Fill Out a Valid Rhode Island Tx 16 Template

In the realm of taxation within Rhode Island, the TX-16 form emerges as a significant document, administered by the State's Division of Taxation, specifically under the Employer Tax Section. Its primary purpose is to facilitate the process for individuals seeking refunds for overpaid Temporary Disability Insurance taxes—a fundamental component of the state's support system for workers incapacitated by non-work-related injuries or illnesses. This intricately designed form, last revised on October 24, 2008, guides claimants through the process of reclaiming their due, specifying that it caters to overpayments made in the specific calendar years of 2007, 2008, and 2009. To be eligible, claimants must have earned wages from two or more Rhode Island registered employers in a year, exceeding the set taxable wage base, signaling this form's critical role in ensuring taxpayers' rights are upheld. Besides personal identification and the year of the claim, the form mandates the inclusion of employers' details and the attachment of W-2 forms (without which the claim stands incomplete), highlighting the structured and meticulous approach required for a successful refund. Although seemingly straightforward, the procedure encapsulated within requires careful attention to detail—ranging from correctly entered calendar years to the condition that spouses must file separately, and ensuring the W-2 forms are original and legible—underscoring the intricate balance between taxpayer accountability and the safeguarding of public funds.

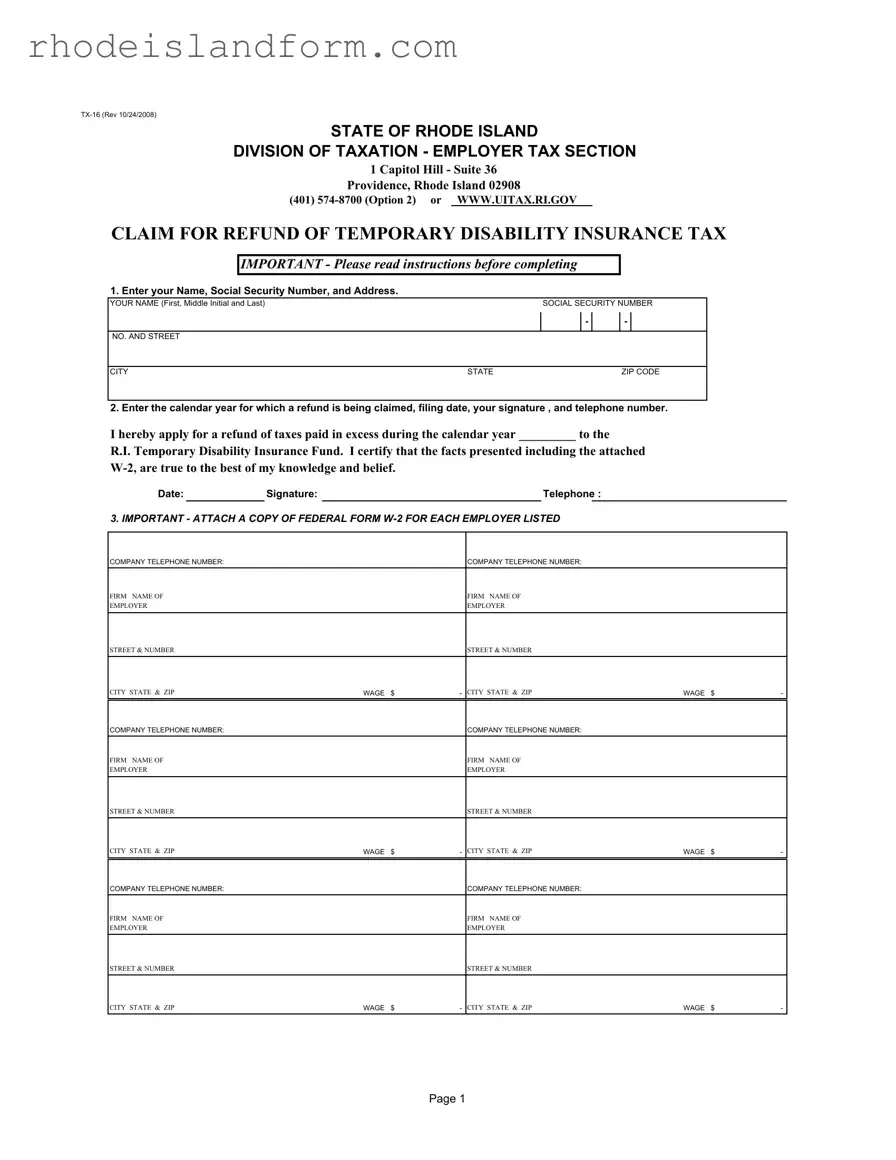

Rhode Island Tx 16 Preview

STATE OF RHODE ISLAND

DIVISION OF TAXATION - EMPLOYER TAX SECTION

1 Capitol Hill - Suite 36

Providence, Rhode Island 02908

(401)

CLAIM FOR REFUND OF TEMPORARY DISABILITY INSURANCE TAX

IMPORTANT - Please read instructions before completing

1. Enter your Name, Social Security Number, and Address.

YOUR NAME (First, Middle Initial and Last) |

SOCIAL SECURITY NUMBER |

-

-

NO. AND STREET

CITY |

STATE |

ZIP CODE |

2. Enter the calendar year for which a refund is being claimed, filing date, your signature , and telephone number.

I hereby apply for a refund of taxes paid in excess during the calendar year _________ to the

R.I. Temporary Disability Insurance Fund. I certify that the facts presented including the attached

Date: |

|

Signature: |

|

|

|

|

Telephone : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. IMPORTANT - ATTACH A COPY OF FEDERAL FORM |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||

COMPANY TELEPHONE NUMBER: |

|

|

|

|

COMPANY TELEPHONE NUMBER: |

|

|

|

|||

FIRM NAME OF |

|

|

|

|

FIRM NAME OF |

|

|

|

|||

EMPLOYER |

|

|

|

|

EMPLOYER |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

STREET & NUMBER |

|

|

|

|

STREET & NUMBER |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

CITY STATE & ZIP |

|

WAGE |

$ |

- |

CITY STATE & ZIP |

WAGE |

$ |

- |

|||

COMPANY TELEPHONE NUMBER: |

|

|

|

|

COMPANY TELEPHONE NUMBER: |

|

|

|

|||

FIRM NAME OF |

|

|

|

|

FIRM NAME OF |

|

|

|

|||

EMPLOYER |

|

|

|

|

EMPLOYER |

|

|

|

|||

STREET & NUMBER |

|

|

|

|

STREET & NUMBER |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

CITY STATE & ZIP |

|

WAGE |

$ |

- |

CITY STATE & ZIP |

WAGE |

$ |

- |

|||

COMPANY TELEPHONE NUMBER: |

|

|

|

|

COMPANY TELEPHONE NUMBER: |

|

|

|

|||

FIRM NAME OF |

|

|

|

|

FIRM NAME OF |

|

|

|

|||

EMPLOYER |

|

|

|

|

EMPLOYER |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

STREET & NUMBER |

|

|

|

|

STREET & NUMBER |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

CITY STATE & ZIP |

|

WAGE |

$ |

- |

CITY STATE & ZIP |

WAGE |

$ |

- |

|||

Page 1

IMPORTANT INFORMATION

1.Refunds can only be requested for the calendar years of 2007, 2008, and 2009.

2.This form should only be completed if during a prior calendar year you worked for two or more Rhode Island registered employers. The refund will be based on the amount of wages in excess of the taxable wage base to the Rhode Island Temporary Disability Insurance Fund. Those wage bases are as follows:

2007- $ 52,100.00, and 2008 - $ 54,400.00, and 2009 - $ 56,000.00

3.A separate Claim For Refund Form must be completed for each year a refund is requested.

4.Spouses cannot combine wages and must file a separate Claim For Refund Form.

5.The Rhode Island Temporary Disability Insurance Act does not allow a refund of under one dollar to be processed.

IMPORTANT INSTRUCTIONS

1.Complete all of the information in section 1 and section 2. The Claim For Refund Form cannot be processed without this information.

2.Check to make sure the calendar year and your telephone number is correct.

3.List each employer for whom you worked during the calendar year in section 3. Enter the employer name, address, employer telephone number and wages paid. List only Rhode Island registered employers from whom you received wages on which Rhode Island Temporary Disability Taxes were paid.

4.Attach a copy of Federal Form

of

5.Please review your Claim For Refund Form and sign before mailing.

6.Return completed form to:

DIVISION OF TAXATION - EMPLOYER TAX SECTION

ONE CAPITOL HILL SUITE 36

PROVIDENCE, RI 02908 - 5829

Page 2

File Breakdown

| Fact | Detail |

|---|---|

| Form Name | TX-16 |

| Purpose | Claim for Refund of Temporary Disability Insurance Tax |

| Revision Date | October 24, 2008 |

| Governing Body | Rhode Island Division of Taxation - Employer Tax Section |

| Contact Information | (401) 574-8700 (Option 2) or www.uitax.ri.gov |

| Eligible Calendar Years for Refund | 2007, 2008, and 2009 |

| Refund Eligibility Requirement | Refund is based on wages in excess of the taxable wage base for RI Temporary Disability Insurance Fund |

| Minimum Refund Amount | Under one dollar refunds are not processed |

| Required Documentation | Attachment of a copy of Federal Form W-2 for each employer listed |

| Governing Law | Rhode Island Temporary Disability Insurance Act |

Rhode Island Tx 16 - Usage Guidelines

Filing for a refund from the Rhode Island Temporary Disability Insurance (TDI) fund can be a necessary step if you've overpaid into the system during a specified calendar year. This situation typically arises when you've worked for multiple employers in Rhode Island and your combined income exceeded the taxable wage base for TDI. To navigate this process, the Rhode Island TX-16 form is your starting point. Below is a breakdown designed to guide you through each step of completing this form, ensuring that your request for a refund is compiled correctly and efficiently.

- Begin by entering your full name (first, middle initial, last) in the space provided. Ensure the name matches that on your Social Security card to avoid processing delays.

- Fill in your Social Security Number. This is crucial for accurately identifying your tax records.

- Provide your complete mailing address, including the number, street, city, state, and ZIP code. This will be used for any correspondence related to your claim.

- Indicate the calendar year for which you are claiming a refund by entering the year in the designated space.

- Sign and date the form to authenticate your claim. Your signature certifies that the information provided is accurate to the best of your knowledge.

- Enter a valid telephone number where you can be reached. This may be used for any follow-up questions or clarifications needed regarding your claim.

- Under the section requiring employer information, list each Rhode Island registered employer you worked for during the specified calendar year. Include the employer's name, address, telephone number, and the wages received from each. This information is critical for verifying your claim against the taxable wage base.

- Attach a copy of your Federal Form W-2 for each employer listed. It's important to note that photocopies are not accepted and each W-2 must be legible. These documents are essential for validating the wages on which Rhode Island Temporary Disability Taxes were paid.

- Review your filled-out form to ensure all information is complete and accurate.

- Mail the completed TX-16 form along with the required W-2 attachments to the Division of Taxation - Employer Tax Section, One Capitol Hill Suite 36, Providence, RI 02908 - 5829.

After submitting your Claim For Refund Form, the Rhode Island Division of Taxation will process your request. Should they require further information or documentation, they will contact you using the details provided on your form. Efficient completion and submission of the TX-16 form is the first step towards rectifying overpayments into the TDI fund, ensuring that your financial records are accurate and up-to-date.

Essential Queries on Rhode Island Tx 16

What is the Rhode Island TX-16 form used for?

The Rhode Island TX-16 form is primarily used for claiming a refund of taxes paid in excess to the Rhode Island Temporary Disability Insurance Fund during a specific calendar year. It is meant for individuals who have worked for two or more Rhode Island registered employers within the same year and have paid more in Temporary Disability Insurance taxes than required based on their total income.

Who is eligible to file a Rhode Island TX-16 form?

To be eligible to file a Rhode Island TX-16 form, you must have been employed by two or more Rhode Island registered employers in the same calendar year and have contributed more than the maximum taxable contribution to the Rhode Island Temporary Disability Insurance Fund. Additionally, this form can only be used to request refunds for the calendar years 2007, 2008, and 2009.

What information do I need to complete the TX-16 form?

To properly fill out the TX-16 form, you will need your Social Security Number, a detailed list of your employers for the calendar year including each employer's name, address, and telephone number, your total wages earned from each employer, and your W-2 forms for each employment held during the taxable year. Ensure all information is accurate and complete to avoid processing delays.

What documents are required to be attached with the TX-16 form?

When submitting the TX-16 form, you are required to attach a copy of the Federal Form W-2 for each employer you have listed in Section 3. Note that photocopies of the W-2 forms are not accepted, and these documents must be legible. Ensure the W-2 forms you provide have different Federal Identification Numbers for each employer.

Can spouses combine wages and file a single TX-16 form?

No, spouses cannot combine their wages to file a single TX-16 form. If both spouses have worked for two or more Rhode Island registered employers and exceeded the maximum taxable contribution for Temporary Disability Insurance, each spouse must file a separate Claim For Refund Form for the respective calendar year(s).

Is there a minimum refund amount for the TX-16 form?

Yes, according to the Rhode Island Temporary Disability Insurance Act, any claim for a refund under one dollar will not be processed. This means that the amount you are claiming as a refund must exceed one dollar in order to be eligible for processing.

How do I submit the Rhode Island TX-16 form?

Once you have completed the TX-16 form and attached all required documents, you should mail your claim to the Division of Taxation - Employer Tax Section at One Capitol Hill Suite 36, Providence, RI 02908 - 5829. Before mailing, ensure all sections are filled out correctly and that you've signed and dated the form.

What years can I claim a refund for with the TX-16 form?

The TX-16 form allows individuals to request refunds for Temporary Disability Insurance taxes paid in excess for the calendar years 2007, 2008, and 2009. Refunds for years outside of this range are not permitted with this form. Each year requires a separate Claim For Refund Form.

Common mistakes

Filling out the Rhode Island TX-16 form, a claim for a refund of Temporary Disability Insurance Tax, can be a straightforward process, but certain common mistakes can complicate or delay refunds. Being aware of these pitfalls can help ensure a smoother experience when seeking a refund.

Incorrect Personal Information: Entering inaccurate personal information such as name, social security number, or address is a significant mistake. Accuracy is crucial because any discrepancy between the form and official records can lead to delays in processing your claim. It's imperative to double-check this data before submission.

Wrong Calendar Year: A common error is not correctly specifying the calendar year for which a refund is being claimed. Given that refunds can only be requested for specific years (such as 2007, 2008, and 2009 as noted in the form's instructions), claiming for a non-eligible year or failing to specify the year at all can result in the immediate rejection of the form.

Omitting W-2 Forms: The requirement to attach a copy of Federal Form W-2 for each employer listed is sometimes overlooked. Without these forms, the claim cannot be processed. It's also important to note that photocopies of W-2 forms are not accepted, and all submissions must be legible. This mistake can significantly delay the refund process.

Failing to List All Eligible Employers: Not listing each Rhode Island registered employer from whom wages were received on which Rhode Island Temporary Disability Taxes were paid is a mistake that can lead to receiving a lesser refund than one is entitled to. Ensuring that every eligible employer is listed, along with accurate wages and employer information, is crucial for a complete and accurate claim.

Not Signing the Form: An often-overlooked but critical step is signing the form before mailing it. The signature certifies that the information presented is true to the best of the claimant's knowledge and belief. Failure to sign can result in the form being returned and delays in processing the claim.

For individuals seeking a refund, attention to detail when completing the TX-16 form can not be overstressed. Avoiding these common mistakes not only ensures compliance with the Rhode Island Division of Taxation's requirements but also assists in the timely processing of refunds. Every detail, from personal information to employer details and the proper inclusion of required documents, plays a vital role in the successful submission of a claim for a refund of Temporary Disability Insurance Tax.

Documents used along the form

Filling out the Rhode Island TX-16 form is an important step for those seeking a refund of Temporary Disability Insurance Taxes they've paid in excess. However, this form is often part of a larger suite of documents individuals might need to manage their affairs in related areas. Knowing which documents to prepare alongside the TX-16 can streamline the process and ensure everything is handled efficiently and accurately.

- Federal Form W-2: This is crucial for the TX-16 form, as it provides evidence of your earnings and the taxes paid in a calendar year. It's a necessary attachment to claim your refund.

- Rhode Island Personal Income Tax Return (Form RI-1040): Individuals seeking a refund on the TX-16 might also need to file their state income tax return, which can affect their overall tax situation.

- Employment and Tax Information Form: This form gathers detailed information on your employment history and tax payments, helpful in substantiating claims made on the TX-16.

- Direct Deposit Authorization Form: If you expect to receive a refund, setting up direct deposit can expedite the process, ensuring you receive your funds more quickly and securely.

- Power of Attorney Form: In cases where someone else will be handling your tax affairs or TX-16 form on your behalf, a Power of Attorney may be necessary.

- Request for Copy of Tax Return: This document allows you to request a copy of previous tax returns, which can be helpful for reference or if you need to amend past filings in connection with your TX-16 refund.

- Amendment Form for Rhode Island Personal Income Tax: If errors were made on previous state tax returns that affect your eligibility for a TX-16 refund, you might need to submit an amendment.

- Non-Resident Worker Tax Form: For those who worked in Rhode Island but reside in another state, this form may be necessary to clarify state tax obligations and refunds.

- Application for Extension of Time to File: If you need more time to gather all necessary documents for your TX-16 refund claim, an extension application can provide relief.

- Rhode Island Health Insurance Coverage Form: Since the TX-16 deals with disability insurance, related health insurance information might be pertinent, especially if there are questions about your coverage period.

Navigating through the process of claiming a refund or managing your tax affairs doesn't have to be complicated. Understanding what documents are needed, like the Rhode Island TX-16 form, and preparing them in advance can help make the process smoother. Whether you're dealing with state taxes, employment documentation, or personal income details, taking things step by step ensures that all your bases are covered for a successful resolution.

Similar forms

The Rhode Island Tx 16 form is similar to the Federal Form 843, "Claim for Refund and Request for Abatement." Both documents are designed to help individuals and businesses claim a refund for certain taxes that have been overpaid. The key similarity lies in their core purpose: to ensure taxpayers can recover funds that are rightfully theirs due to overpayment or specific qualifying conditions. For the Rhode Island Tx 16 form, this pertains to overpayments on Temporary Disability Insurance Tax. Alternatively, Federal Form 843 covers a wider range of taxes but serves a similar function in allowing claims for refunds. Both forms require taxpayers to detail their claim, provide necessary documentation, and certify the accuracy of the information provided through a signature.

Another document similar to the Rhode Island Tx 16 form is the "Request for Refund of Louisiana Citizens Property Insurance Corporation Assessments" form available in Louisiana. Though specific to a different type of refund, related to property insurance assessments rather than disability insurance taxes, the structure and intent are parallel. Taxpayers must identify the tax year(s) for which they are claiming a refund, provide personal information such as name and address, and attach required supporting documents. This showcases the universal need for taxpayers to provide detailed and accurate records when seeking any kind of tax refund, regardless of the state or specific tax issue at hand.

Dos and Don'ts

When dealing with the Rhode Island TX-16 form, which is a claim for a refund of Temporary Disability Insurance tax, attention to detail can save you time and avoid errors. Here are some essential dos and don'ts to consider:

- Do ensure you've read all the instructions carefully before beginning to fill out the form.

- Do verify the calendar year for which you are claiming a refund is one of the years for which refunds can be requested as mentioned in the instructions.

- Do complete all required fields in sections 1 and 2, including your full name, Social Security number, address, and the year for which you are requesting a refund.

- Do provide accurate and complete information for each Rhode Island registered employer, including the correct W-2 form attached for each one.

- Do review your form for completeness and accuracy, then sign and date it before mailing.

- Don't attempt to claim a refund for years outside of those specified as eligible for refunds in the instructions.

- Don't leave any required fields blank or provide incomplete information in sections 1 and 2.

- Don't list employers not registered in Rhode Island or from whom you did not receive wages on which Rhode Island Temporary Disability Taxes were paid.

- Don't submit photocopies of your W-2 forms or W-2 forms that are not legible.

- Don't forget to attach a copy of the Federal Form W-2 for each employer listed to ensure your claim can be processed.

By following these guidelines, individuals can navigate the process more efficiently and increase their chances of a successful claim with the Rhode Island Division of Taxation.

Misconceptions

Understanding the Rhode Island TX-16 form, related to claiming a refund of Temporary Disability Insurance Tax, involves navigating through complex tax regulations. Unfortunately, misconceptions about this process are widespread, leading to confusion and potential errors in filing. Below are ten common misconceptions about the Rhode Island TX-16 form and clarifications to help untangle these misunderstandings.

- Anyone can claim a refund: Only individuals who have worked for two or more Rhode Island registered employers in a calendar year and paid taxes on wages exceeding the taxable wage base are eligible for a refund.

- Refunds apply to any tax year: Refunds can only be requested for specific years - currently, for the years 2007, 2008, and 2009, as per the form's latest revision.

- Spouses can file jointly: Each individual must file a separate Claim For Refind Form; spouses cannot combine their wages for a joint refund claim.

- Claims can be made for any amount: The Rhode Island Temporary Disability Insurance Act stipulates that refunds of under one dollar will not be processed. Therefore, the claim must exceed this amount.

- Information in sections 1 and 2 is optional: Completing all information in sections 1 and 2 is mandatory for the claim to be processed.

- Any employer's W-2 form is acceptable: W-2 forms from only Rhode Island registered employers, from whom Rhode Island Temporary Disability Taxes were paid, should be attached. Each employer must have a different Federal Identification Number.

- Photocopies of W-2 forms are acceptable: Photocopies of Federal Form W-2 will not be accepted. Originals must be legible and are required for the process.

- W-2 forms will be returned after processing: W-2 Forms submitted with the TX-16 form will not be returned. Applicants should keep copies for their records.

- Refunds are automatic for eligible individuals: Individuals must actively apply for a refund by accurately and completely filling out a TX-16 form for each eligible year. Refunds are not issued automatically.

- The process is digital: The current guidance requires the completed form and necessary documentation to be mailed to the Division of Taxation - Employer Tax Section, indicating that a fully digital submission process is not yet in place.

Correcting these misconceptions is crucial for individuals seeking to accurately claim a refund of Rhode Island Temporary Disability Insurance Tax. Understanding the specific requirements and limitations of the TX-16 form is the first step towards ensuring that eligible taxpayers can successfully reclaim their overpaid funds.

Key takeaways

The Rhode Island TX-16 form is essential for those seeking a refund from the Temporary Disability Insurance Tax in the state. Understanding how to properly complete and use this form is crucial to ensure a smooth process. Here are key takeaways that individuals should keep in mind:

- Only apply for refunds for the specific calendar years of 2007, 2008, and 2009. This timeframe restriction is important when considering eligibility.

- The form is intended for individuals who worked for two or more employers in Rhode Island during a single calendar year.

- A refund is determined based on wages that exceed the taxable wage base for the Temporary Disability Insurance Fund for the specified years. The wage bases were set at $52,100 for 2007, $54,400 for 2008, and $56,000 for 2009.

- Each refund year requires a separate Claim For Refund Form, so if you're seeking refunds for multiple years, you must complete and submit multiple forms.

- Spouses must file separately and cannot combine their wages to apply for a refund. Each individual’s earnings are considered independently.

- The Rhode Island Temporary Disability Insurance Act stipulates that no refunds under one dollar will be processed, highlighting the importance of reviewing the refund amount eligibility.

- It's imperative to complete all sections of the form and provide accurate information, such as your social security number, address, and the correct calendar year for which you're applying for a refund.

- An attachment of the Federal Form W-2 for each employer is required to support your claim. However, remember that photocopies of W-2 forms are not accepted, and the original forms submitted must be legible.

- Before mailing, ensure that the Claim For Refund Form is signed and review it for accuracy to avoid any processing delays.

Adhering to these guidelines when filling out and submitting the Rhode Island TX-16 form can significantly affect the success of your refund claim. Providing clear and accurate information, along with the necessary documentation, will help streamline the process.

Discover Popular Templates

Ri State Police - Ensure all vehicle and driver information is accurately reported, including make, model, VIN, and insurance details.

Ri Probate Forms - Designed for situations where a previous administrator has either passed away, resigned, or been removed without completing the estate's administration.

Rhode Island Asbestos Legal Question - It serves as a record-keeping tool for asbestos abatement projects, aiding in future property and health assessments.