing this document unless stated otherwise in the specifications below:

Specifications (if any): ___________________________________________________________

___________________________________________________________________________________

This Power of Attorney shall remain effective until the Principal revokes it in writing or upon the death of the Principal. However, the Agent's authority to act on the Principal's behalf under this document shall be suspended if the Principal becomes incapacitated, unless the Power of Attorney is designated as "durable," meaning it will continue to remain in effect even if the Principal becomes incapacitated.

Durability Clause

To ensure that this Power of Attorney remains in effect during the Principal's incapacity, the following statement is included: This Power of Attorney shall not be affected by the subsequent incapacity of the Principal.

Signatures

- Principal's Signature: ______________________ Date: ____________

- Agent's Signature: _________________________ Date: ____________

- Witness's Signature: _______________________ Date: ____________

This document was prepared on the specific date mentioned above and should be reviewed by a legal professional to ensure it meets the current legal standards and requirements as per Rhode Island law.

PDF Data

| Fact | Detail |

|---|---|

| Governing Law | Rhode Island General Laws Section 18-16-1 et seq. – Uniform Power of Attorney Act |

| Type of Form | Can be durable or non-durable, depending on the principal's preferences and the purpose of the power of attorney. |

| Witness Requirement | Must be signed by two witnesses and notarized by a notary public to be legally binding. |

| Revocation | The power of attorney can be revoked at any time by the principal as long as they are mentally competent, through a written notice to the agent and any third parties who might rely on the power of attorney. |

Rhode Island Power of Attorney - Usage Guidelines

Completing the Rhode Island Power of Attorney form is a critical process that delegates legal authority to an individual, known as the agent, to make decisions on behalf of the person completing the form, referred to as the principal. This legal document can cover a broad range of duties, from managing financial affairs to making healthcare decisions. It’s essential that the document is filled out accurately to ensure the agent can act in the principal's best interest. The following steps are designed to guide you through the process clearly and ensure that all necessary information is correctly provided.

- Start by entering the full legal name and address of the principal (the person granting the power) at the top of the form.

- Indicate the full legal name and address of the agent (the person receiving the power) in the designated section. If you wish to appoint more than one agent, make sure to specify whether they must make decisions together or if they can act independently.

- Specify the powers being granted to the agent. This could include managing real estate, handling financial transactions, making healthcare decisions, or other responsibilities. Be as detailed as possible to avoid any ambiguity.

- If the power of attorney is to be durable, which means it remains in effect even if the principal becomes incapacitated, ensure the form includes a statement to that effect. Not all forms automatically include this, so it may need to be added.

- Set forth any special instructions or limitations on the agent’s powers. This section allows you to define any stipulations or specific matters you wish to exclude from the agent’s authority.

- Determine the effective date of the power of attorney. Some forms take effect immediately upon signing, while others are activated upon the occurrence of a specific event, such as the principal’s incapacity.

- If required by state law, have witnesses sign the form. The requirement for witnesses may vary, so it's important to understand Rhode Island’s specific regulations.

- Sign and date the form in the presence of a notary public. The notary will also sign and seal the document, making it legally binding.

- Keep the original signed document in a safe place and provide the agent with a copy or the original, depending on what is most appropriate for your situation.

Once the Power of Attorney form is fully completed and signed, it grants the agent the authority to perform tasks on behalf of the principal according to the powers provided in the document. It's crucial that both the principal and the agent fully understand the extent and limitations of the powers granted to ensure they are exercised responsibly and in the principal’s best interest. Keeping clear and open communication between all parties involved can help prevent misunderstandings and ensure the arrangement works smoothly.

Essential Queries on Rhode Island Power of Attorney

What is a Power of Attorney (POA) form in Rhode Island?

A Power of Attorney in Rhode Island is a legal document that allows one person, known as the principal, to delegate authority to another person, called the agent or attorney-in-fact, to make decisions and take actions on the principal's behalf. This can include handling financial matters, making healthcare decisions, or conducting other personal affairs.

Who can serve as an agent under a Rhode Island Power of Attorney?

In Rhode Island, an agent in a Power of Attorney can be almost any competent adult selected by the principal. This could be a trusted friend, family member, or even a professional like an attorney. The key requirement is trust in the agent's ability to act in the principal's best interests.

Does a Rhode Island Power of Attorney need to be notarized?

Yes, for a Power of Attorney to be legally valid in Rhode Island, it generally must be signed in the presence of a notary public. The notary public verifies the identity of the signer and ensures that the signature is authentic and made willingly.

What types of Power of Attorney are available in Rhode Island?

Rhode Island recognizes several types of Power of Attorney, including:

- General Power of Attorney - grants broad powers to the agent over the principal’s affairs.

- Durable Power of Attorney - remains in effect if the principal becomes incapacitated.

- Springing Power of Attorney - becomes effective upon a specified event or condition, such as the principal's incapacitation.

- Medical Power of Attorney - allows the agent to make healthcare decisions on behalf of the principal.

- Limited or Special Power of Attorney - grants the agent authority to conduct specific acts or handle certain matters.

How can a Power of Attorney be terminated in Rhode Island?

A Power of Attorney in Rhode Island can be terminated in several ways, including:

- The principal revokes it by notifying the agent and any relevant third parties in writing.

- The principal dies (unless the POA is specifically designed to survive the principal's death).

- The purpose of the POA is fulfilled or the term specified in the document expires.

- The principal becomes incapacitated, if the POA is not durable.

- A court invalidates the document or appoints a guardian for the principal.

Is a Rhode Island Power of Attorney effective in other states?

Generally, a Power of Attorney executed in Rhode Island will be recognized in other states due to the Full Faith and Credit Clause of the U.S. Constitution. However, some states may have specific requirements that could affect the POA’s validity. It's recommended to consult with legal counsel in the state where the document is intended to be used to ensure compliance with local laws.

How can I ensure my Rhode Island Power of Attorney is legally valid?

To ensure the legality of your Rhode Island Power of Attorney, make sure the document is clear, covers all desired authority to be granted to the agent, is signed by the principal in front of a notary public, and complies with Rhode Island state laws. Consulting with a legal professional can provide guidance and peace of mind.

Can a Power of Attorney grant authority to make healthcare decisions in Rhode Island?

Yes, a specific type of Power of Attorney known as a Medical or Healthcare Power of Attorney can authorize an agent to make medical decisions on the principal’s behalf in Rhode Island. For this type of POA, the document must clearly state that the agent has the authority to make healthcare decisions, and it may also need to comply with additional requirements, such as witness signatures.

What should I do if my Power of Attorney is not being recognized?

If your Rhode Island Power of Attorney is not being recognized by financial institutions, hospitals, or other entities, you should first review the document to ensure it complies with Rhode Island law and is applicable to the situation. Contacting an attorney may be necessary to address legal concerns or to potentially draft a new POA. Sometimes, a simple conversation explaining the POA's authority and providing a copy of the legal document can resolve misunderstandings.

Common mistakes

When filling out a Rhode Island Power of Attorney form, it’s essential to do so with great care. Various common mistakes can undermine the document’s validity, or worse, grant powers unintended by the principal. Awareness and avoidance of these errors can ensure the document truly reflects the principal’s wishes and stands up under legal scrutiny.

Firstly, many individuals neglect to provide clear specifics about the powers they are transferring. It is crucial to delineate precisely which decisions the agent can make on the principal's behalf. Without specific guidelines, confusion and misinterpretation can arise, possibly leading to the agent making decisions outside the intended scope.

An often-overlooked detail is not setting a clear termination date. Without it, the Power of Attorney remains in effect until the principal either revokes it or passes away. Specifying an end date can align the document’s validity with the principal's actual needs, especially if the intent is to grant authority for a limited time or purpose.

- Failing to choose an alternate agent is a mistake that can render the Power of Attorney ineffective if the initial agent is unable or unwilling to serve. It’s prudent to have a contingency plan to ensure uninterrupted management of the principal’s affairs.

- Not discussing the contents and responsibilities with the chosen agent can lead to misunderstandings and reluctance on the agent's part, which can be problematic in times of need.

- Omitting to sign and date the document in the presence of the required witnesses and a notary public jeopardizes its legality. This formal procedure is critical for the document’s enforceability.

- Keeping the Power of Attorney document in an inaccessible place can delay actions that might need to be taken on the principal’s behalf. It is advisable to inform the agent and possibly other trusted individuals of the document’s location.

- Assuming that one standard Power of Attorney form suits all situations is incorrect. Rhode Island law may have specific requirements based on the type of Power of Attorney being executed, be it financial, health care, or otherwise.

It is also important to avoid making changes to the Power of Attorney form informally. Any amendment should be executed with the same formalities as the original document. Cross-outs, write-ins, and marginal notes can lead to challenges regarding the document’s authenticity and the principal’s true intentions.

- In summary, the intricacies of preparing a Rhode Find Island Power of Attorney form warrant careful attention to detail. By avoiding common mistakes such as lack of specificity, failure to designate an alternate agent, and improper execution, individuals can ensure their intentions are accurately and legally represented.

- Moreover, it’s wise to seek legal guidance when filling out this form to navigate the nuances of state laws and to tailor the document to meet specific needs and circumstances.

Ultimately, a well-prepared Power of Attorney can provide peace of mind, ensuring that the principal’s affairs will be managed according to their wishes, should they become unable to do so themselves.

Documents used along the form

When handling matters that require a Rhode Island Power of Attorney, it is often the case that additional forms and documents are necessary to ensure comprehensive legal arrangements. These documents can complement the power of attorney form by specifying wishes in greater detail, protecting assets, or ensuring medical decisions adhere to an individual’s preferences. Here are eight such forms and documents that are commonly used in conjunction with a Rhode Island Power of Attorney.

- Advance Directive: This document allows an individual to specify their preferences for medical care if they become unable to make decisions due to illness or incapacity. It usually includes a living will and a medical power of attorney.

- Will: A will is a legal document that outlines how an individual’s property and assets will be distributed after their death. It can also appoint a guardian for any minor children.

- Trust: Trusts are arranged for managing an individual’s assets, providing clear instructions on how these assets should be handled and distributed during their lifetime or after death.

- Healthcare Proxy: Similar to a medical power of attorney, a healthcare proxy designates someone to make medical decisions on behalf of the individual, should they be unable to make these decisions themselves.

- Living Will: This document specifies an individual's wishes regarding the types of medical treatment they do or do not want to receive in the event they are unable to communicate their desires directly.

- Financial Statement: Often used alongside a financial power of attorney, this document provides a detailed overview of an individual's assets, liabilities, and overall financial condition.

- Guardianship Agreement: If there are minor children or dependents involved, a guardianship agreement can designate a specific individual to care for them if the parent or current guardian is unable to do so.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains in effect even if the individual becomes incapacitated. It can cover both financial and health care decisions.

Each of these documents serves a distinct purpose and complements the Rhode Island Power of Attorney by covering aspects of one’s personal, financial, and healthcare wishes that the Power of Attorney alone might not address. Understanding and preparing these documents in advance can ensure that an individual’s wishes are respected and that their affairs are in order during unforeseen circumstances.

Similar forms

The Rhode Island Power of Attorney form is similar to other legal documents that grant someone the authority to act on another person's behalf. These documents, while varying slightly in terms of scope and application, share a fundamental purpose: to ensure that an individual's affairs can be managed according to their wishes by a trusted delegate, even when they are unable to oversee these matters personally.

Living Will: Much like the Power of Attorney, a Rhode Island Living Will allows individuals to outline their wishes regarding medical treatment in situations where they are unable to communicate these preferences themselves. Both documents are proactive steps in planning for scenarios where decision-making capabilities might be compromised. However, while a Power of Attorney can cover a broad range of actions including financial, legal, and health-related decisions, a Living Will specifically addresses medical care and life-sustaining measures.

Health Care Proxy: Similar to a Power of Attorney focused on health care, a Health Care Proxy appoints someone to make health-related decisions on behalf of another person. This similarity lies in the delegation of authority to another individual, empowering them to make important decisions based on predetermined wishes or best judgments. The primary difference is that a Health Care Proxy is exclusively concerned with medical decisions, whereas a Power of Attorney can encompass broader authority, including financial and legal decisions.

Durable Power of Attorney: The Durable Power of Attorney and the standard Power of Attorney share the same foundational concept; they both authorize a person to act on someone else’s behalf. The key distinction lies in the durability clause. A Durable Power of Attorney remains effective even if the principal becomes incapacitated or mentally incompetent, highlighting its importance for long-term planning. This durability aspect ensures that the agent's power to act remains uninterrupted by the principal's health status, providing a continuous mechanism for managing the principal's affairs under all circumstances.

Dos and Don'ts

When filling out the Rhode Island Power of Attorney form, certain practices should be followed to ensure the process is completed accurately and effectively. Below are guidelines highlighting the do's and don'ts to consider:

Do:- Read the instructions carefully before you start to fill out the form.

- Use ink that is blue or black for clarity and to maintain the document's legal validity.

- Include the full legal names and addresses of both the principal and the agent to avoid any confusion regarding the identities of the parties involved.

- Specify the powers you are granting with clear, concise language to ensure they are understood and enforceable.

- Check the requirements for witnesses and/or notarization specific to Rhode Island, as these are critical for the form's legal standing.

- Review the form with the appointed agent to ensure they understand their duties and are willing to accept the responsibility.

- Keep a copy of the completed form for your records and provide another to the agent for their reference.

- Consider specifying a start and end date for the power of attorney, particularly if it is for a specific task or limited time period.

- Consult with a legal professional if you have any questions or concerns about the powers being granted or the form itself.

- Inform family members or other interested parties about the power of attorney, where appropriate, to avoid confusion or disputes later on.

- Leave any sections blank; if a section does not apply, mark it as "N/A" (not applicable).

- Sign the form without thoroughly understanding every provision it includes; if unsure, seek clarification.

- Forget to date the document — the date of signing is essential for its validity.

- Use vague language when specifying powers; ambiguity can lead to misinterpretation and legal challenges.

- Assume the form does not require witness signatures or notarization without verifying Rhode Island’s specific requirements.

- Ignore the instructions regarding how to revoke the power of attorney if such action becomes necessary in the future.

- Choose an agent without considering their capability, trustworthiness, and willingness to take on the responsibility.

- Overlook the importance of specifying how disputes related to the power of attorney will be resolved.

- Fails to update the form when circumstances change, rendering the document inaccurate or out of date.

- Underestimate the significance of choosing a backup agent in the event the primary agent is unable to serve.

Misconceptions

When discussing the Rhode Island Power of Attorney (POA), several misconceptions often arise. These misunderstandings can cloud judgment and lead to decisions that may not align with an individual's best interests or intentions. It’s crucial to dispel these myths and shed light on the realities of a Power of Attorney in Rhode Island.

- All Power of Attorney documents are the same. This is a common misconception. The truth is that the state of Rhode Island, like others, recognizes various types of Power of Attorney documents. Each type is tailored to specific circumstances, including healthcare decisions, financial management, and more. The scope and duration of the authority granted can also vary significantly.

- Creating a Power of Attorney means losing all control over personal affairs. Many individuals hesitate to draft a POA due to the fear of losing autonomy over their decisions. In reality, a Power of Attorney can be structured to activate only under certain conditions, such as incapacitation. Moreover, the principal (the person who creates the POA) can specify the extent of the powers granted and can revoke the document at any time, as long as they are mentally competent.

- A Power of Attorney is effective after the death of the principal. This belief is not accurate. In Rhode Island, as in all other states, the authority granted through a POA terminates upon the death of the principal. Estate planning tools, such as a will or trust, are needed to manage and distribute assets posthumously.

- Only elderly individuals need a Power of Attorney. While it's true that Power of Attorney documents are crucial in elder law and estate planning, individuals of all ages can benefit from having a POA. Unexpected events, such as accidents or sudden illnesses, can happen to anyone, emphasizing the importance of being prepared.

- You must hire an attorney to create a valid Power of Attorney. Although it's advisable to consult with a legal professional to ensure that a Power of Attorney document meets all legal requirements and align later with your needs and goals, Rhode Island law does not mandate the involvement of an attorney to create a valid POA. However, an attorney can provide invaluable guidance on the types of POA available, the powers to include, and how to ensure it is correctly executed according to Rhode Island law.

Understanding these facts can help Rhode Island residents make informed decisions regarding Power of Attorney documents, ensuring that their rights are protected and their wishes are effectively carried out.

Key takeaways

When considering the creation and use of a Power of Attorney (POA) in Rhode Island, individuals should take into account several critical aspects. These documents are powerful tools that allow one person to grant another the authority to act on their behalf in various capacities, ranging from financial decisions to health care matters. Ensuring the correct completion and utilization of this form is essential for its effectiveness and legality. Here are key takeaways to understand:

- Understand the Types of POA: Rhode Island recognizes different types of POAs, including General, Limited, Durable, and Health Care. Each serves distinct purposes, offering varying levels of control and specificity regarding the powers granted.

- Select the Right Agent: Choosing a trustworthy and competent agent is crucial, as this individual will have significant authority over your affairs. The agent's responsibilities should be clearly understood by both parties to prevent misuse of the power granted.

- Complete the Form Accurately: The POA form must be filled out with precise details, including full names, addresses, and the specific powers being bestowed. Any ambiguity in the document can lead to interpretation issues or disputes later on.

- Understand the Durable Nature of POAs: In Rhode Island, a POA is considered durable unless stated otherwise. This means it remains in effect even if the principal becomes incapacitated, emphasizing the importance of selecting a reliable agent.

- Notarization and Witnesses: To ensure the POA's legality, the form usually needs to be notarized and signed in the presence of witnesses. The number of witnesses and the notarization process may vary based on the type of POA and specific requirements in Rhode Island.

- Revoke When Necessary: The principal has the right to revoke the POA at any time, provided they are competent to do so. This revocation must be done in writing and communicated to the agent and any third parties relying on the POA.

Understanding these elements is fundamental to creating a POA that reflects the principal's wishes and provides the necessary authority to the chosen agent. It's advisable to consult with a legal expert in Rhode Audience to navigate the specifics of Rhode Island law and ensure the POA's proper execution and validity.

Find Some Other Forms for Rhode Island

How Long Does a Divorce Take in Ri - An essential legal tool that assists couples in navigating the complexities of divorce, promoting a fair and considerate resolution.

Rhode Island Rental Agreement - Details on how emergency repairs will be handled and who is responsible for them are included in the agreement.