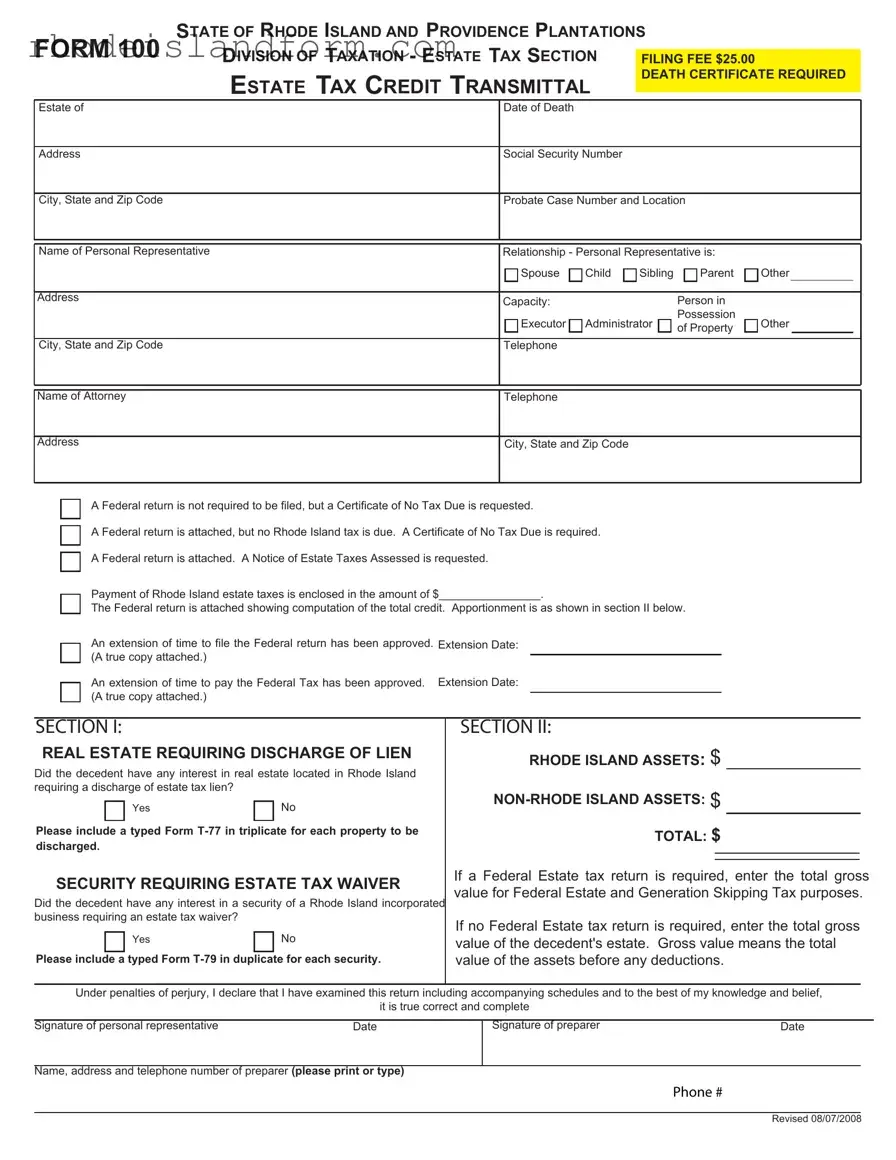

Fill Out a Valid Rhode Island 100 Template

When managing the final affairs of a loved one in Rhode Island, one may encounter the Rhode Island 100 form, a crucial document for estate administration within the state. This form, issued by the Division of Taxation under the Estate Tax Section, plays a significant role in the process of settling estate taxes, requiring a filing fee of $25.00 and a mandatory inclusion of the death certificate. It serves multiple purposes, including notifying the state about the decedent's assets both within and outside Rhode Island, determining the necessity of a federal return, and whether an estate tax waiver for securities or a discharge of lien on real estate is needed. The form meticulously gathers information about the decedent, such as date of death, social security number, and detailed estate asset values to assess if Rhode Island estate taxes are due, providing a structured way for personal representatives to report and calculate potential taxes owed. Moreover, it includes sections for declaring real estate interests in Rhode Island, specifying the allocation of assets between in-state and out-of-state, and outlining how taxes are to be computed based on the decedent's domicile. This form, revised as of August 2008, is a testament to Rhode Island's methodical approach to estate tax compilation, ensuring a clear pathway for executors to follow in fulfilling their duties toward estate tax responsibilities.

Rhode Island 100 Preview

FORM 100 |

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS |

|

|

|

|

|||||||||||||||

D |

IVISION OF AXATION |

- E |

STATE |

|

AX |

S |

ECTION |

FILING FEE $25.00 |

|

|

|

|||||||||

|

|

|

T |

|

|

|

|

|

T |

|

|

|

|

|

||||||

|

E |

|

T |

C |

|

|

|

T |

|

|

|

|

|

|

DEATH CERTIFICATE REQUIRED |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

STATE |

AX |

|

REDIT |

|

RANSMITTAL |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

Estate of |

|

|

|

|

|

|

|

|

|

|

|

Date of Death |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Address |

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City, State and Zip Code |

|

|

|

|

|

|

|

|

|

|

|

Probate Case Number and Location |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Name of Personal Representative |

|

|

|

|

|

|

|

|

|

|

Relationship - Personal Representative is: |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse |

Child Sibling Parent |

Other |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

Capacity: |

|

|

Person in |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Executor |

Administrator |

Possession |

Other |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

of Property |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State and Zip Code |

|

|

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of Attorney |

|

|

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Address |

|

|

|

|

|

|

|

|

|

|

|

City, State and Zip Code |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A Federal return is not required to be filed, but a Certificate of No Tax Due is requested.

A Federal return is attached, but no Rhode Island tax is due. A Certificate of No Tax Due is required.

A Federal return is attached. A Notice of Estate Taxes Assessed is requested.

Payment of Rhode Island estate taxes is enclosed in the amount of $________________.

The Federal return is attached showing computation of the total credit. Apportionment is as shown in section II below.

An extension of time to file the Federal return has been approved. Extension Date: (A true copy attached.)

An extension of time to pay the Federal Tax has been approved. Extension Date: (A true copy attached.)

SECTION I:

REAL ESTATE REQUIRING DISCHARGE OF LIEN

Did the decedent have any interest in real estate located in Rhode Island requiring a discharge of estate tax lien?

Yes |

|

No |

|

|

|

Please include a typed Form

SECURITY REQUIRING ESTATE TAX WAIVER

Did the decedent have any interest in a security of a Rhode Island incorporated business requiring an estate tax waiver?

Yes |

|

No |

|

|

|

Please include a typed Form

SECTION II:

RHODE ISLAND ASSETS: $

TOTAL: $

If a Federal Estate tax return is required, enter the total gross value for Federal Estate and Generation Skipping Tax purposes.

If no Federal Estate tax return is required, enter the total gross value of the decedent's estate. Gross value means the total value of the assets before any deductions.

Under penalties of perjury, I declare that I have examined this return including accompanying schedules and to the best of my knowledge and belief,

it is true correct and complete

Signature of personal representative |

Date |

Signature of preparer |

Date |

Name, address and telephone number of preparer (please print or type)

Phone #

Revised 08/07/2008

SCHEDULE A: COMPUTATION OF TAX - DECEDENT DOMICILED IN RHODE ISLAND

1. |

Federal Credit for State Death Taxes from Federal Form 706: |

|

|

$ |

|

||||||||||

2. |

Death |

taxes paid to a |

state |

other than |

Rhode |

Island: |

|

$ |

|

|

|

||||

|

|

(If none, skip lines 2 through 7. Enter amount from line 1 on line 8). |

|

|

|

|

|

||||||||

3. |

Federal Gross Estate from Federal Form 706: |

|

|

|

|

$ |

|

|

|

||||||

4. |

|

|

|

|

|

|

$ |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||||

5. |

Percentage of |

% |

|||||||||||||

|

|

(Divide Line 4 by Line 3). |

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Adjusted State Death Tax Credit - Multiply Line 1 by Line 5: |

|

|

|

$ |

|

|

|

|||||||

7. |

Enter the lesser of line 2 or line 6: |

|

|

|

|

|

|

$ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

8. |

Tax Payable to Rhode Island (Line 1 less line 7): |

|

|

|

|

$ |

|

||||||||

|

|

|

B: C |

|

T |

- D |

D |

|

O |

|

R |

||||

S |

|

OMPUTATION OF |

|

UTSIDE OF |

|||||||||||

|

CHEDULE |

|

AX |

|

ECEDENT OMICILED |

|

|

HODE ISLAND |

|||||||

1. |

Federal Credit for State Death Taxes from Federal Form 706: |

|

|

$ |

|

|

|

||||||||

2. |

Federal Gross Estate from Federal Form 706: |

|

|

|

|

$ |

|

|

|

||||||

3. |

Rhode Island Gross Estate**: |

|

|

|

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

4. |

Percentage of Rhode Island Gross Estate to Federal Gross Estate: |

|

% |

||||||||||||

|

|

(Divide Line 3 by Line 2). |

|

|

|

|

|

|

|

|

|

|

|

||

5. |

Tax Payable to Rhode Island (Multiply Line 1 by line 4): |

|

|

|

$ |

|

|||||||||

*

**Rhode Island Gross Estate for a decedent domiciled outside of Rhode Island means the value of real estate and tangible personal property (cars, boats, clothes, jewelry, furniture, etc.) which is located in Rhode Island at the date of death.

PLEASE NOTE: Bank accounts, stocks, bonds and mortgages are intangible assets and are taxable by the state in which the decedent was domiciled at the time of death regardless of where the asset was then located.

Make checks payable to the RI Division of Taxation.

Mail forms and checks to the Rhode Island Division of Taxation Estate Tax Section

One Capitol Hill Providence, RI 02908

Revised 08/07/2008

File Breakdown

| Fact | Detail |

|---|---|

| Governing Law(s) | Rhode Island General Laws Title 44 - Taxation, specifically sections relevant to estate taxation |

| Filing Fee | $25.00 |

| Supporting Documents | Death Certificate is required. Additional forms such as Form T-77 for real estate and Form T-79 for securities may also be required. |

| Certificate of No Tax Due | Can be requested even if a Federal return is not required or if a Federal return is attached but no Rhode Island tax is due. |

| Estates Involving Real Estate and Securities | If the decedent had interests in real estate or securities in Rhode Island, specific forms and procedures apply for discharging liens or obtaining tax waivers. |

Rhode Island 100 - Usage Guidelines

Fulfilling the requirements of the Rhode Island 100 form is a straightforward process, but it requires attention to detail. This document is essential for managing estate matters in the state of Rhode Island, including the discharge of estate tax liens and securing estate tax waivers for certain assets. The following steps are designed to guide an individual through the completion of the form to ensure accuracy and compliance.

- Gather all necessary documents beforehand, including the death certificate, probate case information, and details about the decedent's assets.

- Enter the full legal name of the deceased in the space provided as "Estate of".

- Fill in the "Date of Death" accurately.

- Provide the decedent’s last known address, including the city, state, and zip code.

- Add the Social Security Number of the decedent.

- Write the Probate Case Number and Location.

- Insert the full name, address, and telephone number of the Personal Representative managing the estate.

- Specify the relationship of the Personal Representative to the deceased, selecting from options such as Spouse, Child, Sibling, Parent, or Other.

- State the capacity in which the representative is acting (Executor, Administrator, etc.)

- Include the attorney’s name, phone number, and address if applicable.

- Check the appropriate box indicating whether a Federal return is filed, and what documentation or actions are requested (e.g., Certificate of No Tax Due, Notice of Estate Taxes Assessed).

- Answer whether the decedent had any interest in real estate or securities within Rhode Island that would require a discharge of estate tax lien or an estate tax waiver, respectively. Attach additional forms as required (Form T-77 for real estate and Form T-79 for securities).

- In Section II, list the Rhode Island and non-Rhode Island assets and provide their total gross values. If a Federal Estate tax return is needed, use its aggregate gross value. Otherwise, calculate the total value of the decedent's estate.

- Under penalties of perjury, the personal representative must sign and date the form. A preparer must also sign, providing their name, address, and telephone number.

- Compile the completed form along with any additional required documents and the filing fee. Make a check for the $25.00 filing fee payable to the RI Division of Taxation.

- Mail the form, attachments, and payment to the Rhode Island Division of Taxation Estate Tax Section at One Capitol Hill, Providence, RI 02908.

By accurately following these instructions, individuals can ensure they meet the necessary requirements for managing estate affairs within the state of Rhode Island. Proper completion of the Rhode Island 100 form helps facilitate the processing of estate-related tax matters, including the determination of tax responsibilities and the discharge of any applicable estate tax liens.

Essential Queries on Rhode Island 100

What is the Rhode Island Form 100, and when is it required?

Rhode Island Form 100 is a document that must be filed with the Rhode Island Division of Taxation - Estate Tax Section. It is needed for estates where there is a filing fee of $25.00, and a death certificate is required. The form is used to report the decedent's assets, calculate estate taxes, and request discharge of lien on real estate or estate tax waivers for securities. It must be filed when a deceased person had assets in Rhode Island or was a Rhode Island resident at the time of their death.

What types of assets need to be reported on Form 100?

Assets to be reported include all real estate located in Rhode Island requiring a discharge of estate tax lien and any interest in a security of a Rhode Island incorporated business requiring an estate tax waiver. Additionally, both Rhode Island assets and non-Rhode Island assets must be reported to calculate the gross value of the decedent's estate for estate and generation-skipping tax purposes.

Is a Federal Estate Tax Return required to file Rhode Island Form 100?

No, a Federal Estate Tax Return is not always required to file Rhode Island Form 100. However, the form specifies different scenarios, such as requesting a Certificate of No Tax Due without a Federal return, attaching a Federal return but no Rhode Island tax being due, or attaching the Federal return showing computation of the total credit for cases where it is applicable.

How do I request a Certificate of No Tax Due or a Notice of Estate Taxes Assessed?

On the Rhode Island Form 100, you can indicate whether you are requesting a Certificate of No Tax Due or a Notice of Estate Taxes Assessed by checking the appropriate box in the section where the nature of the request is specified. This choice depends on whether a Federal Estate Tax Return is filed and if estate taxes are due to the state of Rhode Island.

How is the tax payable to Rhode Island determined on this form?

The tax payable to Rhode Island is determined through a calculation process outlined in Schedule A for a decedent domiciled in Rhode Island, and Schedule B for those domiciled outside of Rhode Island. It involves identifying the Federal Credit for State Death Taxes, adjusting for taxes paid to other states, and calculating the proportional share of Rhode Island estate based on the total gross estate value.

What if an extension of time is needed to file or pay the Federal Estate Tax?

If you have received an approved extension of time to file or pay the Federal Estate Tax, you can indicate this on the Rhode Island Form 100 by checking the appropriate box and attaching a true copy of the extension approval. This can affect the processing of your Rhode Island estate tax filings.

What should be done if the decedent had real estate or securities requiring estate tax waivers?

If the decedent had any interest in real estate located in Rhode Island or in securities of a Rhode Island incorporated business, you must include a typed Form T-77 in triplicate for each real estate property and a typed Form T-79 in duplicate for each security. These forms are necessary for the discharge of estate tax lien and for the estate tax waiver process, respectively.

Where should Rhode Island Form 100 and associated payments be mailed?

Completed Rhode Island Form 100 along with any payments for estate taxes should be mailed to the Rhode Island Division of Taxation, Estate Tax Section, One Capitol Hill, Providence, RI 02908. Make sure checks are payable to the RI Division of Taxation.

Common mistakes

Filling out forms is rarely anyone's idea of a good time, especially when it comes to taxes and legal documents. The Rhode Island 100 form, required for estate taxes, is no exception. Though it might look daunting at first, avoiding common mistakes can streamline the process considerably. Let’s discuss some of the frequent pitfalls people encounter with this form.

One of the first mistakes involves not attaching the required death certificate. The State of Rhode Island mandates this document to process the estate taxes properly. It seems simple, but in the flurry of estate management, such vital details can be overlooked.

A second error often seen is incorrect or incomplete information regarding the decedent's real estate and security interests within Rhode Island. This oversight can delay the discharge of estate tax liens and the issuance of tax waivers, clogging up what could have been a smoother process.

Next, there's the failure to accurately report both Rhode Island and non-Rhode Island assets. This miscalculation affects the total value of the estate, potentially leading to inaccuracies in tax calculations and liabilities. Understanding what constitutes an asset in Rhode Island versus elsewhere is crucial.

Additionally, some fail to detail their status correctly — whether as executor, administrator, or another capacity. Clarifying this position is essential since it outlines the extent of one's authority and responsibility throughout the filing process.

- Not providing a clear relationship between the personal representative and the decedent.

- Skipping the section on federal return requirements or inaccurately stating the estate's need for a federal return or Certificate of No Tax Due.

- Omitting signatures of both the personal representative and the preparer, if applicable, thereby invalidating the submission.

- Failing to attach a true copy of any approved extension for filing or paying federal taxes, when such extensions have been granted.

- Incorrectly calculating the tax payable to Rhode Island, often by misapplying the percentages or misunderstanding the computation instructions.

- Forgetting to make the check payable to the correct entity, the RI Division of Taxation, or sending the form and payment to the wrong address.

Handling the Rhode Island 100 form demands attention to detail, a clear understanding of the estate's components, and a methodical approach to avoid these common errors. Whether you are a personal representative, executor, or an assisting family member, keeping these points in mind can help ensure a smoother filing process and swift compliance with Rhode Island's taxation requirements.

It's always recommended to seek professional advice or assistance when dealing with complex forms and financial matters. This practice not only helps in avoiding the aforementioned pitfalls but also ensures compliance with the state's legal and tax regulations, ultimately safeguarding the interests of both the estate and its beneficiaries.

Documents used along the form

The Rhode Island 100 form is crucial for handling estate matters within the state, particularly concerning the estate tax filings and ensuring compliance with state tax laws. This form works alongside several other documents to streamline the process of estate administration, providing clarity and structure for the personal representatives and attorneys involved. Below is a list of other forms and documents often used in conjunction with the Rhode Island 100 form, each playing a specific role in the estate management process.

- Form T-77: This is required for each piece of real estate in Rhode Island that needs a discharge of the estate tax lien. It ensures the property can be transferred without issues related to unpaid estate taxes.

- Form T-79: For estates that include securities from Rhode Island-incorporated businesses requiring an estate tax waiver, this form is necessary. It addresses the specific tax considerations for these financial assets.

- Death Certificate: An official death certificate is essential for all estate proceedings, confirming the death of the decedent and enabling the estate's administration to formally proceed.

- Federal Estate Tax Return (Form 706): Although not always required for Rhode Island tax purposes, this federal form may be necessary when the estate exceeds certain value thresholds or for calculating the federal credit for state death taxes.

- Certificate of No Tax Due: This document signifies that the estate owes no taxes to the state of Rhode Island, allowing for the distribution of assets without the concern of future tax liabilities.

- Probate Court Documents: Various documents from the probate court, including the application for the appointment of a personal representative and the probate case number, are key for legitimizing the individual's authority to act on behalf of the estate.

- Notice of Estate Taxes Assessed: If estate taxes are due, this notice outlines the amounts assessed against the estate by Rhode Island, offering clear guidance on tax obligations.

- Extension Documents: If an extension is granted for filing or paying taxes, these documents prove the state’s approval, providing more time for estate administrators to fulfill their duties.

- Schedule A: Computation of Tax: This is an inherent part of the Rhode Island 100 form, detailing the calculation of estate taxes due to Rhode Island, based on both domicile and asset location.

Together, these documents ensure thorough compliance and effective management of an estate's tax obligations in Rhode Island. Each complements the Rhode Island 100 form, offering specific information or legal approvals necessary for different aspects of estate administration. By familiarizing oneself with these forms and documents, personal representatives can navigate the estate settlement process more smoothly, ensuring all legal and financial duties are met. This level of preparation and organization significantly aids in the efficient, compliant management of estate obligations.

Similar forms

The Rhode Island 100 form shares similarities with several other documents, particularly in its purpose and structural components. Most notably, its resemblance to the Federal Form 706, the U.S. Estate (and Generation-Skipping Transfer) Tax Return, is quite pronounced. The Federal Form 706 is utilized for reporting the value of an estate and calculating any taxes owing to the federal government following an individual's death. The Rhode Island 100 form, while focused on state-level estate taxation, mirrors the Federal Form 706 in its requirement for detailed asset listings, value calculations, and tax computations. Both forms necessitate the disclosure of real and intangible estate assets, tax credits, and deductions before arriving at the tax payable. Furthermore, they require the certification of estate representatives and potentially an attorney or preparer, underlining their role in estate tax administration within their respective jurisdictions.

Similarities can also be observed with the State Death Tax Return forms of other states, such as New York's ET-706. While each state has specific regulations and thresholds for estate taxation, the underlying structure of these forms is comparable. They all aim to determine the tax liability of an estate with assets within the state, based on the value of those assets at the time of the decedent's death. Like the Rhode Island 100 form, New York's ET-706 includes sections for calculating the gross estate value, deductions, applicable credits, and ultimately the tax due to the state. They share similar requirements for documentation, such as death certificates and asset valuations. However, the specific rates, exemptions, and credits differ, reflecting each state's tax code. These forms ensure that estates are appropriately taxed according to state laws, contributing to the fiscal resources of the states, and adhere to principles of fairness and equity in estate taxation.

Dos and Don'ts

Filling out the Rhode Island Form 100, an essential document for managing estate affairs in the state of Rhode Island, requires careful attention to detail. This form, integral to the proper handling of an estate's taxes, necessitates a precise understanding of what should and should not be done during its completion. To guide you through this process, here are four dos and don'ts:

Things You Should Do:- Include a Death Certificate: It's vital to attach a death certificate with the Rhode Island Form 100, confirming the deceased's identity and facilitating the processing of estate affairs.

- Complete All Required Sections: Ensure that every section applicable to your situation is filled out thoroughly. This includes detailing assets located in Rhode Island as well as those outside of the state, to accurately assess tax obligations.

- Attach a Copy of the Federal Return if Applicable: If a federal estate tax return has been filed, attach a copy to the Form 100. This helps determine if any additional state taxes are due or if a Certificate of No Tax Due can be issued.

- Sign and Date the Form: The personal representative's signature is a declaration that the information provided is accurate and complete to the best of their knowledge. Failing to sign can result in the form being returned or unprocessed.

- Don't Estimate Asset Values: Report the accurate value of both Rhode Island and non-Rhode Island assets. Estimations can lead to inaccuracies in tax calculations and potential legal complications.

- Don't Leave Sections Blank: If a section does not apply to your situation, it's better to write "N/A" (not applicable) rather than leaving it blank. This indicates that the question was not overlooked.

- Don't Forget to Include Payment if Required: If the estate owes Rhode Island taxes, include the correct payment amount with the Form 100. Missing or incorrect payments can delay processing.

- Don't Ignore the Deadline for Filing Extensions: If you've received an extension for filing the federal return, attach a true copy of the extension approval. Missing this detail can complicate the state tax assessment and compliance.

By adhering to these guidelines, the process of completing and filing Rhode Island Form 100 can be conducted smoothly, ensuring that all legal and state tax requirements are satisfactorily met. Remember, accuracy, and attention to the specifics of the estate's assets are paramount in fulfilling your responsibilities in estate administration.

Misconceptions

One common misconception is that the Rhode Island 100 form is only necessary if the estate owes taxes in Rhode Island. In reality, this form may be required for several reasons beyond tax liability, such as to obtain a Certificate of No Tax Due or to discharge an estate tax lien on real estate owned in Rhode Island.

Many people believe that if a federal estate tax return is not required, then the Rhode Island 100 form is not necessary. However, even if a federal return is not required, this form may still be needed to address Rhode Island-specific issues, like estate tax waivers for securities in a Rhode Island incorporated business.

There's a misconception that all assets, regardless of their nature or location, need to be reported on the Rhode Island 100 form. In truth, the form distinguishes between Rhode Island assets and non-Rhode Island assets, focusing especially on real estate and tangible personal property located within the state.

Some assume that completing the Rhode Island 100 form is straightforward and doesn't require professional assistance. Given the complexities involved, including the computation of taxes and understanding the apportionment rules, consulting with an attorney or tax professional is advisable to ensure accuracy and compliance.

Another misconception is that the form doesn't need to be filed if the decedent didn't live in Rhode Island. If the decedent owned real estate or tangible personal property in Rhode Island, filing might still be necessary regardless of the decedent's state of domicile.

Many believe the filing fee is negotiable or can be waived. The filing fee, as stated on the form, is $25.00 and is a fixed cost that cannot be waived or altered.

A common misunderstanding is that the Rhode Island 100 form applies to all estates. It is specific to situations requiring the discharge of a lien for real estate, estate tax waivers for securities, or the settlement of estate taxes within Rhode Island.

It's often thought that once the Rhode Island 100 form is filed, no further action is needed. Depending on the instructions received from the Division of Taxation, additional documentation or forms, like the Form T-77 or Form T-79 for specific assets, may be necessary.

There's a misconception that personal representatives can sign the form without declaring it under penalties of perjury. The form clearly requires the personal representative to declare, under penalties of perjury, that the information provided is true, correct, and complete.

Finally, some believe that only the personal representative needs to fill out and sign the Rhode Island 100 form. In fact, if a preparer is involved in filling out the form, their information, signature, and declaration are also required.

Key takeaways

Filling out and using the Rhode Island 100 form, which is critical for handling the estate tax matters in the State of Rhode Island, requires understanding a few key aspects. This form plays a pivotal role in settling estate tax issues following the death of an individual. Here are seven key takeaways for effectively completing and submitting this document:

- The Rhode Island 100 form must be accompanied by a $25.00 filing fee, ensuring the form is processed by the Division of Taxation - Estate Tax Section.

- A death certificate is essential for the form's submission, serving as proof of the decedent's passing and initiating the process of estate evaluation and taxation.

- Details such as the estate of the deceased, date of death, address, and social security number are crucial for identifying the estate and ensuring accurate tax assessment and communication.

- The form differentiates between estates requiring to file a federal return and those that do not, while still requesting a Certificate of No Tax Due or addressing specific tax obligations like the Notice of Estate Taxes Assessed.

- For real estate or securities in Rhode Island requiring a discharge of estate tax lien or an estate tax waiver respectively, additional documentation (Form T-77 for real estate, Form T-79 for securities) must be provided in specified quantities.

- The gross value of the decedent’s assets, both within Rhode Island and elsewhere, is required to evaluate the estate correctly. This value defines the basis for tax assessment, distinguishing between assets that contribute to the Rhode Island Gross Estate versus those constituting the Non-Rhode Island Gross Estate.

- There are distinct sections for calculating tax owed, depending on whether the decedent was domiciled in Rhode Island or elsewhere, highlighting the importance of domicile in determining the estate tax calculation.

This form reflects Rhode Island's approach to estate taxation, emphasizing the need for detailed reporting and documentation to accurately assess and process estate taxes. Compliance with these requirements ensures the proper management of the decedent's fiscal responsibilities in the state.

Discover Popular Templates

Rhode Island Tx 16 - Understanding the Rhode Island TX-16 form for refunds on overpaid Temporary Disability Insurance contributions.

Ri Probate Forms - Allows for a detailed record to be made in probate court records, ensuring the transparency of the administration process.