Attorney-Approved Quitclaim Deed Template for Rhode Island

Imagine you're ready to transfer property ownership in the smallest state with a big heart, Rhode Island. The tool for this task isn't as complex as a puzzle but rather simple, and it's known as the Quitclaim Deed form. This document, unlike its counterpart, the warranty deed, does not offer guarantees about the title's clarity, making it a popular choice for transactions among family members or close associates. It provides a swift means to transfer interest in a property, yet it demands precision and understanding to navigate its specifics. Every line filled and signature inked brings you a step closer to altering ownership, but it's crucial to appreciate the subtleties -- from understanding the lack of warranty to recognizing the state-specific requirements that Rhode Island insists upon. Often used in personal transactions where trust is not in question, the Quitclaim Deed simplifies the process, enabling parties to bypass the complexities typically associated with real estate transfers. It's a path many choose when speed and simplicity are paramount, but walking it with a thorough understanding of its nature is essential to ensure its benefits fully materialize.

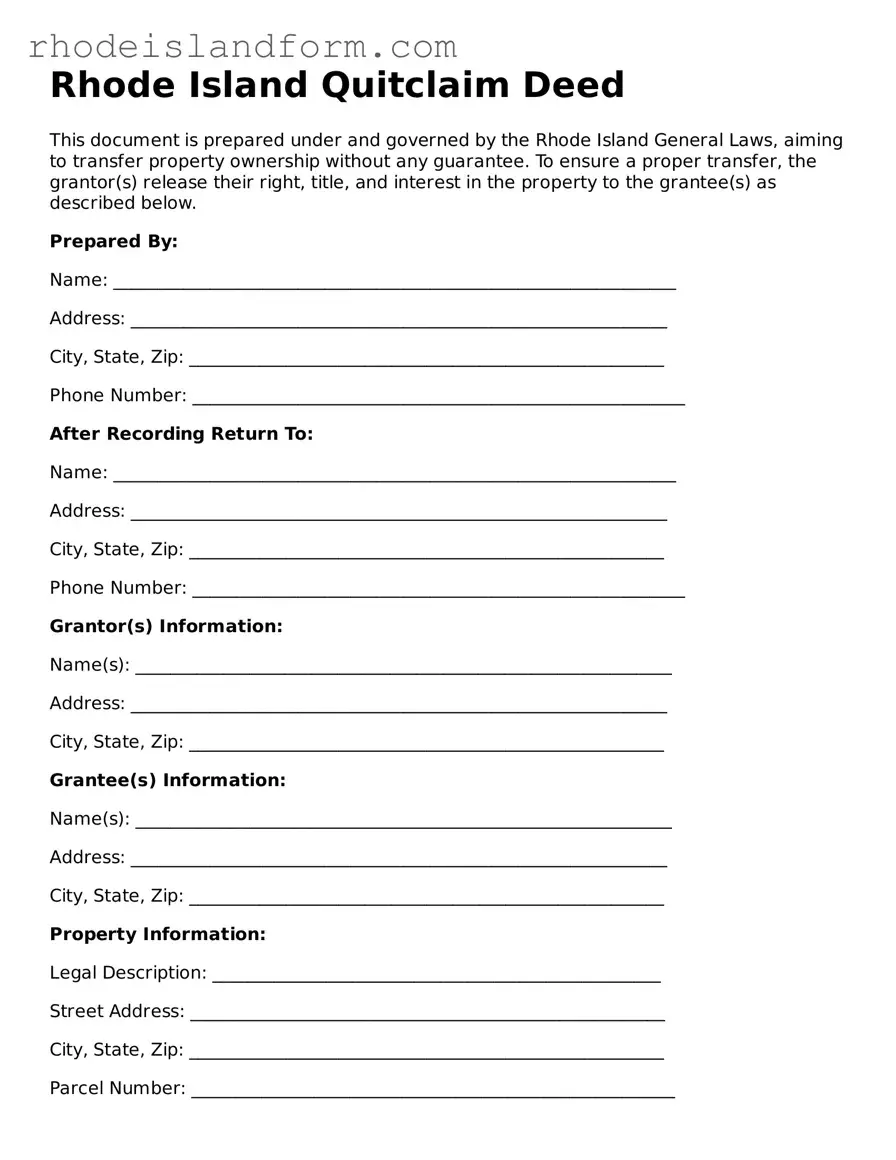

Rhode Island Quitclaim Deed Preview

Rhode Island Quitclaim Deed

This document is prepared under and governed by the Rhode Island General Laws, aiming to transfer property ownership without any guarantee. To ensure a proper transfer, the grantor(s) release their right, title, and interest in the property to the grantee(s) as described below.

Prepared By:

Name: ________________________________________________________________

Address: _____________________________________________________________

City, State, Zip: ______________________________________________________

Phone Number: ________________________________________________________

After Recording Return To:

Name: ________________________________________________________________

Address: _____________________________________________________________

City, State, Zip: ______________________________________________________

Phone Number: ________________________________________________________

Grantor(s) Information:

Name(s): _____________________________________________________________

Address: _____________________________________________________________

City, State, Zip: ______________________________________________________

Grantee(s) Information:

Name(s): _____________________________________________________________

Address: _____________________________________________________________

City, State, Zip: ______________________________________________________

Property Information:

Legal Description: ___________________________________________________

Street Address: ______________________________________________________

City, State, Zip: ______________________________________________________

Parcel Number: _______________________________________________________

Conveyance:

The Grantor(s) hereby quitclaims to the Grantee(s) all right, title, and interest in the following described real estate located in the State of Rhode Island:

__________________________________________________________

__________________________________________________________

for the sum of $________________ (Dollars).

Signatures:

The parties acknowledge and sign this document on the date(s) below:

Grantor's Signature: __________________________________ Date: ___________________

Print Name: ___________________________________________

Grantee's Signature: __________________________________ Date: ___________________

Print Name: ___________________________________________

State of Rhode Island

County of ____________________

This document was acknowledged before me on _______________ (date) by _______________________________ (name/s of signatory/ies).

Notary Public: ________________________________

My Commission Expires: ________________________

Instructions for Seller/Grantor:

- Ensure all information is accurate and complete.

- Review the document carefully before signing.

- The document must be signed in the presence of a notary public.

- Keep a copy of the document for your records after it has been filed.

Instructions for Buyer/Grantee:

- Confirm that all the details in the deed are correct, including your own information.

- Record the deed at the local county recorder's office where the property is located as soon as possible.

- Maintain a copy of the recorded deed for your records.

PDF Data

| # | Fact | Description |

|---|---|---|

| 1 | Purpose | A Rhode Island Quitclaim Deed is used to transfer property ownership without any guarantee that the grantor holds clear title to the property. |

| 2 | Legal Authority | Governed by Rhode Island General Laws, Title 34 - Property, the form and procedure must comply with these statutes. |

| 3 | Recording Requirement | To be considered valid and to provide public notice, the deed must be recorded in the city or town where the property is located. |

| 4 | Documentation Required | Besides the quitclaim deed, a Rhode Island Real Estate Sales Disclosure form must typically accompany the filing. |

| 5 | Grantor and Grantee | The person transferring the property is the Grantor, and the recipient is the Grantee. Both must be clearly identified in the deed. |

| 6 | Witness and Notarization | The deed must be signed by the Grantor and notarized. Although not always required, having witnesses can provide additional legitimacy. |

| 7 | Consideration | The deed must state the consideration, or value exchanged, for the property, even if it is minimal or non-monetary. |

| 8 | Description of Property | A legal description of the property being transferred must be included in the quitclaim deed to clearly identify the property. |

| 9 | Revocation | Once executed and delivered, a quitclaim deed in Rhode Island cannot be revoked without the consent of the grantee. |

| 10 | Conveyance Tax | When filing the deed, a conveyance tax may be applicable depending on the transaction and property value. |

Rhode Island Quitclaim Deed - Usage Guidelines

When transferring property ownership in Rhode Island without warranties regarding the title, a Quitclaim Deed form is commonly used. This document is relatively straightforward but requires attention to detail to ensure accuracy and legality. The following steps are designed to guide you through filling out a Rhode Island Quitclaim Deed form. Following these instructions carefully will help streamline the process, making it more efficient and less prone to errors.

- Begin by obtaining the official Rhode Island Quitclaim Deed form. This can typically be found online through the Rhode Island government websites or at local county clerk’s offices.

- Fill in the preparer's information. This includes the name and address of the individual who is completing the form.

- Enter the return address. Specify where the completed deed should be sent after recording. This is usually the address of the grantee (the person receiving the property).

- State the consideration. Write the amount of money being exchanged for the property, if applicable. Even if no money is exchanged, a minimal amount must be stated to satisfy legal requirements.

- List the grantor’s information. The grantor is the person transferring the property. Include full legal name(s) and address(es).

- Specify the grantee’s information. Similar to the grantor's information, include the full legal name(s) and address(es) of the recipient(s) of the property.

- Describe the property. Provide a detailed legal description of the property being transferred. This description can include the address, tax map number, and any other identifying details that are specific to the property.

- Sign and date the form. The grantor must sign the Quitclaim Deed in the presence of a notary public. Some states may require additional witnesses.

- Have the form notarized. The notary public will fill in their section, confirming the identity of the grantor and witnessing the signature.

- File the completed form with the local county recorder’s office. There may be a filing fee, which varies by county. Ensure to pay the required fee to successfully record the deed.

After these steps have been completed, the Quitclaim Deed will be processed and recorded, officially transferring the property. It's important to keep a copy of the recorded deed for personal records. To ensure the form is filled out accurately and all legal requirements are met, consider consulting with a legal professional experienced in Rhode Island property law.

Essential Queries on Rhode Island Quitclaim Deed

What is a Rhode Island Quitclaim Deed?

A Rhode Island Quitclaim Deed is a legal document used to transfer a property owner's interest in a piece of real estate to another party without any guarantees that the title is clear of claims or liens. It's a straightforward way to convey property, typically used between family members or close associates, where there is a high level of trust.

When should one use a Rhode Island Quitclaim Deed?

This deed is most appropriate when transferring ownership between trusted parties, such as within a family, between spouses, or in divorce settlements. It is also used when clearing up a title or transferring property into a trust. Because it doesn't guarantee a clear title, it is less commonly used in transactions where the property is being sold to a third party.

What are the legal requirements for a Quitclaim Deed in Rhode Island?

In Rhode Island, a Quitclaim Deed must be in writing, contain the legal description of the property, and be signed by the grantor (the person transferring the property). Witness signatures may also be required, and the deed must be notarized. Finally, it needs to be recorded with the appropriate county office to be valid against third parties.

Does a Rhode Island Quitclaim Deed guarantee a clear title?

No, it does not. A Quitclaim Deed transfers whatever interest the grantor has in the property without assurances. It doesn't guarantee that the title is free of liens, claims, or encumbrances. Buyers or recipients should conduct a thorough title search to understand any potential issues with the property's title.

What is the difference between a Quitclaim Deed and a Warranty Deed in Rhode Island?

The primary difference is the level of guarantee about the title's status. A Warranty Deed guarantees that the property title is clear of liens and encumbrances, offering protection to the buyer. In contrast, a Quitclaim Deed transfers the grantor's rights to the property without any guarantees, making it a riskier transaction for the grantee (recipient).

How can one obtain a Rhode Island Quitclaim Deed form?

Quitclaim Deed forms specific to Rhode Island can be obtained from legal document providers, attorneys, or online resources that offer state-specific legal forms. Ensure that the form complies with Rhode Island's requirements for content and format.

What is the process for recording a Quitclaim Deed in Rhode Island?

After completion and notarization, the Quitclaim Deed must be filed with the town or city clerk's office in the county where the property is located. Recording fees must be paid, typically at the time of filing. This process makes the deed a public record and initiates the legal transfer of property rights.

Are there any tax implications when using a Quitclaim Deed in Rhode Island?

Transferring property through a Quitclaim Deed may have tax implications, including potential liability for gift or transfer taxes. The specific tax consequences depend on the relationship between the grantor and grantee, the conveyed property's value, and other factors. Consultation with a tax professional is advised to understand these implications fully.

Can a Quitclaim Deed be reversed or undone?

Reversing a Quitclaim Deed is challenging and typically requires mutual agreement between the original parties and a new deed to transfer the property back. In cases of fraud or duress, legal action may be necessary. Due to the complexities involved, seeking legal advice is recommended for anyone considering reversing a Quitclaim Deed.

Common mistakes

In Rhode Island, the process of transferring property rights through a Quitclaim Deed is commonplace, yet errors can frequently occur. These mistakes, often simple to avoid, can lead to significant complications, delays, and sometimes even legal disputes. Understanding what these common errors are is the first step towards ensuring a smooth property transaction.

Firstly, one of the most critical errors is not correctly identifying the parties involved. The person transferring the property rights, known as the grantor, and the recipient, or grantee, must be accurately identified by their full legal names. Any inaccuracies here can invalidate the document or create confusion about the property’s rightful ownership.

Another common mistake is failing to provide a complete legal description of the property. This description is not the same as a street address; instead, it should include the property's boundaries and any other details that are legally recognized for identifying the property. Omitting this information or providing an incomplete description can lead to disputes regarding what property was actually transferred.

- Incorrectly identifying the parties involved.

- Not providing a complete legal description of the property.

- Overlooking the requirement for signatures to be notarized.

- Forgetting to include relevant attachments or exhibits.

- Neglecting to record the deed with the appropriate county office.

- Misunderstanding the effect of the quitclaim deed.

The necessity of having the signatures notarized is another area where people often falter. For a Quitclaim Deed to be legally binding in Rhode Island, it must be signed by the grantor in the presence of a Notary Public. The notarization process verifies the identity of the signatory and helps protect against fraud.

Often, individuals forget about including necessary attachments or exhibits with their Quitclaim Deed. If the deed refers to any attachments that detail the property or specific terms of the transfer, these must be included at the time of signing and when the deed is recorded.

One of the most significant oversights is the failure to record the deed with the appropriate county office after it has been executed. Recording the deed is crucial as it serves as public notice of the change in ownership and protects the grantee's interests. Without recording, future transactions can become incredibly complicated.

Lastly, a misunderstanding about the nature and effect of the quitclaim deed is quite common. Unlike warranty deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property. It merely transfers whatever interest the grantor has, if any. This misunderstanding can lead to unexpected disputes and challenges down the line.

Averting these mistakes starts with diligent preparation, a clear understanding of the quitclaim deed process in Rhode Island, and, when in doubt, seeking professional guidance. Being meticulous in filling out the Quitclaim Deed form can save a great deal of time, expense, and legal headaches in the future.

Documents used along the form

When dealing with real estate transactions in Rhode Island, particularly when using a Quitclaim Deed, several accompanying documents are typically required to ensure the process is thorough and complies with legal standards. A Quitclaim Deed is often used to transfer property ownership without a traditional sale, typically between family members or to clear up title issues. Besides the Quitclaim Deed itself, other forms and documents are necessary for a comprehensive and legally sound transaction.

- Real Estate Transfer Tax Declaration: This form is necessary for calculating and reporting the tax due on the property transfer. Rhode Island requires this document to determine the amount of transfer tax owed based on the property's sale price or value.

- Homestead Exemption: A document that allows homeowners to claim a reduction in property taxes on their primary residence. If applicable, this should be filed to ensure the homeowner benefits from any available tax exemptions.

- Property Disclosure Statement: Although not always mandatory for Quitclaim Deed transactions, this statement provides the buyer with known information about the property's condition, including any defects or issues that could affect its value.

- Federal Tax Lien Release: If there are any federal tax liens on the property, a release form must be obtained from the IRS. This document is critical for clearing the title so the property can be transferred without encumbrances.

- Mortgage Discharge Statement: In cases where there is an existing mortgage on the property, this statement from the lender confirms that the mortgage has been fully paid and can be discharged from the property records.

- Title Insurance Policy: While not a requirement, obtaining a title insurance policy can protect the buyer from any future claims or legal issues related to the property's title. It ensures peace of mind for both parties involved in the transfer.

- Property Tax Bills: Recent property tax bills should be presented to confirm that all taxes have been paid up to the date of transfer. This helps avoid any potential disputes or liens related to unpaid taxes.

- Proof of Identity: Legal identification, such as a driver's license or passport, is required for all parties involved in the transaction. This is necessary to verify identities and protect against fraud.

In combination, these documents facilitate a smoother and more legally secure property transfer process. Whether you're transferring property to a family member or settling an estate, ensuring you have all the necessary documentation in place can vastly reduce complications and help guarantee that the transaction adheres to Rhode Island's legal requirements.

Similar forms

The Rhode Island Quitclaim Deed form is similar to other real estate deed forms used across the United States, in that its primary function is to transfer interest in property from one party to another. However, it is notably distinct in the level of warranty it provides the recipient about the quality of the title being transferred.

One similar document is the Warranty Deed. Like the quitclaim deed, it is used to transfer ownership of a property. However, unlike the quitclaim deed, the warranty deed provides the grantee (buyer) with certain guarantees from the grantor (seller). These guarantees include assurance that the seller holds clear title to the property, has the right to sell the property, and that the property is free from any liens or encumbrances unless specifically listed in the deed. This makes the warranty deed a much safer option for buyers because it offers them legal protection against future claims on the property.

Another document that bears resemblance is the Grant Deed. The grant deed, like the quitclaim deed, is used to transfer interest in real property. The key difference lies in the middle ground of protection it offers; more than a quitclaim but less than a warranty deed. With a grant deed, the seller assures the buyer that they haven’t transferred the title to someone else and that the property is free from any encumbrances made by the seller, but it doesn't protect against any unknown claims. This partial protection offers a balance of assurance against claims by the seller, without extending full warranty coverage.

The Special Warranty Deed, also similar to the quitclaim, transfers property ownership with limited warranty. This document provides a middle ground, where the seller only guarantees against title defects or encumbrances during their period of ownership, not for any issues that may have arisen before. This deed is often used in specific transactions where the seller is unable or unwilling to provide full title guarantees, but still wishes to offer some level of assurance to the buyer, setting it apart from the no-frills quitclaim deed by providing a basic level of protection for the buyer.

Dos and Don'ts

When dealing with the Rhode Island Quitclaim Deed form, it's crucial to approach the process with care. This form plays a vital role in the conveyance of property, transferring a claim or interest in real estate from one party to another without guarantees. For a smooth and legally sound process, here are essential do's and don'ts to consider:

Do:- Verify the form’s accuracy: Ensure that the Rhode Island Quitclaim Deed form you're using is up to date and specifically designed for Rhode Island as state requirements can vary.

- Provide clear information: Fill out the form with clear and accurate information to prevent any potential legal issues arising from misunderstandings or misrepresentations.

- Double-check spelling: Pay special attention to the spelling of names, addresses, and legal descriptions of the property to avoid any discrepancies that could affect the deed’s validity.

- Include a complete legal description of the property: A verbal description is not sufficient; the legal description should include lot numbers, boundary lines, and other details that precisely identify the property.

- Sign in the presence of a notary: Rhode Island law requires that a Quitclaim Deed be signed in the presence of a notary public to be legally valid.

- Obtain witnesses if required: Check the latest state requirements for witnesses. Some jurisdictions may require the presence of one or more witnesses during the signing.

- Retain a copy for your records: Always keep a copy of the signed and notarized deed for your personal records.

- Conduct a title search (recommended): Although not a requirement for a Quitclaim Deed, conducting a title search can inform you of any encumbrances on the property.

- Understand the limitations: Be aware that a Quitclaim Deed transfers only the interest the grantor has in the property, with no warranties regarding the quality of the title.

- Record the deed: After signing, ensure the deed is filed with the appropriate county office in Rhode High Island for it to be effective.

- Use a generic form: Avoid using generic forms found online unless you’ve verified that they comply with Rhode Island's specific requirements.

- Guess on details: If you’re unsure about any details, especially the legal description of the property, seek clarification before completing the form.

- Overlook the notarization requirement: Failing to have the document notarized can render the deed invalid.

- Sign without understanding: Never sign the deed without fully understanding the implications of transferring property rights without warranty.

- Skip professional advice: When in doubt, consult with a real estate attorney to avoid any legal pitfalls.

- Ignore local filing requirements: Be aware of and adhere to the specific filing requirements of the local county office to ensure the deed is properly recorded.

- Forget to provide consideration: While a Quitclaim Deed often involves a nominal amount, the consideration (or lack thereof) should be accurately stated.

- Neglect to check for liens: Failing to check for existing liens or encumbrances can lead to complications for the buyer down the road.

- Assume warranty of title: Remember, a Quitclaim Deed does not guarantee a clear title, merely the transfer of the grantor's interest.

- Delay recording the deed: Timely recording of the deed is essential for protecting your interests and ensuring the transfer is public record.

Misconceptions

When it comes to transferring property, the Rhode Island Quitclaim Deed form often comes into play. However, a number of misconceptions surround its use and implications. Here are seven common misunderstandings:

- A Quitclaim Deed guarantees a clear title. Many believe that this document guarantees the seller (grantor) holds a clear title to the property. In reality, it offers no warranties regarding the title's status, only transferring whatever interest the grantor has at the time of transfer, which may be none at all.

- It can only be used between family members. While frequently used for property transfers among family due to its simplicity, there's no restriction limiting its use to such instances. Quitclaim deeds can be used between any parties for various reasons.

- The Quitclaim Deed offers the buyer (grantee) protection. This misconception could lead to surprises down the line. Contrary to the belief, the deed does not protect the grantee against claims or encumbrances on the property. Essentially, buyers take a risk regarding the property's legal status.

- Filing a Quitclaim Deed changes the property taxes immediately. The act of filing this deed does not directly affect property taxes. Tax assessments may eventually change due to ownership transfer, but this process is independent and involves separate filings and evaluations by tax authorities.

- A Quitclaim Deed transfers property ownership immediately. While the document does facilitate the transfer of the grantor's interest in a property, the process isn't instantaneous. It involves completing the deed, having it properly signed, and filing it with the appropriate local office to be effective.

- You can't use a Quitclaim Deed if there's a mortgage. It's a common belief that properties with mortgages cannot be transferred using a quitclaim deed. However, the deed can still be used; the crucial factor is that the mortgage remains the responsibility of the person who signed it, unless otherwise negotiated.

- Using a Quitclaim Deed is always the best option for property transfer. Depending on the situation, other forms of deed like warranty deeds may be preferable for ensuring a clean title and offering protections to the buyer. The best choice depends on the circumstances and the level of risk the parties are willing to accept.

Key takeaways

When dealing with a Rhode Island Quitclaim Deed form, individuals are engaging in the process of transferring property ownership rights from one party to another without warranties. This type of deed is commonly used between family members, divorcing spouses, or in other situations where the parties know each other and the property well. The following key takeaways can provide guidance throughout this process:

- Familiarize Yourself with the Form: Before filling out the Quitclaim Deed, it is important to understand its sections and requirements. This knowledge helps in accurately conveying the property details and ownership information.

- Accurate Description of Property: Make sure to include a precise and comprehensive description of the property. This description should match the one used in the property’s current deed to ensure continuity and avoid legal issues.

- Clear Identification of Parties: Identify clearly the grantor (the person transferring the property) and the grantee (the recipient of the property). Full legal names, addresses, and the marital status of the parties should be included to prevent disputes and confusion.

- Notarization is Required: After the Quitclaim Deed is completed, it must be signed by the grantor in the presence of a notary public. This step is crucial as it verifies the identity of the parties involved and the authenticity of their signatures.

- Record the Deed: Once notarized, the Quitclaim Deed should be filed with the appropriate Rhode Island town or city hall. Recording the deed is vital as it notifies the public of the change in property ownership and protects the grantee’s legal interests.

Completing and using the Rhode Island Quitclaim Deed form requires careful attention to detail and adherence to legal procedures. By following the outlined steps, individuals can ensure a smooth and legally sound transfer of property. It is always advisable to consult with a real estate professional or attorney if there are any questions or concerns during this process.

Find Some Other Forms for Rhode Island

Ri Bill of Sale - An important function of this form is to release the seller from liability for any future incidents involving the ATV.

Ri Lease Agreement - Amendments to the agreement require consent from both the landlord and tenant, ensuring fairness in the lease terms.

Rhode Island Durable Power of Attorney - The Medical Power of Attorney remains in effect indefinitely, unless you specify an expiration date on the document.