Attorney-Approved Promissory Note Template for Rhode Island

In the scenic state of Rhode Island, where the sea meets the shores with timeless grace, the act of borrowing and lending money is as common as the ocean's tide. At the heart of many financial transactions, from the simple loans between friends to the more complex dealings between businesses, lies a crucial document - the Rhode Island Promissory Note form. This form serves as a legal agreement, binding the borrower to repay the lender under the conditions they've both agreed upon. It meticulously outlines the amount of money borrowed, the interest rate, if applicable, and the repayment schedule, ensuring clarity and understanding between all parties involved. Moreover, it provides legal protections for the lender, giving them a clear recourse should the borrower fail to fulfill their obligations. Delving into the makeup of this form reveals its ability to adapt to various scenarios, be they unsecured or secured loans, each with its stipulations and requirements to match the needs of the transaction. Understanding the Rhode Island Promissory Note form is essential for anyone looking to navigate the financial landscapes of borrowing and lending within this charming New England state.

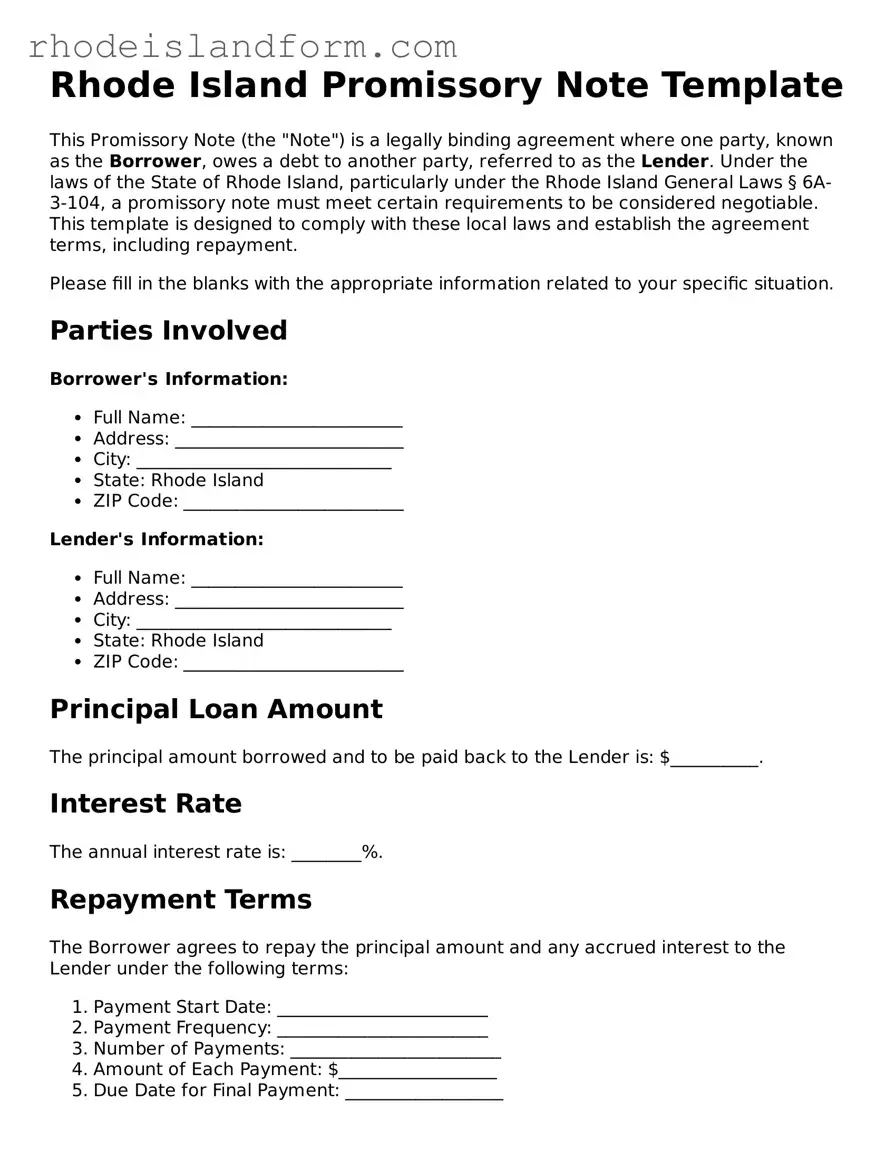

Rhode Island Promissory Note Preview

Rhode Island Promissory Note Template

This Promissory Note (the "Note") is a legally binding agreement where one party, known as the Borrower, owes a debt to another party, referred to as the Lender. Under the laws of the State of Rhode Island, particularly under the Rhode Island General Laws § 6A-3-104, a promissory note must meet certain requirements to be considered negotiable. This template is designed to comply with these local laws and establish the agreement terms, including repayment.

Please fill in the blanks with the appropriate information related to your specific situation.

Parties Involved

Borrower's Information:

- Full Name: ________________________

- Address: __________________________

- City: _____________________________

- State: Rhode Island

- ZIP Code: _________________________

Lender's Information:

- Full Name: ________________________

- Address: __________________________

- City: _____________________________

- State: Rhode Island

- ZIP Code: _________________________

Principal Loan Amount

The principal amount borrowed and to be paid back to the Lender is: $__________.

Interest Rate

The annual interest rate is: ________%.

Repayment Terms

The Borrower agrees to repay the principal amount and any accrued interest to the Lender under the following terms:

- Payment Start Date: ________________________

- Payment Frequency: ________________________

- Number of Payments: ________________________

- Amount of Each Payment: $__________________

- Due Date for Final Payment: __________________

Governing Law

This Note shall be governed by and construed in accordance with the laws of the State of Rhode Island, without giving effect to its conflict of laws principles.

Signatures

To make this Note legally binding, both the Borrower and the Lender must sign below:

Borrower's Signature: ___________________________ Date: ___________

Lender's Signature: _____________________________ Date: ___________

This document is a simplified version and may not cover all possible legal requirements or nuances of your specific situation. For more complex arrangements or advice, consulting with a legal professional specializing in local Rhode Island law is recommended.

PDF Data

| # | Fact |

|---|---|

| 1 | In Rhode Island, a promissory note is a binding legal document where one party promises to pay another a specific sum of money either on demand or at a defined future date. |

| 2 | The document can be either "secured" or "unsecured," depending on whether collateral is used to guarantee repayment. |

| 3 | Rhode Island General Laws Title 6A governs promissory notes within the state, ensuring they meet all legal requirements for enforceability. |

| 4 | To be considered valid, a Rhode Island promissory note must include the principal amount, interest rate, maturity date, and the signatures of both the payor and payee. |

| 5 | The interest rate on a promissory note in Rhode Island cannot exceed the state's usury limit unless a specific exemption applies. |

| 6 | Provisions for late fees and prepayment penalties must be clearly stated in the promissory note to be enforceable. |

| 7 | In case of default, Rhode Island law allows the lender to seek immediate repayment of the entire outstanding balance under certain conditions. |

| 8 | A promissory note must be executed with the formalities required for legal documents in Rhode Island, including acknowledgment by a notary public for certain types. |

| 9 | Electronic signatures are recognized as valid on promissory notes in Rhode Island, as long as they comply with both state and federal e-signature laws. |

Rhode Island Promissory Note - Usage Guidelines

Filling out the Rhode Island Promissory Note form is a straightforward process that plays an essential role in formalizing a loan agreement between two parties. This process not only delineates the expectations and obligations of both the lender and the borrower but also ensures that the agreed upon financial transaction is acknowledged in a legally binding document. Following the correct steps will help both parties understand their commitments and facilitate a smooth financial exchange.

- Begin by entering the date on which the promissory note is being created at the top of the form.

- Write the full name and address of the borrower, identifying the person who is promising to repay the loan.

- Include the full name and address of the lender, the individual or entity lending the money.

- Specify the principal amount of money being loaned in US dollars.

- Detail the interest rate per annum, ensuring it complies with Rhode Island's legal maximum, if applicable.

- Describe the repayment schedule, including the start date of payments, the frequency of payments (monthly, quarterly, etc.), and the duration of the repayment period.

- Include any agreed-upon conditions regarding early repayment or penalties for late payments.

- Clearly state the collateral, if any, that the borrower has agreed to secure the loan with, detailing the item(s) or asset(s).

- Both parties should carefully review the entire document to ensure all information is accurate and complete.

- Have the borrower sign and date the form, thereby agreeing to the terms outlined in the promissory note.

- Have the lender sign and date the form, acknowledging the agreement and the loan terms.

- If required, ensure a witness or notary public signs the promissory note to validate its authenticity.

After completing these steps, the Rhode Island Promissory Note will formalize the loan agreement and set forth the obligations of both the lender and borrower. It's important for each party to keep a copy of the fully executed document for their records. The promissory note then serves as a reference point for the terms of the loan and can be a crucial document in the event of disputes or for record-keeping purposes.

Essential Queries on Rhode Island Promissory Note

What is a Rhode Island Promissorial Note Form?

A Rhode Island Promissory Note Form is a legal document that outlines a loan agreement between two parties, typically a lender and a borrower. It details the amount of money borrowed, the interest rate, repayment schedule, and the obligations of both parties. This document is legally binding and enforceable in the state of Rhode Island.

Who needs to use a Rhode Island Promissory Note Form?

Individuals or entities in Rhode Island that are either lending money or borrowing money may need to use this form. It is essential for formalizing the loan process and ensuring all terms are clearly outlined and agreed upon, providing protection for both the lender and the borrower.

Is there a specific interest rate that must be followed in Rhode Island for promissory notes?

Rhode Island law stipulates a maximum legal interest rate unless a different rate is agreed upon in a contract. It is important for the parties to check the current legal interest rate when drafting a promissory note to ensure compliance with state law. However, the agreed interest rate must not exceed legal limits on usury.

How is a Promissory Note enforced in Rhode Island?

In the event of non-payment, a promissory note can be enforced in Rhode Island through the legal system. The lender may file a lawsuit to recover the owed amount. If the court finds in favor of the lender, it may issue a judgment against the borrower for the debt plus any applicable interest and fees. Enforcement actions might involve wage garnishment or seizing assets.

Are there any specific elements that need to be included in a Rhode Island Promissory Note Form?

A Rhode Island Promissory Note Form must include the names and addresses of the lender and borrower, the principal loan amount, interest rate, repayment schedule, and signatures of both parties. It may also include clauses on late fees, collateral, and default terms to provide clear expectations and remedies for both sides.

What's the difference between a secured and an unsecured Promissory Note?

A secured promissory note requires the borrower to offer collateral (such as real estate or personal property) that the lender can seize if the borrower fails to repay the loan. An unsecured promissory note does not require collateral, which means the lender takes on more risk since recovery options in the case of default are limited to legal action for a judgment against the borrower.

Can a Rhode Island Promissory Note Form be modified after it’s signed?

After being signed, a promissory note can be modified only if both the lender and borrower agree to the changes. Any amendments should be documented in writing and signed by both parties to avoid future disputes.

What happens if a borrower defaults on a Promissory Note in Rhode Island?

If a borrower defaults on a promissory note, the lender may pursue legal action to enforce the note and recover the outstanding debt. The specific remedies available, including any rights to collateral, will be determined by the terms of the note and Rhode Island law.

Can a Rhode Island Promissory Note be used for personal loans between friends or family members?

Yes, a Rhode Island Promissory Note can be used for personal loans between friends or family members. It is advisable to document the loan terms clearly to prevent misunderstandings and ensure that the agreement is enforceable.

Where can I get a Rhode Island Promissory Note Form?

Rhode Island Promissory Note Forms can be obtained from legal document providers, attorneys, or online resources that specialize in legal forms. It’s important to ensure that the form complies with Rhode Island law and meets the specific needs of your agreement.

Common mistakes

When it comes to financial agreements, precision is paramount, especially when drafting documents like the Rhode Island Promissory Note form. This form signifies a borrower's promise to repay a sum of money to a lender, outlining the repayment terms and conditions. Yet, it's common for individuals to make mistakes while filling out this crucial document. Here are ten common missteps to avoid for those navigating through the complexities of this financial pledge.

- Not specifying the type of promissory note: Secured or Unsecured. A secured note means collateral backs the loan, offering the lender protection against defaults. Leaving this detail vague can lead to legal ambiguities in the event of non-payment.

- Omitting crucial details about the borrower or the lender, such as full legal names, addresses, or contact information. This oversight can complicate or even invalidate the note if there are disputes or if enforcement becomes necessary.

- Failure to outline the loan amount in clear, unambiguous terms. This figure should be written in both numeric and word formats to avoid discrepancies.

- Not providing a detailed repayment schedule. This includes specifying the start date, frequency of payments (monthly, quarterly, etc.), and the due date for the final payment. Vague terms can lead to misunderstandings and disputes.

- Forgetting to specify the interest rate or stating it in a way that is not compliant with Rhode Island's usury laws. This could render the interest terms, or possibly even the entire note, unenforceable.

- Skipping over the terms related to late payments or missed payment penalties. Without these details, enforcing penalties or managing late payments becomes legally challenging.

- Leaving out provisions for prepayment. Borrowers often assume they can pay off a note early, but without specific terms allowing for this, they might be subject to penalties or other conditions.

- Neglecting to detail what constitutes default and the repercussions thereof. Clearly defining default conditions and subsequent actions ensures both parties understand the serious consequences of failure to comply with the agreement.

- Omitting signatures or dating them incorrectly. A promissory note must be signed and dated by all parties involved to be legally binding. Failure to do so renders the document essentially worthless in a legal context.

- Not having the note witnessed or notarized, depending on the legal requirements in Rhode Island. While not always mandatory, having a third-party witness or notarize the document can lend additional legal credibility and enforcement weight.

When individuals approach the Rhode Island Promissory Note form, treating it with the seriousness and attention it deserves can prevent these common mistakes. This ensures that the financial relationship between borrower and lender is based on a clear, legally binding agreement, minimizing the potential for future conflict while safeguarding the interests of both parties. In legal and financial matters, the devil is often in the details, and nowhere is this truer than in the realm of promissory notes.

Your journey through creating or engaging with a promissory note is significant—it's not just paperwork but a foundational element of trust and legal obligation between parties. Avoiding these pitfalls can help maintain the integrity of your financial dealings and ensure that both lenders and borrowers are protected under the law. Always consider consulting with a legal professional to navigate the complexities of these forms to ensure they're filled out correctly and in compliance with Rhode Native Island's regulatory framework.

Documents used along the form

In the intricate web of financial and legal transactions, particularly when it comes to lending and borrowing in Rhode Island, a Promissory Note is a fundamental document that outlines the commitment of one party to pay a certain amount of money to another party under agreed-upon terms. However, this document seldom operates in isolation. Several other forms and documents often accompany the Rhode Island Promissory Note form to ensure a comprehensive and enforceable agreement. These auxiliary documents not only bolster the enforceability of the agreement but also provide clarity and legal protection for all parties involved.

- Security Agreement: This document is used alongside a promissary note when the loan is secured with collateral. It details the specific assets pledged by the borrower as security for the debt, ensuring the lender has a claim to the collateral if the borrower defaults.

- Loan Agreement: Often more detailed than a promissory note, a loan agreement complements the note by outlining all terms and conditions of the loan, including but not limited to, repayment schedule, interest rates, and the duties and obligations of both the lender and the borrower.

- Guaranty: This is a separate agreement where a third party (the guarantor) agrees to fulfill the borrower's obligations under the promissory note if the borrower fails to do so. It provides an additional layer of security for the lender.

- Mortgage or Deed of Trust: When the loan is used for purchasing real estate, a mortgage or deed of trust is recorded as a public record. This document secures the promissory note with the property, allowing the lender to foreclose on the property if the borrower defaults on the loan.

- Amendment Agreement: This document may come into play if both the lender and the borrower agree to amend any terms of the original promissory note or related agreements. It ensures that any changes are legally documented and enforceable.

- Release of Promissory Note: Once the debt is fully repaid, this document is issued by the lender to the borrower. It serves as proof that the borrower has fulfilled all repayment obligations and that the lender's claim under the promissory note is terminated.

When used together, these documents form a robust legal framework that governs the lending process. Each document serves a unique purpose, addressing specific aspects of the loan transaction to ensure it is fair, transparent, and adheres to Rhode Island state laws. Borrowers and lenders are well-advised to understand not just the promissory note, but also the role and significance of each accompanying document, to safeguard their interests and maintain a smooth lending experience.

Similar forms

The Rhode Island Promissory Note form is similar to other forms of legal agreements and financial instruments that facilitate various types of transactions. Yet, each document maintains unique features tailored to specific agreement types, their enforceability, and the extent of obligations they impose. Understanding these similarities and distinctions is crucial for grasp the nuances of legal documents effectively.

Firstly, this form shares several similarities with a Mortgage Agreement. Both serve as legally binding documents that outline the terms for borrowing money, with the promissory note detailing the borrower's promise to repay the borrowed amount under specified conditions, and the mortgage agreement adding a layer of security for the lender by attaching the loan to a physical property. This attachment serves as collateral, hence offering the lender a secured interest, contrasting with the unsecured nature of a standalone promissory note. The precise specification of repayment terms, interest rates, and the consequences of default are common grounds, which are elaborated upon to protect the involved parties’ interests.

Another document that bears resemblance to the Rhode Island Promissory Note form is a Loan Agreement. Both are foundational in establishing a formal loan's terms and conditions. The loan agreement, however, encompasses a broader scope, often detailing extensive clauses about parties' responsibilities, guarantees, and covenants. It’s thorough in outlining the operational aspects of managing the loan, making it particularly comprehensive. In contrast, the promissory note typically focuses on the core commitment of the borrower to repay the sum under defined conditions, such as the payment schedule and interest rate, making it more streamlined in comparison.

Lastly, the form is akin to an IOU (I Owe You) document, but with notable enhancements. Both declare a debt obligation where one party owes another money. However, the promissory note is more sophisticated and binding, incorporating specific repayment terms, interest rates, and legal consequences for non-compliance. This distinction elevates it from the informal nature of an IOU, which is a simple acknowledgment of debt without the detailed framework for repayment, lacking the formalities and protections a promissory note offers. Through this enhanced detail, the promissory note creates a tighter obligation and clearer path to enforcement.

Dos and Don'ts

When filling out the Rhode Island Promissory Note form, it's important to follow certain guidelines to ensure the document is both legally binding and accurately reflects the agreement between the lender and borrower. Below are eight vital dos and don'ts to consider:

Do ensure all parties' full legal names and addresses are included to clearly identify the individuals or entities involved.

Do specify the amount being borrowed and the date by which it must be repaid in clear and unambiguous terms.

Do detail the interest rate if applicable, ensuring it complies with Rhode Island's usury laws to prevent it from being considered unlawful.

Do include any agreed-upon repayment schedule, highlighting dates and amounts for each installment, if relevant.

Don't leave blanks on the form. If a section doesn't apply, mark it N/A (Not Applicable) to prevent unauthorized alterations.

Don't use vague language. Clarity is key in legal documents to avoid disputes or misunderstanding regarding the terms of the agreement.

Don't forget to have all parties sign and date the note. In some cases, notarization may enhance the form’s legal standing.

Don't neglect to keep a copy of the fully executed document for your records, ensuring all parties have access to a copy.

Adhering to these guidelines can help safeguard the interests of both borrower and lender, and ensure that the agreement is enforceable in the State of Rhode Island.

Misconceptions

When dealing with the Rhode Island Promissory Note form, several misconceptions commonly arise. Understanding these can help individuals navigate their financial agreements with more confidence and accuracy.

Only formal lending institutions can issue them: A common misconception is that promissory notes are tools reserved exclusively for banks or formal lending organizations. In reality, this form can be used by anyone in Rhode Island lending money to someone else, including private loans between friends or family members.

They do not need to be detailed: Some believe that a promissory note can be overly vague or lack detailed information. However, to ensure the agreement is legally binding and enforceable, the note must include specific details like the amount borrowed, interest rate (if any), repayment schedule, and the consequences of non-payment.

Signing is enough for legal enforcement: Simply signing a promissory note does not automatically make it enforceable. Rhode Island law requires that these documents meet certain criteria, such as being clear, unequivocal, and containing all essential terms, for them to hold up legally. In some cases, notarization may be recommended to add an extra layer of authenticity.

A promissory note is the same as a loan agreement: Though they are related, a promissory note and a loan agreement serve different purposes. A promissory note is a straightforward document wherein one party promises to pay another a specific sum of money by a certain date or upon demand. On the other hand, a loan agreement is more comprehensive and includes additional clauses about the responsibilities and obligations of each party beyond the repayment of money.

Key takeaways

The Rhode Island Promissory Note form is an essential document for individuals looking to formalize the process of lending or borrowing money within the state. To navigate its completion and usage effectively, here are nine key takeaways to consider:

- Understand Its Purpose: A promissory note in Rhode Island serves as a legal agreement that documents a loan's terms, ensuring there is a clear record of the borrower's promise to repay the sum lent, along with any interest that accrues.

- Identify the Type: Determine whether the note is secured or unsecured. A secured note means that the loan is backed by collateral which the lender can claim if the borrower defaults. An unsecured note does not have such collateral.

- Details Matter: Include comprehensive information such as the amount borrowed, interest rate, repayment schedule, and the names and addresses of both the borrower and lender to avoid any ambiguity.

- Legal Requirements: Familiarize yourself with Rhode Island's legal requirements surrounding promissory notes, such as caps on interest rates and the necessity for witness or notarization, to ensure the document's enforceability.

- Repayment Plan: Clearly outline the repayment terms, whether it's in installments or a lump sum, and specify dates to avoid any misunderstandings.

- Interest Rate: When setting the interest rate, make sure it complies with Rhode Island's usury laws to avoid rendering the note void or subject to penalties.

- Signatures: Both parties should sign the promissory note. Depending on the note's nature, having a witness or notary public sign the document might also be prudent to reinforce its validity.

- Keep Records: After completion, both the borrower and the lender should keep copies of the promissory note. It serves as a receipt and a legal record of the loan terms and agreement.

- Legal Counsel: Consider seeking advice from a legal expert familiar with Rhode Island laws to ensure that the promissory note meets all legal standards and protects the interests of both parties involved.

Find Some Other Forms for Rhode Island

Ri Bill of Sale - A motorcycle bill of sale that includes the buyer's and seller's contact information, enhancing post-sale communication.

How Do I Get a Copy of Deed to My House - An important aspect of due diligence, lawyers often review deed forms for accuracy and completeness.