Fill Out a Valid Rhode Island W 9 Template

In Rhode Island, the Form W-9 (Rev. 3/7/11) plays a crucial role in financial and tax operations, serving as an official request for taxpayer identification number and certification. Fundamental to both individuals and companies, this form is necessitated by the IRS to ensure accurate tax reporting and withholding practices. The form requires that taxpayers—whether individuals supplying their Social Security Number (SSN) or entities providing their Employer Identification Number (EIN)—accurately report their taxpayer identification number in a specified section. This straightforward yet essential document streamlines the process of remitting tax-related information to the payer, further emphasizing the importance of providing a correct TIN to avoid potential penalties by the IRS, which can reach up to $50 for failing to furnish this information. It also contains sections for certification that the taxpayer is not subject to backup withholding, exceptions to which need to be clearly noted if affected by IRS notifications regarding under-reporting. Additionally, it requests detailed personal or business information, including name, address, and business designation, thereby facilitating accurate and efficient processing. Adherence to these details ensures compliance with tax laws and aids in preventing tax evasion or discrepancies in tax records. Significantly, this form encapsulates the importance of being precise and honest in one’s financial affairs, fostering a transparent tax environment. Mailing details and specific instructions for businesses operating in multiple locations underscore the tailored approach Rhode Island takes in accommodating diverse business structures within its tax framework.

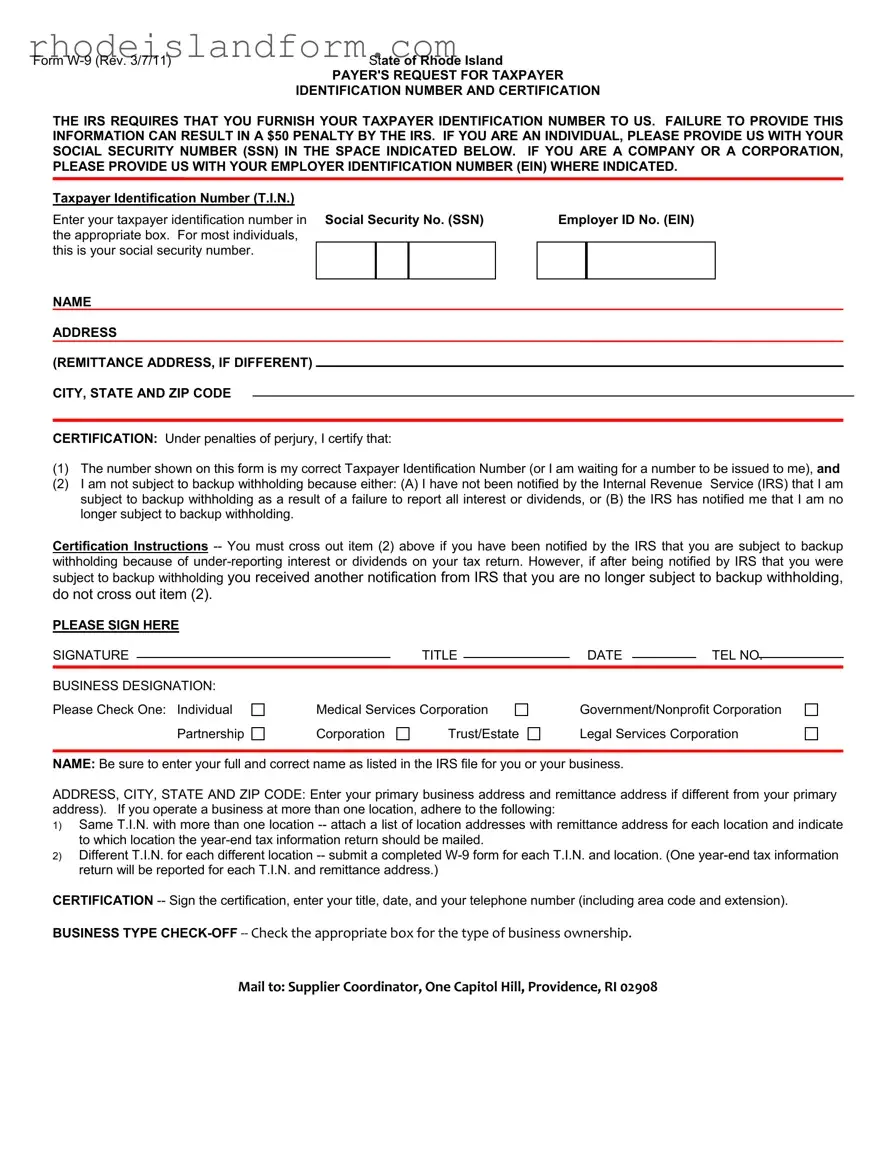

Rhode Island W 9 Preview

Form |

State of Rhode Island |

|

PAYER'S REQUEST FOR TAXPAYER |

|

IDENTIFICATION NUMBER AND CERTIFICATION |

THE IRS REQUIRES THAT YOU FURNISH YOUR TAXPAYER IDENTIFICATION NUMBER TO US. FAILURE TO PROVIDE THIS INFORMATION CAN RESULT IN A $50 PENALTY BY THE IRS. IF YOU ARE AN INDIVIDUAL, PLEASE PROVIDE US WITH YOUR SOCIAL SECURITY NUMBER (SSN) IN THE SPACE INDICATED BELOW. IF YOU ARE A COMPANY OR A CORPORATION, PLEASE PROVIDE US WITH YOUR EMPLOYER IDENTIFICATION NUMBER (EIN) WHERE INDICATED.

Taxpayer Identification Number (T.I.N.)

Enter your taxpayer identification number in Social Security No. (SSN) the appropriate box. For most individuals,

this is your social security number.

NAME

ADDRESS

(REMITTANCE ADDRESS, IF DIFFERENT) CITY, STATE AND ZIP CODE

Employer ID No. (EIN)

CERTIFICATION: Under penalties of perjury, I certify that:

(1)The number shown on this form is my correct Taxpayer Identification Number (or I am waiting for a number to be issued to me), and

(2)I am not subject to backup withholding because either: (A) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (B) the IRS has notified me that I am no longer subject to backup withholding.

Certification Instructions

subject to backup withholding you received another notification from IRS that you are no longer subject to backup withholding, do not cross out item (2).

PLEASE SIGN HERE

SIGNATURE |

|

TITLE |

|

DATE |

|

TEL NO. |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

BUSINESS DESIGNATION:

Please Check One: Individual

Partnership

Medical Services Corporation

Corporation |

Trust/Estate |

Government/Nonprofit Corporation

Legal Services Corporation

NAME: Be sure to enter your full and correct name as listed in the IRS file for you or your business.

ADDRESS, CITY, STATE AND ZIP CODE: Enter your primary business address and remittance address if different from your primary address). If you operate a business at more than one location, adhere to the following:

1)Same T.I.N. with more than one location

2)Different T.I.N. for each different location

CERTIFICATION

BUSINESS TYPE

Mail to: Supplier Coordinator, One Capitol Hill, Providence, RI 02908

File Breakdown

| Fact | Detail |

|---|---|

| Purpose | The Rhode Island W-9 form is used to request taxpayer identification number and certification from payees to ensure accurate tax reporting to the Internal Revenue Service (IRS). |

| Penalty for Non-compliance | Failure to provide a taxpayer identification number as required can result in a $50 penalty imposed by the IRS. |

| Taxpayer Identification Number | Individuals should provide their Social Security Number (SSN), while companies or corporations must provide their Employer Identification Number (EIN). |

| Certification Requirement | Signatories must certify under penalties of perjury that the Taxpayer Identification Number provided is correct and that they are not subject to backup withholding, or if previously notified, that they are no longer subject to backup withholding. |

Rhode Island W 9 - Usage Guidelines

Filling out a Rhode Island W-9 form is an important step for ensuring your transactions are recorded properly and that you comply with tax requirements. The process is straightforward and requires your attention to detail to avoid common mistakes. By providing accurate information, you are facilitating smooth financial operations and are helping prevent potential penalties. Here's how to complete the Rhode Island W-9 form.

- Enter your Taxpayer Identification Number (T.I.N.): For individuals, this will be your Social Security Number (SSN). Companies or corporations should provide their Employer Identification Number (EIN) in the designated space.

- Fill in your Name: Make sure to use the full and correct name as it appears in the IRS records for you or your business. This ensures no discrepancies that could lead to processing delays.

- Provide your Address, City, State, and Zip Code: Include your primary business address. If the remittance address is different, make sure to indicate this clearly. For businesses operating in multiple locations with the same T.I.N., attach a list of those addresses and specify the remittance address for each. If different T.I.N.s are used for different locations, a separate W-9 form must be filled out for each.

- Read and Sign the Certification: By signing, you affirm that the provided T.I.N. is correct and that you are not subject to backup withholding or that you have been exempted from it. Remember, if you have been notified by the IRS about backup withholding due to underreporting interest or dividends, you must cross out item 2 unless a subsequent notification states otherwise.

- Fill in your Title, Date, and Telephone Number: These details help in identifying you and facilitate communication if any clarification is required.

- Check the appropriate Business Type: Indicate whether you are filling out this form as an individual, a partnership, a corporation, a medical services corporation, a trust/estate, a government/nonprofit corporation, or a legal services corporation.

- Mail the completed form to the Supplier Coordinator at One Capitol Hill, Providence, RI 02908. Ensure that all the information is accurate and that the form is signed before sending it.

Submitting the Rhode Island W-9 form correctly is vital for compliance and for facilitating accurate tax reporting. Double-check the information you provide to avoid any issues that might arise due to inaccuracies or incomplete forms. This simple step not only keeps your records straight but also supports efficient and legal financial operations within the state.

Essential Queries on Rhode Island W 9

What is the purpose of the Rhode Island W-9 form?

The Rhode Island W-9 form is used by payers to request the taxpayer identification number (TIN) of the person or entity to whom they are making payments. This form serves as a certification by the payee that the TIN provided is correct and that they are not currently subject to backup withholding by the IRS due to under-reporting of interest or dividends. It’s a requirement for tax reporting purposes to ensure accurate and timely tax document preparation.

Who needs to fill out the Rhode Island W-9 form?

Individuals or entities receiving payments from a Rhode Island-based payer, including freelancers, independent contractors, or other providers of goods and services, need to fill out the Rhode Island W-9 form. Companies or corporations, as well as partnerships, medical services corporations, trusts, estates, government or nonprofit corporations, and legal services corporations, are also required to provide this information if they receive payments from a payer within Rhode Island.

What information is needed to complete the Rhode Island W-9 form?

To complete the Rhode Island W-9 form, you need to provide your taxpayer identification number (TIN), which can be your Social Security Number (SSN) if you are an individual, or your Employer Identification Number (EIN) if you are a company or corporation. Additionally, you must provide your full and correct name, business designation (such as individual, partnership, corporation, etc.), your address, city, state, ZIP code, and signature certifying that the information is accurate and that you are not subject to backup withholding.

What are the consequences of not providing a Rhode Island W-9 form?

If you fail to provide a completed Rhode Island W-9 form to the requestor, the IRS can impose a $50 penalty. Furthermore, the payer might begin backup withholding on payments due to you, which means they would withhold income tax from payments made to you and send it directly to the IRS. This can significantly affect your cash flow and require you to reconcile the amounts when you file your tax return.

How does one certify their Rhode Island W-9 form correctly?

To correctly certify your Rhode Island W-9 form, ensure you have provided the accurate TIN, then read and understand the certification statements. By signing the form, you certify under penalties of perjury that the TIN you provided is correct and that you are not subject to backup withholding, unless you’ve been notified by the IRS otherwise and have not yet received a notice stating you are no longer subject to backup withholding. If applicable, cross out item 2 in the certification section before signing the form.

Where should the completed Rhode Island W-9 form be sent?

Once completed, the Rhode Island W-9 form should be mailed to the Supplier Coordinator at One Capitol Hill, Providence, RI 02908. Ensure that you do not send the form to the IRS but instead provide it directly to the payer requesting your TIN for their records and to facilitate accurate tax reporting.

Common mistakes

When filling out the Rhode Island W-9 form, payers and businesses often make several mistakes that can lead to unnecessary complications or even penalties from the IRS. Understanding these common errors can help ensure that the process is smoother and more compliant with the IRS requirements.

- Incorrect Taxpayer Identification Number (T.I.N.): Providing an incorrect Social Security Number (SSN) or Employer Identification Number (EIN) is a fundamental mistake. This number is crucial for the IRS's records and must match exactly with the name under which you file your taxes. Mistyping a single digit can lead to misprocessed forms and potential penalties.

- Not using the full legal name: It's essential to use the full and correct name as it appears in IRS files. Sometimes, individuals and businesses use abbreviations or nicknames instead of the full legal name, leading to discrepancies between the form and IRS records, which can complicate tax processing.

- Failing to check the correct business designation: The form requires the entity to check a box indicating their business structure, such as an individual, partnership, corporation, etc. Failing to check the appropriate box or checking the wrong one can misrepresent your entity's tax status to the IRS.

- Incomplete or incorrect address: The address field should include your primary business address and, if different, the remittance address. If operating in multiple locations, it's necessary to attach a list of location addresses. Incorrect or incomplete addresses can lead to important communication and tax document deliverability issues.

- Forgetting to sign and date the certification: The form is not valid without the taxpayer's signature, title, and the date. This mistake is often overlooked but can render the submitted form invalid, as the signature certifies the information as accurate and confirms that you are not subject to backup withholding (or correctly indicates if you are).

To avoid these common errors, individuals and businesses should double-check the information provided on the form, ensuring it accurately reflects their IRS records. By paying close attention to details, like correctly entering T.I.N.s, using full legal names, accurately indicating business designations, providing complete addresses, and remembering to sign and date the certification, taxpayers can avoid unnecessary complications with their tax responsibilities in Rhode Island.

Documents used along the form

When dealing with tax-related and financial documentation in Rhode Island, particularly for business or professional engagements, the Rhode Island W-9 form is a crucial piece of the puzzle. However, it's often not the only document needed to ensure compliance and smooth operations. Several other forms and documents frequently accompany the Rhode Island W-9 to provide a comprehensive financial profile or meet specific regulatory requirements. Understanding these documents helps in creating a thorough and compliant financial management system.

- Form 1099-MISC: This document is used to report payments made in the course of a business to a person who's not an employee, such as independent contractors. It's essential for entities that work with freelancers or outside consultants.

- Form 1040: Individual income tax returns filed by residents. It's where individuals report their income, deductions, and credits to calculate their tax refund or tax due to the federal government.

- Form W-4: Used by employers to determine the amount of tax withholding to deduct from employees' wages. It's crucial for correctly managing payroll taxes for employees.

- Form W-2: Issued by employers to report the annual income and taxes withheld from their employees' paychecks. It is necessary for employees to file their personal tax returns.

- Form 941: Employers use this form to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks and to pay the employer's portion of social security or Medicare tax.

- Form 940: Employers fill out this form to report their annual Federal Unemployment Tax Act (FUTA) tax. The form is used to calculate and report the unemployment taxes the employer owes.

- Form SS-4: Application for Employer Identification Number (EIN). This IRS form is used by businesses to apply for an EIN, necessary for tax filing and reporting purposes.

While the Rhode Island W-9 form is for providing taxpayer identification and certification, the accompanying documents ensure proper income reporting, tax withholding, and compliance with employment tax requirements. Together, these forms create a framework for the financial interactions between businesses, contractors, and the government, facilitating legal compliance and financial transparency. Especially for those managing or running a business, familiarity with these documents supports effective financial and tax management.

Similar forms

The Rhode Island W-9 form is similar to several key documents used in the United States for tax reporting and identification purposes. Each document serves a unique function in the financial and regulatory landscape, yet they all share common features with the Rhode Island W-9 form, particularly in their use of taxpayer identification numbers and their role in ensuring compliance with IRS regulations.

One document that bears resemblance to the Rhode Island W-9 form is the Federal Form W-9. Both forms are used to request taxpayer identification numbers and certification from individuals or entities. The similarity lies in their primary function: to provide the necessary information for tax reporting purposes, specifically relating to income and transaction reporting. However, the Federal Form W-9 is used on a national scale, whereas the Rhode Island version is tailored for state-specific requirements. Despite this, the structure and the type of information requested, such as social security numbers or employer identification numbers, are largely the same, highlighting their shared goal of tax compliance and prevention of tax evasion.

Another document related to the Rhode Island W-9 form is the Form 1099. This form is utilized for reporting various types of income other than wages, salaries, and tips to the IRS. While the Rhode Island W-9 requests taxpayer identification information to prevent backup withholding, Form 1099 serves as a report that details the actual income received. The link between these documents is integral to tax reporting; the information provided on a W-9 helps ensure accurate matching of Form 1099 income reports to the correct taxpayer. Thus, while they serve different stages in the tax reporting process, the synchronization of information between the two is crucial for accurate tax compliance.

Additionally, the Rhode Island W-9 form shares similarities with the Form W-4. Form W-4 is designed for employees to inform employers about the amount of tax to withhold from their paycheck. Although serving different purposes - the W-9 for tax identification and the W-4 for tax withholding - both forms are preemptive measures in tax regulation. They ensure that the right amount of tax is withheld or reported, thereby minimizing issues when filing annual tax returns. The personal information and taxpayer identification numbers collected help tailor tax obligations to individuals’ situations, reflecting their interconnected roles in the broader tax ecosystem.

Dos and Don'ts

When completing the Rhode Island W-9 form, attention to detail is essential to ensure compliance and avoid potential penalties. Here are critical dos and don'ts to consider:

- Do provide your correct Taxpayer Identification Number (TIN). For individuals, this is usually your Social Security Number (SSN), and for companies or corporations, this is your Employer Identification Number (EIN).

- Do carefully read the certification statements before signing the form. By signing, you're asserting that the information is accurate and that you're not currently subject to backup withholding by the IRS, among other things.

- Do ensure you enter your name exactly as it appears on IRS records. Any discrepancies could lead to delays or issues with your tax documentation.

- Do check the correct box for your business type. Whether you're an individual, partnership, corporation, etc., it's important that this information is accurately conveyed on the form.

- Don't leave any required fields blank. Incomplete forms may be considered invalid, potentially leading to a $50 penalty imposed by the IRS.

- Don't forget to sign and date the form. An unsigned form is not valid, and therefore cannot be processed, potentially leading to delays or financial penalties.

- Don't ignore the certification about backup withholding. If you've been notified by the IRS that you're subject to backup withholding because of underreporting interest or dividends, you must cross out item 2 in the certification section.

Completing the Rhode Island W-9 form accurately is crucial for all parties involved. By following these guidelines, you can help ensure this process is smooth and compliant with IRS requirements.

Misconceptions

It's often believed that the Rhode Island W-9 form is only for individuals, not companies. This is incorrect. Both individuals and entities such as corporations or partnerships are required to complete it, providing either a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for companies.

Many think that they need to submit a new W-9 form to the Rhode Island government annually. The truth is, you only need to submit it once unless your information changes (for example, your name, business name, or T.I.N.), or the entity requesting the form asks you for an updated one.

Another misconception is that the W-9 form should be mailed to the IRS. Actually, the form should be given to the person or company that requested it from you, not sent to the IRS.

Some people mistakenly cross out the second certification regarding backup withholding without understanding its implications. You should only cross out this item if you have been notified by the IRS that you are specifically subject to backup withholding. Incorrect handling of this part could lead to issues with the IRS.

There's a false belief that providing an EIN is optional for businesses. If you operate as a corporation, partnership, or any kind of entity that is not a sole proprietorship, you must provide an EIN instead of an SSN.

It's mistakenly assumed that filling out a Rhode Island W-9 form will lead to immediate tax withholding. In reality, this form is simply used to provide your taxpayer information to entities that pay you. Withholding is a separate matter that may be influenced by other documents or your tax situation.

Many are under the impression that the W-9 form is a complex document that requires legal expertise to complete. While accuracy and honesty are imperative, the form itself is straightforward and provides clear instructions on how to fill it out.

Lastly, there's a misconception that changes to your business, such as a new address, does not require an updated W-9 form. If your business moves or your remittance address changes, you should provide a new form to ensure that all tax-related documents reach you timely.

Key takeaways

Filling out and using the Rhode Island W-9 form is a necessary step for ensuring that your tax information is accurate for the entity that is paying you. Here are the key takeaways to help guide you through the process:

- It is mandated by the IRS that you provide your Taxpayer Identification Number (TIN); failure to do so can result in a $50 penalty.

- Your Social Security Number (SSN) serves as your TIN if you are filling the form as an individual. Alternatively, businesses or corporations should use their Employer Identification Number (EIN).

- Provide your full and correct name as recognized by the IRS to avoid any discrepancies that could lead to tax issues.

- When adding your address, include your primary business address or remittance address if it is different. This ensures that any tax-related documents reach you or your business efficiently.

- If your business operates in multiple locations with the same TIN, attach a list of all location addresses, specifying the remittance address for each. If different TINs are used for different locations, a separate W-9 form must be completed for each.

- Before submitting, ensure that the certification section is signed, which includes your title, the date, and your contact number. Signing this section certifies that the information you provided is accurate and that you are not currently subject to backup withholding by the IRS.

- If you have been notified by the IRS that you are subject to backup withholding due to under-reporting interest or dividends, you must cross out item 2 in the certification section. Do not cross it if you have since been notified that you are no longer subject to backup withholding.

- Clearly indicate your business type by checking the appropriate box, whether you're an individual, partnership, corporation, or other. This helps in identifying the specific tax classification of your entity.

Lastly, ensure that the completed form is mailed to the Supplier Coordinator at the provided address in Providence, RI. Timely and accurate completion of the Rhode Island W-9 form plays a critical role in your financial and tax dealings, helping to avoid penalties and facilitating efficient transactions with payers.

Discover Popular Templates

Ri State Police - When mailing the report, confirm it is securely sealed and addressed to the RI DMV Accident Office as instructed.

Cm 010 - Contributes to the efficiency of court operations by pre-sorting cases into relevant judicial pathways.

Ri Probate Forms - Functions as a testament to the judicial process's adaptability in managing estates across various situations.