Attorney-Approved Small Estate Affidavit Template for Rhode Island

When a loved one passes away, dealing with their estate can seem like a daunting task, especially when the estate is relatively small. In Rhode Island, the Small Estate Affidavid form is a valuable tool designed to simplify this process, making it possible for assets to be distributed without the need for a full probate procedure. This form is particularly useful for those who find themselves managing an estate that falls below a certain threshold in terms of value, allowing for a more straightforward and less costly transfer of property to beneficiaries. It not only eases the burden on surviving relatives and friends but also expedites the period it takes to settle an estate. Within this context, understanding how to properly use the Small Estate Affidavit form, including who can file it and what it covers, becomes crucial for efficiently handling the assets of a deceased person in Rhode Island. Here, we begin to explore the major aspects of this form, offering a guide to navigating the process with confidence and care.

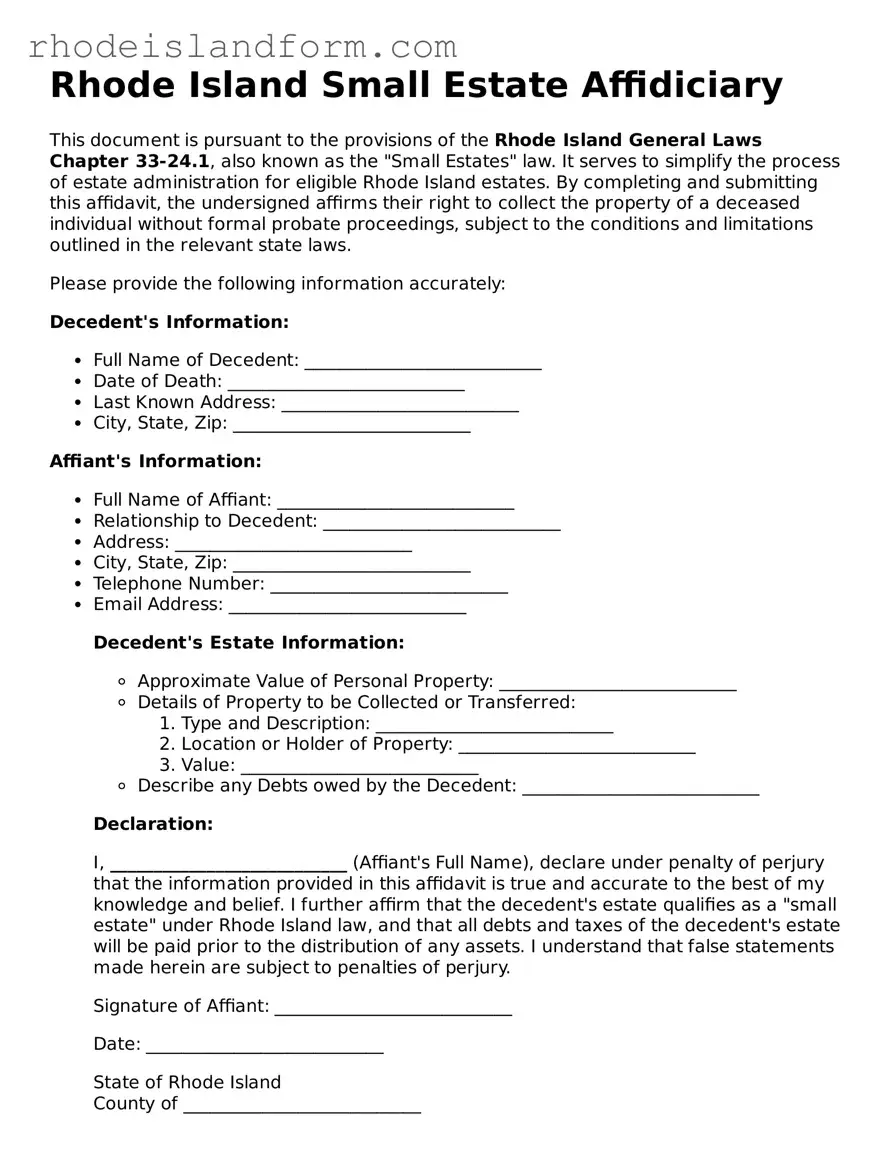

Rhode Island Small Estate Affidavit Preview

Rhode Island Small Estate Affidiciary

This document is pursuant to the provisions of the Rhode Island General Laws Chapter 33-24.1, also known as the "Small Estates" law. It serves to simplify the process of estate administration for eligible Rhode Island estates. By completing and submitting this affidavit, the undersigned affirms their right to collect the property of a deceased individual without formal probate proceedings, subject to the conditions and limitations outlined in the relevant state laws.

Please provide the following information accurately:

Decedent's Information:

- Full Name of Decedent: ___________________________

- Date of Death: ___________________________

- Last Known Address: ___________________________

- City, State, Zip: ___________________________

Affiant's Information:

- Full Name of Affiant: ___________________________

- Relationship to Decedent: ___________________________

- Address: ___________________________

- City, State, Zip: ___________________________

- Telephone Number: ___________________________

- Email Address: ___________________________

- Approximate Value of Personal Property: ___________________________

- Details of Property to be Collected or Transferred:

- Type and Description: ___________________________

- Location or Holder of Property: ___________________________

- Value: ___________________________

- Describe any Debts owed by the Decedent: ___________________________

Decedent's Estate Information:

Declaration:

I, ___________________________ (Affiant's Full Name), declare under penalty of perjury that the information provided in this affidavit is true and accurate to the best of my knowledge and belief. I further affirm that the decedent's estate qualifies as a "small estate" under Rhode Island law, and that all debts and taxes of the decedent's estate will be paid prior to the distribution of any assets. I understand that false statements made herein are subject to penalties of perjury.

Signature of Affiant: ___________________________

Date: ___________________________

State of Rhode Island

County of ___________________________

Subscribed and sworn to (or affirmed) before me this ____ day of _______________, 20____ by ___________________________ (Affiant's Full Name), proving to me on the basis of satisfactory evidence to be the person(s) named in this document.

Notary Public: ___________________________

My Commission Expires: ___________________________

PDF Data

| Fact | Detail |

|---|---|

| Purpose | Used to settle estates that are considered 'small' under Rhode Island law, allowing for a simplified probate process. |

| Governing Law(s) | Rhode Island General Laws § 33-24.1 - Small Estates |

| Qualifying Criteria | The estate's total value must not exceed $15,000, excluding certain assets such as real estate. |

| Required Waiting Period | The affidavit can be filed 30 days after the death of the decedent. |

| Document Signatories | Must be signed by the successor to the deceased's property, typically a close relative or legal heir. |

| Notarization Requirement | The form must be notarized to be considered legally valid and enforceable. |

Rhode Island Small Estate Affidavit - Usage Guidelines

When a loved one passes away in Rhode Island with a relatively small estate, the law provides a simplified process to distribute their assets without going through formal probate. This process involves completing a Small Estate Affiditat form. This document allows the person entitled to receive the decedent's property to claim assets by swearing to their right to do so under oath. While the task might seem daunting at first, following step-by-step instructions can simplify the process.

- Start by gathering all necessary information, including the decedent’s full legal name, date of death, and a detailed list of the assets within the estate. Also, make sure to have the names and addresses of all heirs and beneficiaries.

- Obtain the Small Estate Affidavit form specific to Rhode Island. This can typically be found online through the Rhode Island Judiciary’s website or by visiting the local probate court in the county where the decedent lived.

- Read through the entire form before filling anything out. This will provide a clear understanding of the information required and how to complete the form correctly.

- Fill in the decedent's name, address, and date of death in the designated sections at the top of the form.

- List all known assets of the decedent, including but not limited to bank accounts, stocks, bonds, and real estate, in the section provided. Be as detailed as possible, including account numbers and descriptions of properties.

- Provide the names, addresses, and relationships of all heirs and beneficiaries entitled to the estate under Rhode Island law. This includes anyone named in the will, if one exists, or according to the state’s intestacy laws if there is no will.

- Read the declarations and terms outlined on the form carefully. These will include statements attesting to the truthfulness of the information provided and acknowledging the responsibilities assumed by signing the affidavit.

- Sign and date the form in front of a notary public. The notary will also need to sign and affix their official seal, thereby notarizing the document.

- Attach any additional documentation required by Rhode Island law, which may include a certified copy of the death certificate and proof of ownership for certain assets.

- Submit the completed Small Estate Affidavit form and any accompanying documents to the appropriate entity, which could be a bank, brokerage, or the Rhode Island probate court, depending on the assets involved.

After submitting the Small Estate Affidavit form, the assets listed within it can typically be transferred to the rightful heirs or beneficiaries without the need for formal probate proceedings. This process not only simplifies the distribution of assets but also expedites the ability of family members to close the decedent’s estate and move forward during a difficult time. However, it’s crucial to ensure that all steps are followed thoroughly and accurately to avoid any legal complications or delays. If there are any doubts or concerns, consulting with a legal professional who specializes in estate planning or probate law in Rhode Island can provide guidance and peace of mind.

Essential Queries on Rhode Island Small Estate Affidavit

What is a Rhode Island Small Estate Affidavit?

A Rhode Island Small Estate Affidavit is a legal document used to streamline the process of settling a decedent's estate when the total value of the assets does not exceed a specific amount set by state law. This form allows for the transfer of property without the formal probate process, making it quicker and less expensive for heirs or beneficiaries to claim assets left by a deceased person.

Who can use a Rhode Island Small Estate Affidavit?

Generally, a Rhode Island Small Estate Affidavit can be used by successors of the deceased, such as family members or close friends, who stand to inherit personal property. These individuals must ensure that the total value of the estate falls under the threshold established by Rhode Island law and that all debts and taxes of the estate have been satisfied.

What is the maximum value of an estate to use this affidavit in Rhode Island?

The maximum value of an estate that qualifies for the use of a Small Estate Affidavit in Rhode Island is subject to change based on state law. It is important for individuals to check the current threshold value, which can often be found through state resources or by consulting a legal professional.

What information is needed to fill out a Rhode Island Small Estate Affidavit?

To complete a Small Estate Affidavit in Rhode Island, you'll need detailed information about the deceased, including their full name, date of death, and a list of their assets. You will also need to identify the heirs or beneficiaries, describe their relationship to the deceased, and confirm that the estate’s value is within the legal limit for using this affidavit. Additionally, details concerning any debts and how they have been addressed must be included.

How long do I have to wait after the death to file a Rhode Island Small Estate Affidavit?

There is usually a statutory waiting period before you can file a Rhode Island Small Estate Affidavit. This period allows time to ensure all claims against the estate can be identified. Checking the state’s most current guidelines is crucial, as this timeframe can vary.

Where do I file a Rhode Island Small Estate Affidavit?

A Rhode Island Small Estate Affidavit is typically filed with the probate court in the county where the deceased person lived. If the deceased owned property in another jurisdiction, additional filings might be necessary in that area as well.

Is there a filing fee for the Rhode Island Small Estate Affidavit?

Yes, there is usually a filing fee associated with submitting a Small Estate Affidavit in Rhode Island. The amount can vary by county, so it's a good idea to contact the local probate court to verify the current fee.

What happens after I file the Small Estate Affidavit in Rhode Island?

Once filed, the affidavit typically needs to be reviewed and approved by a probate judge or court official. If approved, you will be granted authority to distribute the deceased's assets according to the affidavit. The process and duration for approval can vary, depending on the specific details of the estate and the local court's procedures.

Can I use a Rhode Island Small Estate Affidavit to transfer real estate?

In Rhode Island, a Small Estate Affidavit is generally used for the transfer of personal property rather than real estate. However, specific circumstances or recent changes in the law may allow for exceptions. Consultation with a legal professional is recommended to explore your options and ensure compliance with state laws and regulations.

Common mistakes

When navigating the legal landscape of settling an estate in Rhode Island, a Small Estate Affidavit can streamline the process for estates that qualify based on their size. However, even with a form designed to simplify matters, there are common pitfalls that individuals often encounter. Acknowledging these mistakes can help ensure a smoother, more efficient handling of a loved one's estate.

First among the frequent missteps is not verifying eligibility for using the Small Estate Affidavit. Rhode Island law specifies certain criteria, including the total value of the estate, that determine whether an estate qualifies as "small." Misjudging this aspect can lead to complications, including the need to start the probate process afresh under proper legal procedures.

Another error is incomplete or inaccurate information. The form requires detailed data, and any oversight or mistake, whether it’s the decedent's full legal name, the itemized list of assets, or the correct addresses of heirs, can delay the process considerably.

- Not correctly identifying assets that fall under the estate. It's crucial to differentiate between assets that are part of the estate and those that pass directly to beneficiaries, such as life insurance policies or jointly owned property.

- Failing to properly notify creditors is another common error. Rhode Island law may require that creditors are given notice, allowing them the opportunity to claim debts owed by the estate. Ignoring this step can result in legal complications down the line.

- An often overlooked aspect is not attaching necessary documentation. This can range from the death certificate to documentation proving the value of the estate's assets. Such omissions can invalidate the affidavit or pause the process.

- Lack of proper signatures and notarization can also be problematic. Without the necessary signatures and official notarization, the affidavit may not be legally enforceable.

- Another pitfall is submitting the form to the wrong entity. Depending on the assets involved, the affidavit may need to be presented to different institutions or agencies, each with its own protocol.

- Finally, misunderstanding the affidavit’s authority can lead individuals to misuse the form, either by attempting to transfer non-qualifying assets or by misinterpreting the scope of what the affidavit allows them to do.

These missteps, though common, can be avoided with thorough preparation, attention to detail, and, when necessary, seeking legal advice. Properly executed, a Small Estate Affidavit in Rhode Island can be a valuable tool for efficiently managing and distributing a loved one's estate with minimal court intervention.

In conclusion, while the Small Estate Affidavit form offers a streamlined avenue for estate administration, its incorrect usage can lead to significant delays and legal hurdles. By being cognizant of and avoiding these eight common mistakes, individuals can navigate this process more smoothly, ensuring the deceased's assets are distributed according to their wishes with a minimal burden on the survivors.

Documents used along the form

In Rhode Island, when navigating the process of estate settlement for small estates, a Small Estate Affidavit is a crucial form. However, this affidavit seldom stands alone in the journey to finalize a loved one's affairs. Several other forms and documents typically accompany it to ensure a comprehensive and legally sound process. Understanding these documents can significantly streamline the sometimes daunting task of estate administration.

- Death Certificate: A certified copy of the death certificate is fundamental. It serves as official proof of death and is required by various agencies and institutions to proceed with transferring assets, closing accounts, and fulfilling other legal obligations.

- Will (if applicable): In instances where the decedent left a will, even in the context of a small estate, submitting a copy of the will is essential. It outlines the deceased's wishes regarding the distribution of their assets and the appointment of an executor.

- Inventory of Assets: An itemized list of all assets within the estate is crucial. This list includes bank accounts, personal property, real estate, and any other assets. It assists in determining the total value of the estate to verify its eligibility as a "small estate" under state law.

- Notice to Creditors: While not always mandatory, a Notice to Creditors can be filed in the newspaper. This notice informs any potential creditors of the decedent’s passing and invites them to present their claims against the estate within a specified timeframe, protecting the estate from future claims.

- Receipts and/or Releases from Beneficiaries: Once the assets are ready to be distributed, obtaining signed receipts or releases from the beneficiaries can provide proof that they have received their inheritance and agree to the terms of distribution. This documentation helps protect the person administering the estate from future disputes.

Procuring and preparing these documents alongside the Rhode Island Small Estate Affidavit form are steps that ensure the process aligns with legal standards and respects the intentions of the deceased. Each document serves a unique purpose, contributing to the mosaic of responsible estate administration. While dealing with the loss of a loved one, these steps provide a structured path towards closure and peace of mind for all involved.

Similar forms

The Rhode Island Small Estate Affidavit form is similar to other forms and documents utilized in the probate process, specifically designed to simplify the transfer of assets from a deceased individual's estate to their rightful heirs or beneficiaries. These documents share a common purpose but differ in applicability, requirements, and specific procedural use. Their similarities lie in their objective to offer a streamlined approach in certain circumstances, minimizing the need for a full probate court process. This comparison can help in understanding the diverse mechanisms available for estate resolution.

Transfer on Death (TOD) Deed

The Rhode Island Small Estate Affidavit form shares similarities with a Transfer on Death (TOD) Deed, as both documents facilitate the passing of assets outside of the traditional probate process. The TOD Deed, specific to real estate, allows property owners to name beneficiaries who will receive the property upon the owner's death, without the property having to go through probate court. Like the Small Estate Affidavit, the TOD Deed simplifies the transfer of assets, but while the affidavit is used for various types of assets up to a certain value threshold, the TOD Deed is employed specifically for real estate and does not have a value limitation.

Payable on Death (POD) Account Designation

Similarly, the Payable on Death (POD) account designation is a mechanism that, like the Rhode Island Small Estate Affidavit, enables assets to bypass the probate process. A POD account designation allows an account holder to designate beneficiaries who will directly receive the funds in the account upon the holder's demise. This tool is exclusively used for financial accounts, such as bank savings or checking accounts. It shares the goal of expedited transfer of wealth to beneficiaries but is limited to financial assets, contrasting the broader applicability of the Small Estate Affidavit, which can encompass a range of personal property items and amounts.

Last Will and Testament

A Last Will and Testament, while a foundational document in estate planning, also has parallels with the Rhode Island Small Estate Affidariat form in terms of intent to transfer assets to designated individuals. The key difference lies in the execution and the scope. A will often requires probate to validate and execute the decedent's wishes, whereas the Small Estate Affidavit bypasses this process for estates within certain value limits. Despite this, both documents express the decedent's intention regarding the distribution of their assets, albeit through different legal pathways, with the affidavit providing a more streamlined method when applicable.

Dos and Don'ts

When dealing with the preparation of a Rhode Island Small Estate Affidavit, certain practices should be upheld to ensure the process is completed accurately and efficiently. This essential document facilitates the transfer of assets from a deceased individual’s estate to their rightful heirs without the need for a lengthy probate process, under specific conditions. It is crucial to approach this document with care, adhering to both what should and shouldn't be done.

Things You Should Do

- Verify eligibility: Ensure that the total value of the estate does not exceed the threshold established by Rhode Island law for small estates. This threshold can change, so it's important to confirm the current limit.

- Gather necessary documents: Collect all required documentation, such as the death certificate of the deceased and an inventory of the deceased's assets, before filling out the affidavit.

- Provide accurate information: Accurately report all assets, debts, and personal details of the deceased. This includes a complete list of assets that are part of the small estate and their respective values.

- Seek legal advice: Consider consulting with a legal professional to ensure that the affidavit is filled out correctly. This is crucial to avoid any legal issues that could arise from inaccuracies or omissions.

Things You Shouldn't Do

- Do not guess asset values: Avoid estimating the value of assets. Use official appraisals or documented valuations to report asset values accurately.

- Do not omit creditors: Failing to report known creditors and any outstanding debts owed by the estate can result in legal complications.

- Do not distribute assets prematurely: Wait until the affidavit is properly filed and approved, and all debts and claims are settled before distributing assets to heirs.

- Do not overlook state-specific requirements: Each state has unique rules and thresholds for small estates. Ensure that all Rhode Island-specific guidelines and thresholds are followed.

Misconceptions

When managing a small estate in Rhode Island, the Small Estate Affidavit form is often used to simplify the process. However, misunderstandings about its use and requirements are common. Below are six misconceptions about the Rhode Island Small Estate Affidariat form.

All assets can be transferred with the Small Estate Affidavit. This is not true. The form is designed for the transfer of personal property only. Real estate and certain other assets cannot be transferred using this affidavit and may require a formal probate process.

There's no monetary limit for using the affidavit. In reality, Rhode Island law restricts the use of the Small Estate Affidavit to estates valued at $15,000 or less. This limit includes only the assets that can be transferred using the affidavit and does not account for real estate or other non-qualifying assets.

The form grants immediate access to the deceased's assets. While the Small Estate Affidavit is intended to simplify the process, it does not provide instant access to the deceased's assets. The form must be properly completed and submitted, and the rightful heirs must wait for the legally required period to elapse before the assets can be distributed.

Any family member can file the affidavit. This misconception can lead to issues. Rhode Island law specifies that the affidavit can be filed by the surviving spouse or, if there is no spouse, by a next of kin. If there are multiple persons with the same priority level (e.g., siblings), they must agree on who will file the affidavit.

Using the affidavit avoids all probate processes. While the Small Estate Affidavit can help avoid a lengthy probate process for certain assets, it does not eliminate the need for all probate procedures in Rhode Island. For example, if the deceased owned real estate in their name only, a different probate process would be necessary for that asset.

Filing the form is free of charge. This is incorrect. There is usually a filing fee associated with submitting the Small Estate Affidavit in Rhode Island. The amount can vary depending on the county, so it's important to check with the local probate court for exact fees.

Key takeaways

The Rhode Island Small Estate Affidavit form offers a simplified process for handling an estate when a loved one passes away, provided certain criteria are met. Understanding how to fill out and use this form properly can save time and streamline the estate management process. Here are key takeaways to bear in mind:

- Individuals can use the Rhode Island Small Estate Affidavit form if the total value of the deceased's estate does not exceed the threshold specified by state law. This includes both personal and real property.

- Before filling out the form, a waiting period must be observed from the time of the individual’s death, as required by Rhode Island law. This waiting period is essential to ensure all claims and debts can be appropriately addressed.

- Collecting dieshe necessary documentation to support the values listed in the affidavit is crucial. This may include bank statements, appraisals, and valuation of personal items.

- The person completing the affidavit, often referred to as the affiant, must swear under oath that the information provided is accurate to the best of their knowledge. This is a legal obligation and must be taken seriously.

- It's important to identify all potential heirs in the affidavit accurately. Rhode Island law determines how the estate is distributed among heirs, and providing complete information helps prevent disputes.

- The affidavit must be filed with the probate court in the county where the deceased resided. Filing fees may apply, and these fees vary by county.

- Once the Small Estate Affidavit is approved by the court, the affiant will be granted the authority to collect and distribute the estate's assets according to the law.

- Seeking advice from a legal professional experienced in Rhode Island estate law is advisable to navigate any complexities that may arise during the process. They can provide guidance tailored to the specific situation.

Find Some Other Forms for Rhode Island

Molst Form Rhode Island - By setting clear directives, this document helps to ease the emotional burden on families during highly stressful times.

Power of Attorney Rhode Island - Used to grant permission for all medical and educational decisions on behalf of the child.

Rhode Island Non-compete Contract - A tool used by companies to protect themselves from competition by former employees who possess sensitive information.