Attorney-Approved Transfer-on-Death Deed Template for Rhode Island

In Rhode Island, the Transfer-on-Death (TOD) Deed form stands as a pivotal document for individuals planning their estate, allowing for the seamless transfer of real property to a designated beneficiary upon the death of the property owner, without the need for probate court involvement. This legal instrument enables homeowners to ensure that their real estate assets are passed on according to their wishes, while also providing the flexibility to revise or revoke the deed as circumstances change, up until their passing. The TOD Deed, by virtue of its design, simplifies the process of transferring real estate, making it a practical option for many seeking to avoid the complexities and expenses associated with traditional inheritance methods. It is crafted to be utilized with residential property, including single-family homes, condominium units, and certain types of multifamily buildings, offering a straightforward path for ensuring that one's real estate investments are effectively managed and transferred posthumously. Importantly, the execution of a TOD Deed requires strict adherence to Rhode Island's legal guidelines, including proper documentation and witness protocols, to ensure its validity and effectiveness in conveying property rights after the owner's death.

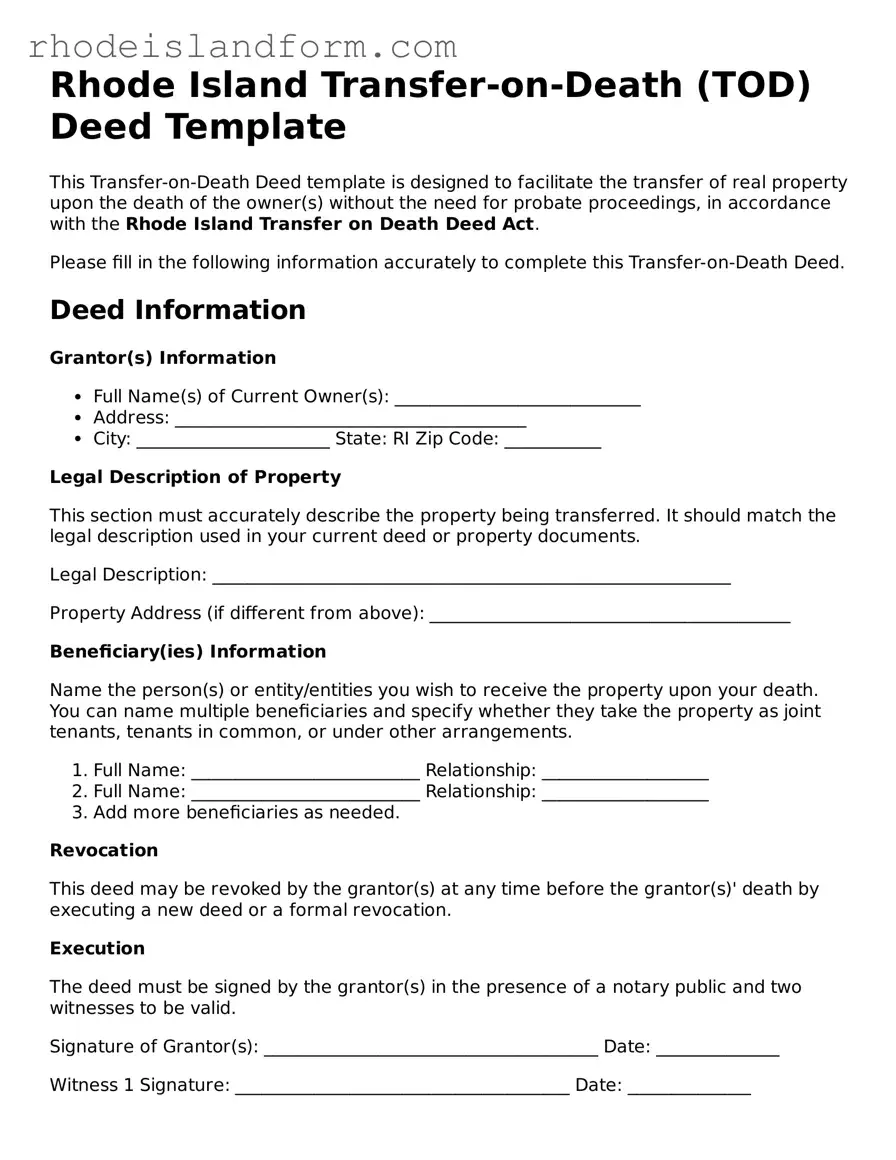

Rhode Island Transfer-on-Death Deed Preview

Rhode Island Transfer-on-Death (TOD) Deed Template

This Transfer-on-Death Deed template is designed to facilitate the transfer of real property upon the death of the owner(s) without the need for probate proceedings, in accordance with the Rhode Island Transfer on Death Deed Act.

Please fill in the following information accurately to complete this Transfer-on-Death Deed.

Deed Information

Grantor(s) Information

- Full Name(s) of Current Owner(s): ____________________________

- Address: ________________________________________

- City: ______________________ State: RI Zip Code: ___________

Legal Description of Property

This section must accurately describe the property being transferred. It should match the legal description used in your current deed or property documents.

Legal Description: ___________________________________________________________

Property Address (if different from above): _________________________________________

Beneficiary(ies) Information

Name the person(s) or entity/entities you wish to receive the property upon your death. You can name multiple beneficiaries and specify whether they take the property as joint tenants, tenants in common, or under other arrangements.

- Full Name: __________________________ Relationship: ___________________

- Full Name: __________________________ Relationship: ___________________

- Add more beneficiaries as needed.

Revocation

This deed may be revoked by the grantor(s) at any time before the grantor(s)' death by executing a new deed or a formal revocation.

Execution

The deed must be signed by the grantor(s) in the presence of a notary public and two witnesses to be valid.

Signature of Grantor(s): ______________________________________ Date: ______________

Witness 1 Signature: ______________________________________ Date: ______________

Witness 2 Signature: ______________________________________ Date: ______________

Notary Public: ___________________________________________ Date: ______________

Recording

After execution, this deed must be recorded with the appropriate Rhode Island city or town hall where the property is located to be effective.

Disclaimer

This template is provided as a general guide and for informational purposes only. Use of this template does not create an attorney-client relationship or constitute legal advice. Property owners are encouraged to consult with a legal professional before executing a Transfer-on-Death Deed.

PDF Data

| Fact | Detail |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners in Rhode Island to pass their real estate to a beneficiary without the need for probate upon the owner's death. |

| Governing Law | Rhode Island General Laws Section 34-22 outlines the specifics of Transfer-on-Death deeds, including execution, revocation, and beneficiary rights. |

| Revocability | A Transfer-on-Death deed is revocable at any time before the owner's death, enabling the owner to change their mind about the beneficiary designation or the property transfer entirely. |

| Beneficiary Eligibility | Individuals, legal entities like trusts or corporations, and multiple beneficiaries with specified percentages of ownership can be named as beneficiaries in a Transfer-on-Death deed in Rhode Island. |

Rhode Island Transfer-on-Death Deed - Usage Guidelines

When preparing for the future, a Transfer-on-Death (TOD) Deed can be a straightforward way to manage the transition of property in Rhode Island. This document allows property owners to name a beneficiary who will inherit their property without the need for a lengthy probate process. Understanding and filling out a TOD Deed correctly is crucial in ensuring that your wishes are honored. Here are the steps you’ll need to take.

- Identify the current property owner(s) as the grantor(s). Write their full legal name(s), including any middle names or initials, exactly as they appear on the current property deed.

- Specify the legal description of the property. This information must be precise and should match the description used in the property's current deed. It often includes the lot number, subdivision, and any other details that define the property's boundaries.

- Select the beneficiary or beneficiaries. Provide the full legal names of the individuals or entities you wish to inherit your property. You can name multiple beneficiaries and specify the percentages of ownership each will receive.

- Review contingency plans. In the event that your named beneficiary predeceases you or is unable to inherit the property, consider naming an alternate beneficiary.

- Sign and date the form. The grantor(s) must sign the TOD Deed form in the presence of a notary public. The notarization process formally acknowledges that the signature(s) on the deed are legitimate and that the grantor(s) signed the document willingly.

- Record the deed. After notarization, the TOD Deed must be filed with the local county recorder’s office where the property is located. This step is crucial; until the deed is officially recorded, it won't be legally effective.

After you've successfully filled out and recorded your TOD Deed, the designated beneficiary will have the right to claim ownership of the property upon your passing, without having to go through probate court. This straightforward approach simplifies the process for your beneficiaries, allowing for a smoother transition during what can be a difficult time. It's always wise to consult with a legal professional when dealing with matters of property and inheritance to ensure that all your paperwork is in order and your wishes are clearly articulated.

Essential Queries on Rhode Island Transfer-on-Death Deed

What is a Rhode Island Transfer-on-Death Deed?

A Rhode Island Transfer-on-Death Deed is a legal document that allows a property owner to pass their real estate directly to a named beneficiary without the need for probate court proceedings upon their death. This type of deed becomes effective upon the death of the owner, ensuring a smoother and faster transfer of property.

How do I create a Transfer-on-Death Deed in Rhode Island?

To create a Transfer-on-Death Deed in Rhode Island, the property owner must complete a deed form that meets state requirements, which include stating the owner's intention to pass the property to the beneficiary upon death and naming the beneficiary specifically. The deed must then be signed in the presence of a notary public and recorded with the county's land records office where the property is located.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time by the property owner without the consent of the named beneficiary. Revocation can be done by filing a new deed that explicitly revokes the previous one or by selling or transferring the property to someone else, thus nullifying the previous deed.

Are there any restrictions on who I can name as a beneficiary in a Transfer-on-Death Deed?

In Rhode Island, you can name any individual, a trust, or an organization as a beneficiary in a Transfer-on-Death Deed. However, it's important to provide accurate and specific information about the beneficiary to avoid any confusion or disputes after the owner's death.

What happens to the property if the named beneficiary predeceases the owner?

If the named beneficiary predeceases the owner and no alternate beneficiary is named, the property will then be included in the owner’s estate and subject to distribution according to their will or the state's laws of intestacy if no will exists.

Does a Transfer-on-Death Deed eliminate the need for a will?

While a Transfer-on-Death Deed can be a valuable tool for avoiding probate for specific assets like real estate, it does not replace the need for a will. A will is necessary to cover any assets or wishes not addressed by the Transfer-on-Death Deed or other beneficiary designations.

Are Transfer-on-Death Deeds subject to estate taxes in Rhode Island?

Transfer-on-Death Deeds do not exempt the property from estate taxes in Rhode Island. The value of the transferred property may be included in the overall valuation of the estate for determining estate tax liability. Proper estate planning advice from a qualified professional is recommended to understand the tax implications.

Common mistakes

Filling out a Rhode Island Transfer-on-Death (TOD) Deed form is a significant step for property owners who wish to ensure a smooth transition of their real estate to a beneficiary upon their death. However, people often make mistakes during this process, which can lead to complicated legal issues or even invalidate the deed. Recognizing these common errors can help individuals avoid them.

Firstly, one of the most significant mistakes is not providing the correct legal description of the property. The legal description is more detailed than just the address and includes the lot number, subdivision, and any other details that are used to legally identify the property in public records. An incorrect or incomplete legal description can lead to disputes over the property's ownership.

Another common error is failing to sign the document in the presence of a notary. The Rhode Island TOD deed must be notarized to be valid. Without notarization, the deed is not legally binding and will not effectively transfer ownership upon the death of the property owner.

- Not specifying the beneficiary clearly is a frequent oversight. The beneficiary's full legal name, contact information, and relationship to the owner should be clearly stated to prevent any confusion or legal battles among potential heirs after the owner's death.

- Overlooking the need to file the deed with the Rhode Island county recorder's office is another mistake. For a TOD deed to be effective, it must be recorded in the county where the property is located before the owner's death.

- Choosing the wrong type of deed for the property transfer can also lead to issues. Rhode Island law requires specific language to be included in a TOD deed to differentiate it from other types of property deeds.

- Not considering the implications of a TOD deed on the owner's estate plan is a common oversight. Property owners should ensure that the TOD deed aligns with their overall estate planning goals and does not unintentionally disinherit other beneficiaries.

- Finally, failing to update the TOD deed when circumstances change, such as the death of a beneficiary or a change in the property owner's intentions, is a mistake that can have significant repercussions. Regularly reviewing and updating the deed as necessary is crucial.

Commonly, people also create mistakes by not consulting with a legal or financial advisor before completing a TOD deed. Professionals can offer guidance tailored to an individual's specific situation, ensuring that the deed aligns with broader estate planning objectives and complies with Rhode Island laws. Avoidance of these errors ensures the TOD deed serves its intended purpose effectively.

Documents used along the form

When planning for the seamless transfer of property upon one's passing, the Rhode Island Transfer-on-Death (TOD) Deed is a crucial document. However, ensuring one's estate is fully prepared often involves several other forms and legal documents. The following list includes documents that are commonly used in conjunction with the Rhode Island TOD Deed. Together, they provide a comprehensive approach to estate planning, making sure that all aspects of one's assets and wishes are addressed clearly and legally.

- Last Will and Testament: This document outlines how a person wants their property and possessions to be distributed after their death. It can cover assets not included in the Transfer-on-Death Deed and can designate guardians for any minor children.

- Financial Power of Attorney: This grants a designated person the authority to make financial decisions on behalf of another person while they are still alive but possibly incapacitated. It allows for the management of financial affairs outside of the assets handled by the TOD deed.

- Advance Directive: An advance directive, sometimes known as a living will, outlines a person's wishes regarding medical treatment in case they become unable to communicate. This document ensures that their healthcare preferences are respected and followed.

- Beneficiary Designations: Forms that allow individuals to name beneficiaries for specific assets that can bypass the probate process, such as life insurance policies, retirement accounts, and certain bank accounts. These designations should be reviewed in the context of the TOD deed to ensure all assets are distributed according to the individual's wishes.

Understanding and completing these forms can offer peace of mind, knowing that one's affairs are in order for the benefit of their loved ones. They work together to create a well-rounded estate plan that addresses various aspects of one's life and assets. Consulting with a legal professional can provide guidance tailored to an individual's specific situation, ensuring that all legal requirements are met and the estate plan is effectively implemented.

Similar forms

The Rhode Island Transfer-on-Death Deed form is similar to several other estate planning documents that facilitate the transfer of assets upon death, though its features and functions have unique aspects which distinguish it from others. While this document directly allows property owners to name beneficiaries to their real estate to avoid probate without creating a trust or drafting a will, several other documents share this aim with differing scopes and mechanisms.

Living Trusts: Like the Transfer-on-Death (TOD) Deed, a living trust allows individuals to specify beneficiaries for their assets to avoid probarth documentation. A crucial difference is that living trusts cover a broader range of property types—not just real estate. When someone creates a living trust, they transfer ownership of their assets into the trust and manage them as the trustee. The major benefit over a TOD deed is the comprehensiveness and flexibility in terms of the assets it can include, such as bank accounts, securities, and personal property.

Last Will and Testament: The functionality of a last will and testament is also akin to that of a TOD deed, in the sense that it specifies heirs for the testator's property. However, unlike the TOD deed, which takes effect immediately upon the death of the property owner without the need for probate court involvement, a will must go through the probate process. This can lead to potential delays and additional costs for the estate, which the TOD deed aims to avoid specifically for real estate assets.

Joint Tenancy with Right of Survivorship: This form of joint ownership allows properties to pass to the surviving owner(s) automatically upon one owner’s death, similar to the transfer mechanism in a TOD deed. However, the major difference lies in the control and ownership during the original owner's lifetime. In a joint tenancy, all owners have equal rights to the property while alive, and decisions about the property must be made jointly. A TOD deed, on the other hand, allows the property owner to retain full control of the property until their death, at which point it transfers to the named beneficiary.

Dos and Don'ts

Filling out a Rhode Island Transfer-on-Death (TOD) Deed form requires attention to detail and an understanding of specific legal requirements. Below are essential do's and don'ts to ensure the process is completed accurately and effectively.

Do:

- Ensure all personal details are accurate, including full legal names and addresses of the owner and designated beneficiary(ies).

- Verify that the legal description of the property is precise. This may include referring to a previous deed or the property's legal documents for exact wording.

- Seek advice from a legal professional if there are any doubts or unfamiliar terms. It’s important to understand all aspects of the deed.

- Sign the deed in front of a notary public. Rhode Island law requires notarization for the document to be legally valid.

- File the completed deed with the appropriate county recorder’s office in Rhode Island to make it effective. There might be a filing fee involved.

- Regularly review the deed, especially after major life events such as marriage, divorce, or the birth of a child, to ensure it remains up-to-date.

- Keep a copy of the notarized deed in a secure place and inform the beneficiary(ies) about the TOD designation and where the document is stored.

Don't:

- Leave any blanks on the form. If a section does not apply, mark it accordingly with "N/A" (not applicable) or an equivalent notation.

- Assume this deed overrides a will. Be aware that the property will transfer to the designated beneficiary outside of probate, regardless of instructions in a will.

- Forget to update the deed if the beneficiary’s information changes (e.g., name changes due to marriage or divorce).

- Overlook the impact of outstanding mortgages or debts secured by the property. The beneficiary will receive the property subject to these encumbrances.

- Assume the beneficiary designation is reversible without the proper execution of a new deed or revocation document.

- Ignore state laws regarding TOD deeds, as failing to comply with legal requirements may invalidate the deed.

- Use the deed to attempt to transfer property held in tenancy by the entirety or joint tenancy without consulting with a legal expert first.

Misconceptions

The Rhode Island Transfer-on-Death (TOD) Deed form is subject to a range of misconceptions that may lead to confusion or incorrect use. Understanding these misconceptions is crucial for anyone considering this estate planning tool. Here are ten common misunderstandings:

- It avoids probate for all your assets. The TOD deed only avoids probate for the specific piece of real estate it covers. Other assets not similarly designated will still go through the probate process.

- It's equivalent to a will. This form only addresses the transfer of real estate upon death and does not serve as a substitute for a comprehensive will that covers a wider range of assets and directives.

- It allows you to bypass taxes. While the TOD deed can simplify the transfer of property, it does not exempt the estate or beneficiaries from potential estate or inheritance taxes.

- Once signed, it cannot be revoked. The owner can revoke a Transfer-on-Death deed at any time before death, as long as the revocation is done following Rhode Island's legal requirements.

- The beneficiary has rights to the property before the owner's death. The beneficiary has no legal rights to the property or its use until the owner's death.

- It's a complex and costly process. Creating a TOD deed can be relatively straightforward and affordable, particularly when compared to the potential cost and complexity of probate.

- Jointly owned property cannot utilize a TOD deed. Joint owners can use a TOD deed, but the deed will only take effect after the last surviving owner's death.

- It guarantees the property will transfer free of debts or liens. The TOD deed transfers property subject to any existing debts or liens against the property at the time of the owner's death.

- You need a lawyer to create one. While legal advice is invaluable, especially in complex situations, Rhode Island law does not require an attorney to draft or execute a TOD deed. However, consulting with an estate planning professional is strongly advised to ensure the deed aligns with the rest of your estate plan.

- It's a suitable option for everyone. TOD deeds can be a useful tool for many, but they are not suitable for all situations. Factors such as the property's value, potential tax implications, the owner's marital status, and the needs of potential beneficiaries should be carefully considered.

Key takeaways

The Rhode Island Transfer-on-Death (TOD) Deed form allows property owners to pass real estate to a beneficiary upon the owner’s death without the property having to go through probate. Here are seven key takeaways to keep in mind when filling out and using this form:

- The form needs to be completed accurately, providing clear details about the grantor (current property owner), the beneficiary, and the legal description of the property in question.

- It's important to specify the beneficiary with precise information, including their full legal name and address, to avoid any ambiguity.

- The Rhode Island Transfer-on-Death Deed must be notarized. This involves signing the document in the presence of a notary public who will also sign and seal the document, verifying its authenticity.

- After notarization, the deed must be filed with the local county land records office where the property is located. This step officially records the deed and is necessary for the transfer-on-death provision to be effective.

- Keep in mind that the property owner retains full ownership and control over the property during their lifetime, including the right to sell it or change the beneficiary.

- If the property owner wishes to change the beneficiary or revoke the deed, they must fill out a new deed form or a revocation form and follow the same process of notarization and filing with the county records office.

- It’s crucial to inform the beneficiary about the Transfer-on-Death Deed to ensure they are aware of their impending ownership and the responsibilities that come with it.

These steps are designed to provide a straightforward path for transferring real estate upon death, bypassing the often lengthy and complex probate process. However, it's recommended to consult with a legal professional when preparing and filing a Transfer-on-Death Deed to ensure compliance with all state laws and requirements.

Find Some Other Forms for Rhode Island

Ri Dmv Registration Form - It provides a structured way for sellers to disclose specific defects or issues with the vehicle, adhering to “lemon laws” in some states.

How Long Does a Divorce Take in Ri - This document makes the transition to separation smoother by providing a clear plan for how each aspect of the marriage will be resolved.

Probate Forms Ri - Take control of your digital legacy by including digital assets and online accounts in your Last Will and Testament.